Market Data

December 4, 2018

Ceasefire: Trump and Xi Postpone U.S./China Trade War

Written by Tim Triplett

By the CRU Group Economics Team

The meeting between Chinese President Xi Jinping and President Trump on Dec. 1 turned out to be better than expected. According to the White House press release and Chinese official reports, tariffs will not rise from their current levels over the next 90 days. Both sides agreed to enter immediate negotiations on “structural issues”—in other words, trade practices. We interpret this as a ceasefire between Trump and Xi, which in our view has the potential to pave the way for a more optimistic trade agreement between the U.S. and China.

Tariffs on Hold at 10 Percent

President Trump has agreed not to escalate tariffs further. This means not raising the tariffs on $200 billion of Chinese exports from 10 percent to 25 percent on Jan. 1 as originally scheduled. In return, China agreed to make “very substantial” purchases of U.S. goods, including agricultural (most likely including soybeans) and energy. The U.S. said there would be talks on structural reform covering five areas—forced technology transfer, intellectual property (IP) protection, non-tariff barriers, cyber intrusions and cyber theft, and services and agriculture. If there is no progress after 90 days, the U.S. will implement the planned tariff hike.

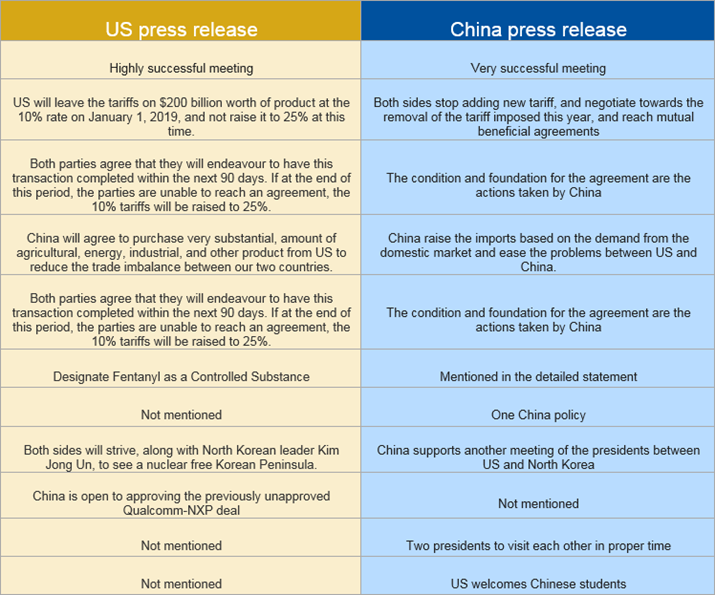

The table below compares CRU’s interpretation of the press releases from the two countries.

China Expected to Open More Markets

Chinese policymakers now face the difficult task of ironing out a deal that is acceptable to the Chinese people, but also involves significant enough concessions not to be toppled by the China hawks in the Trump administration.

In our view, China is very likely to increase imports of U.S. products and services to help reduce the bilateral trade deficit. China is also likely to agree to speed up market opening in several industries in a hope that this will help address U.S. concerns on technology transfer and IP protection. Indeed, domestic support for further market opening and better IP protection has increased in China in recent months. China already announced that it would enhance the IP court system and introduce punitive damages for IP violations. Regulation of foreign investment in China in some specific industries, such as automotive, also seemed to be more relaxed.

Temporary Ceasefire a Reason for Optimism

CRU foresees that it will be incredibly challenging to reach an agreement on such complicated structural issues within a three-month timeframe. Though the two camps agreed on the temporary truce, tariff sanctions have not been lifted, suggesting that the trade war is still on. China’s offers on IP protection may not be enough for the Trump administration. More importantly, Beijing’s “Made in China 2025” high-tech manufacturing initiative and industrial subsidy practices remains an “off-limits” discussion.

Despite these difficulties, the most positive takeaway from the Xi-Trump meeting is that both top leaders seem to want a trade agreement. But it is too soon to expect the meeting marks the end of the trade dispute. After all, China thought it had a deal with U.S. Commerce Secretary Wilbur Ross back in May, only to have it broken within weeks. That said, the recent meeting does pave the way for greater optimism about the future.