Analysis

August 3, 2018

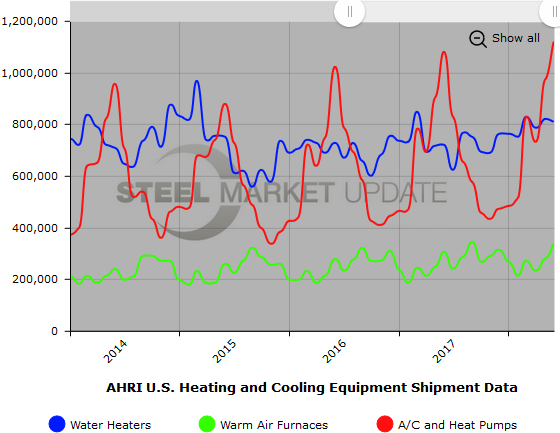

June Heating and Cooling Equipment Shipments at Record Level

Written by Brett Linton

Heating and cooling equipment shipments were up 7.8 percent in June compared to one year ago, according to data released by the Air-Conditioning, Heating, and Refrigeration Institute (AHRI) on Friday. This is the highest total equipment shipment level in the institute’s 10+ year history at 2.27 million units shipped, topping the previous record of 2.10 million units in June 2017.

Residential and commercial storage water heater shipments were up 12.6 percent year over year to a combined 809,192 units; 787,764 units were shipped for residential use and 21,428 units for commercial use.

Shipments of warm air furnaces totaled 337,087 units in June, up 10.7 percent compared to the same month last year.

Central air conditioners and air-source heat pump shipments rose 3.8 percent over a year ago to 1,120,459 total units; 783,705 air conditioners and 336,754 heat pumps were shipped.

The full press release is available on the AHRI website here.

Below is a graph showing the history of total water heater, warm air furnace and air conditioner shipments. You will need to view the graph on our website to use it’s interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact Brett Linton at 706-216-2140 or Brett@SteelMarketUpdate.com.