Market Data

April 19, 2018

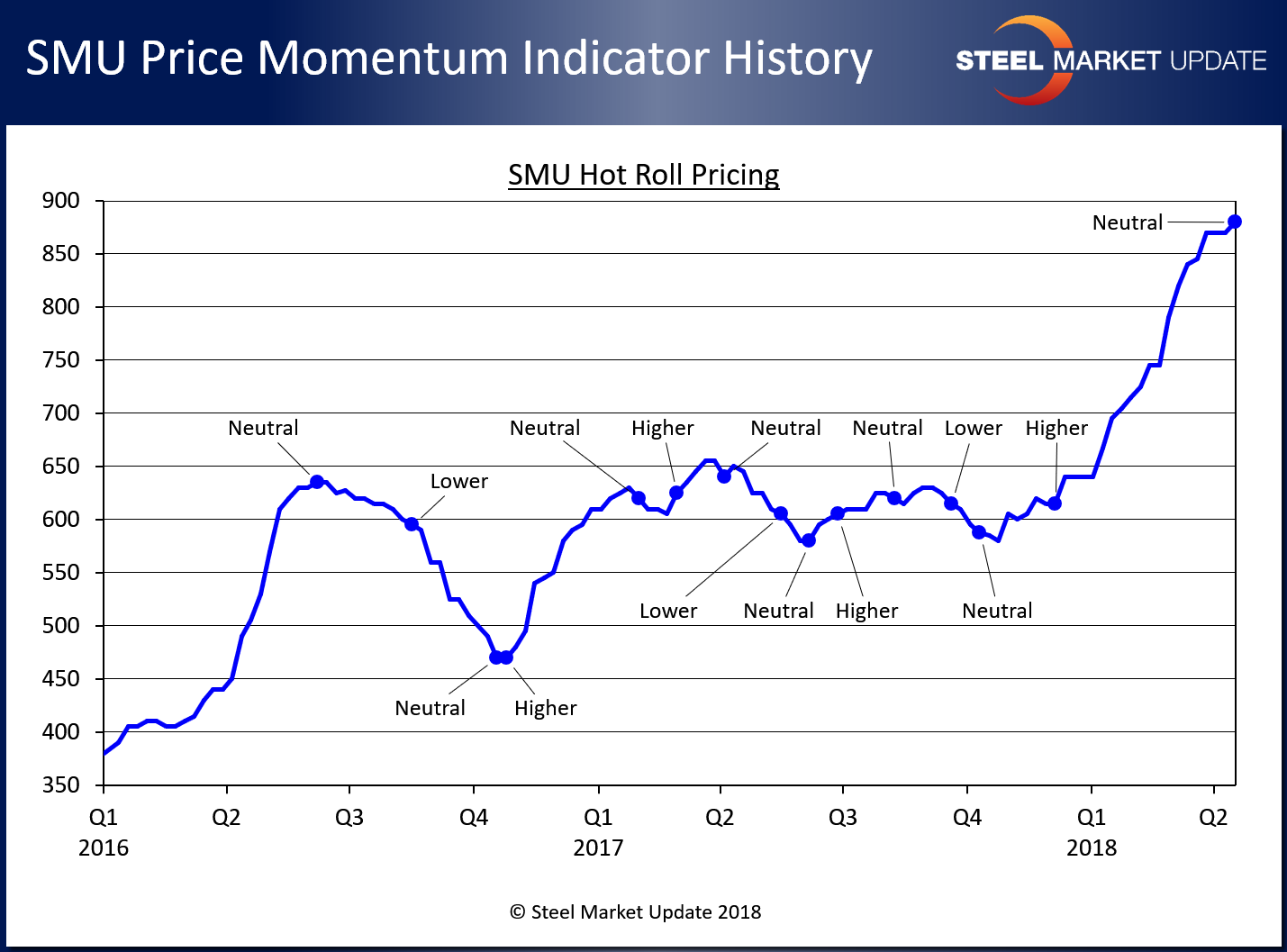

SMU Price Momentum Adjusted to Neutral

Written by John Packard

We have been struggling with the decision as to when we should make an adjustment to the SMU Price Momentum Indicator. The issue that has been holding us back for the last week or two is the role the government is playing in the steel market, which muddies the water.

We have made the decision that even though there is another “gray swan” event staring us in the face (May 1), we need to operate as though the government is not actively involved and then let you – the buyers and sellers of steel – figure out if our sense of the market is correct or not.

With that being said, Steel Market Update today adjusted our Price Momentum Indicator to Neutral.

We last adjusted our indicator on Dec. 5 when we moved from Neutral to Higher and for the past 19 weeks our indicator has been referencing higher steel prices.

Our move to Neutral does not mean we anticipate an immediate change in the direction of steel prices. It means that we believe the market is at a point of “reflection” as both steel buyers and sellers figure out whether the market can afford to pay higher prices, or for that matter whether prices need to move lower to accommodate changes in supply or demand.

Perhaps the response we received this week from a flat rolled steel service center best sums up why SMU decided now was the time to move our Momentum Indicator to Neutral. “Good news: Steel is becoming easier to find with domestic suppliers. Bad news: Steel is becoming easier to find with domestic suppliers. That being said, mills are doing everything they can to avoid any indication of ‘holes’ and things are still relatively tight.”

The subject of momentum came up during the HARDI steel conference call. Many of the wholesalers on that call reported good demand, balanced inventories and were nervous about the next move in pricing. One wholesaler from the East Coast told the group he was already seeing an erosion in “street” prices.

The kicker or “gray swan” event that everyone needs to focus on is the date May 1, 2018. That is the date the exclusions expire from Canada, Mexico, Australia, South Korea, Brazil, Argentina and the European Union. Each country or region has been dealing with the exclusion issue differently. South Korea negotiated quotas (now they are asking the U.S. government exactly what that means) and the European Union is demanding a permanent exclusion before they will discuss any other trade issues. Others have taken their complaints to the WTO.

President Trump can sway prices in one direction or another based on how he handles the existing exclusions and what he decides to do with countries like Japan and India.

All eyes are on Washington, D.C. (or Mar-a-Lago here in Florida) searching for answers….

There are a number of articles in tonight’s newsletter: Sentiment Index, Lead Times, Negotiations that have all impacted our decision to alter our Momentum Indicator.