Prices

February 12, 2019

U.S. Steel Exports Low in November

Written by Brett Linton

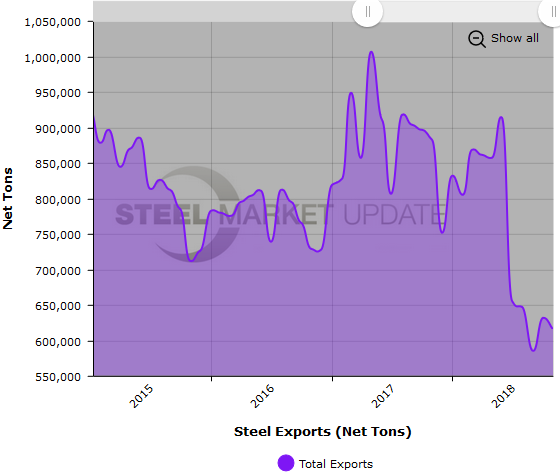

U.S. steel exports in November totaled 615,818 net tons (558,661 metric tons), down 2.4 percent from October, and down 30.2 percent from levels one year ago.

After the September 2018 low of 584,858 tons, last November is the next lowest month for exports since February 2009 when 602,945 tons of steel were exported outside of the United States. Looking back to the first half of 2018, total exports were averaging around 850,000 tons per month for over a year, with the only sub-800,000 figure being in December 2017.

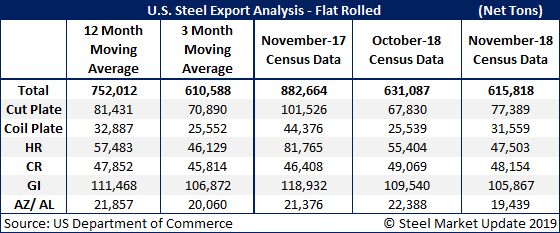

The total November export figure is above the three-month moving average (average of September 2018, October 2018 and November 2018), but below the 12-month moving average (average of December 2017 through November 2018). Here is a breakdown by product:

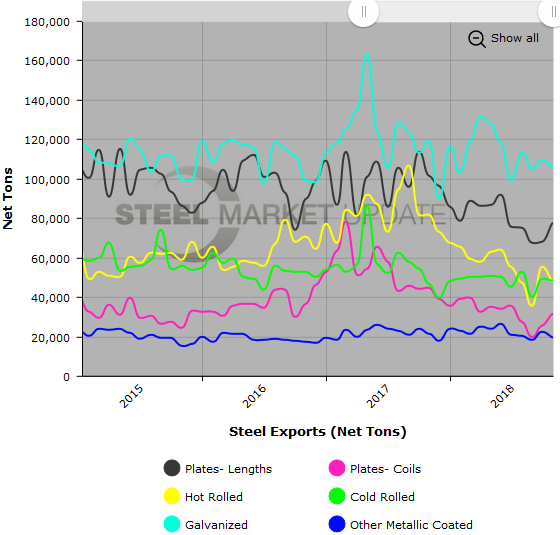

Cut plate exports increased 14.1 percent from October to 77,389 tons, but were down 23.8 percent compared to levels one year ago.

Exports of coiled plate were 31,559 tons in November, up 23.6 percent month over month, but down 28.9 percent year over year.

Hot rolled steel exports fell 14.3 percent month over month to 47,503 tons, and were down 41.9 percent from November 2017 levels.

Exports of cold rolled products were 48,154 tons in November, down 1.9 percent from October, but up 3.8 percent over the same month last year.

Galvanized exports fell 3.4 percent month over month to 105,867 tons. Compared to one year ago, November levels were down 11.0 percent.

Exports of all other metallic coated products came in at 19,439 tons, a 13.2 percent decrease from October, and a 9.1 percent decrease compared to one year ago.

To see an interactive graphic of our steel imports history through final November data (examples below), visit our website here. If you need any assistance logging in or navigating the site, contact us at info@SteelMarketUpdate.com or 800-432-3475.