Prices

April 29, 2018

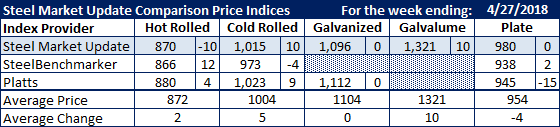

Comparison Price Indices: Another Mixed Week as the Market Waits

Written by John Packard

Yet another mixed week as the flat rolled and plate steel markets wait for the government to decide what to do next… It’s tough to be a steel buyer when the laws of supply and demand are no longer in sync with the actual market.

Hot rolled prices were mixed although the spread between Steel Market Update, SteelBenchmarker and Platts have been tightening. One reason for the tightening is the strength of the energy markets and the limited amount of foreign imports. For HRC there seems to be a semblance of supply being squeezed which tightens prices.

The three indexes split on cold rolled. Platts and SMU saw CRC as higher while SteelBenchmarker was $50 per ton below Platts…

SteelBenchmarker does not provide hot dipped galvanized numbers, so Platts and SMU were quite close and both saw HDG as being stable last week.

Galvalume is for SMU only and we saw AZ up $10 per ton.

Plate is on allocation and certain months are not yet open. Transactions and offers may be getting picked up differently resulting in our number being higher than Platts and SteelBenchmarker.

SMU Note: Galvanized prices include $86 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Plate price FOB points are different for each of the indexes:

SMU: FOB Delivered to the Customer (includes freight)

Platts: FOB Midwest Mill (includes freight)

SteelBenchmarker: Domestic Mill, East of the Mississippi (does not include freight)

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.