Prices

October 16, 2018

October Import Trends Continue to Surprise to the Upside

Written by John Packard

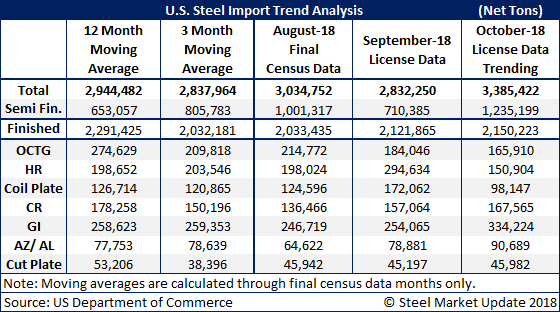

Earlier today, the U.S. Department of Commerce released the latest foreign steel import license data for September and October. Based on our analysis, the import trend for October continues to be much higher than we would have anticipated. We are looking at the month trending over 3 million net tons. The biggest reason for the increase over September’s 2.8 million net tons is due to semi-finished steels (mostly slabs). Semi’s are trending toward 1.2 million tons or more than one-third of the total imports for the month. Our trend is based on license data through Tuesday, Oct. 16, 2018. We then take the daily rate of import licenses and use that number over the full month to come up with our total “trending” number. Our expectation is for imports to come in around 3 million tons (not 3.4 million) once the dust settles.

From our perspective, the important numbers are in OCTG (oil country tubular goods), hot rolled, cold rolled, galvanized and Galvalume/Aluminized (“other metallic”). OCTG is trending below the 12-month and 3-month moving averages as is hot rolled and coiled plate. What may be the most disappointing for the domestic mills is galvanized and Galvalume as each of these products is well above the 12-month and 3-month averages.

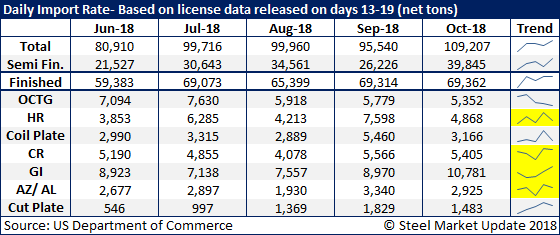

The table below shows daily import levels based on data collected between the 13th and 19th days of each respective month.