Long Products

January 10, 2019

Inventory, Imports, Scrap Put Domestic Long Product Prices Under Pressure

Written by Tim Triplett

By CRU North America Analyst Ryan McKinley

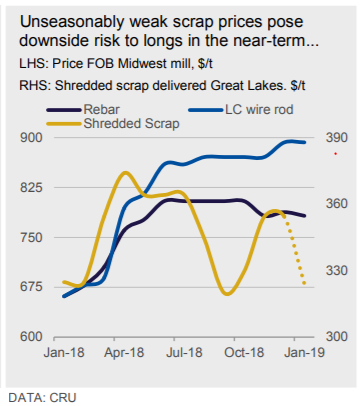

Long product prices in the U.S. are coming under downward pressure after a build-up in late-2018 inventory levels lingered into the new year and import prices became more attractive for domestic buyers. Price drops so far—where they have occurred—have been minimal but import deals with arrival dates 60-90 days out were concluded at price levels that point toward further short-term price pressure. Domestic prices are unlikely to find support from the scrap market, which is poised to drop in January m/m for the first time since 2006.

Wire rod mills that announced a $1.50/cwt price increase in the beginning of December achieved about two-thirds of their targeted increase. While market participants largely expected the remaining increase to take hold by early January, delayed construction projects and heavy buying earlier in the year resulted in an inventory build, reducing demand and preventing the remaining mills from achieving similar increases. In addition, this demand decrease has coincided with competitive import prices. Low-carbon mesh-quality wire rod, for example, is now available at a landed price of $35.00-36.00/cwt. The total impact from imports on the market in terms of volume for December is unclear at the moment, with license data unavailable amid a government shutdown.

Similar factors weighed on domestic rebar prices, eliminating expectations that mills would push for a price increase in late-December or early-January. Much like wire rod, construction delays caused by rainy weather, particularly in the southern and eastern U.S., have resulted in lower overall demand. Commercial Metals Co., a producer with exposure to demand curtailments in the construction industry, reported in its fourth-quarter earnings that a historic amount of wet weather, alongside typically slower seasonal demand, reduced shipment rates at its facilities. Imports also remain competitive for U.S. buyers, with imports booked recently into Houston from Italy and Portugal at prices between $33.50-34.00/cwt. Still, fabricator backlogs are solid, and easing weather conditions along with the return of seasonally stronger demand may prevent prices from falling near-term.

In contrast, increased demand for merchant bar buoyed prices in January and has made downward price pressure unlikely. While a variety of end-use sectors are strong, nonresidential construction has been the primary driver. Despite a 5.8 percent y/y contraction in residential construction, the latest data show that nonresidential construction increased by 7.3 percent in October y/y. Steel buildings and frames in particular have underpinned this higher demand and fabricators see little slowdown in the near future.

Likewise, beam prices were also unchanged this month amid solid nonresidential construction demand. Mills kept buyers at or near list prices, although imported material is expected to hit the market in three weeks at levels under domestic prices.

Outlook: Long Product Demand to Pick Up Seasonally Even as Scrap Prices Languish

Heavy long product buying from service centers and end users from mid- to late-2018 will likely subside, following inventory level growth that thwarted attempted and expected price hikes in January. We expect elevated inventory levels to work though the supply chain as seasonally stronger demand picks up. However, imports will continue to provide a ceiling for potential domestic price increases for the near term.

While we do not expect demand to decline meaningfully in the first half of 2019, potential long product price pressure could originate in the scrap market. The January scrap market is poised to decline by $30/l. ton (see chart). A m/m decrease in January scrap prices would be the first such occurrence since 2006 and would likely set the stage for further price falls into the second quarter. Going forward, these deteriorating scrap prices may provide leverage for buyers to push finished steel prices lower.