Prices

November 29, 2018

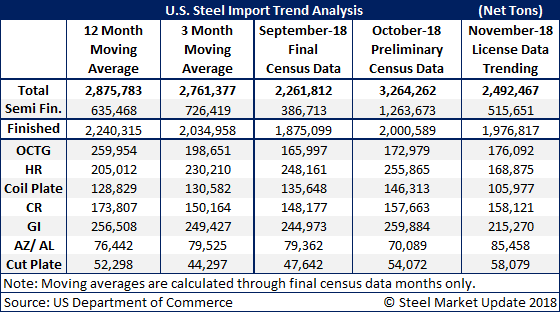

Steel Imports Trending Down in November

Written by Brett Linton

U.S. steel imports are trending down in November to around 2.5 million tons from the preliminary total of 3.3 million tons in October, according to import license data from the Department of Commerce.

The November decline is largely a result of fewer imports of semi-finished products. Imports of slabs jumped in October to nearly 1.3 million tons—well above the average level around 635,000 tons. Therefore, with domestic steelmakers well supplied, it’s no surprise that licenses for imports of semi’s are down significantly in November at just over 500,000 tons.

The November trend is based on import license data through Tuesday, Nov. 27. Steel Market Update calculates the trending total by taking the daily rate of import licenses and multiplying it for the full month.

Imports of finished steel products in November are on pace to approximately equal October at around 2 million tons.

To see an interactive history of total steel imports (through September final data), visit our website here. If you need assistance logging into or navigating the website, please contact Brett at Brett@SteelMarketUpdate.com.