Prices

March 21, 2019

SMU Market Trends: Majority Skeptical of “Steelmageddon” Scenario

Written by Tim Triplett

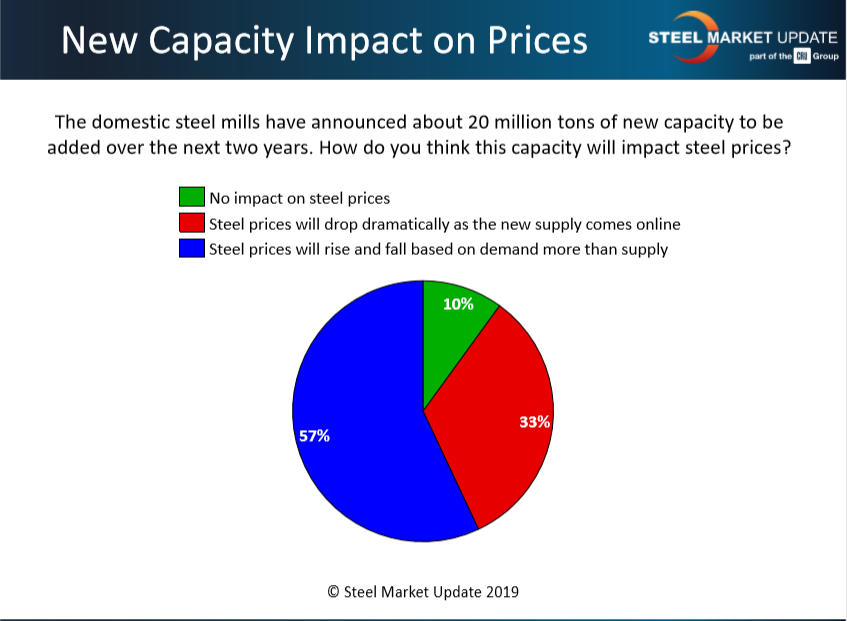

Bank of America Merrill Lynch predicts that billions in capital investments by domestic steelmakers over the next few years, adding more than 20 million tons of new capacity to the market, will cause a glut of supply that proves disastrous for steel prices—a phenomenon they have dubbed “Steelmageddon.” Steel Market Update canvassed the market this week and asked executives, mostly from service centers and OEMs, how they feel this coming capacity will impact steel prices. The majority appear surprisingly unconcerned.

One third agree with BAML that steel prices will drop dramatically as the new supply comes online. But 10 percent expect no impact on steel prices from the new capacity. The majority, 57 percent, expect steel prices to rise and fall based on demand more than supply.

Following are some of their comments:

“Prices are a function of input costs and demand.”

“Supply and demand will adjust. Imports will decrease. Two years is a long way out and some of these facilities are not off the drawing board yet.”

“I think there will be a steadying and then a slow erosion of price as new production comes on line.”

“If tariffs with Canada and Mexico are removed and if a quota is deemed generous, this will create an interesting dynamic, which will play out differently by product group. HRC exports will increase, but you would expect that some of the construction-based products like Galvalume will have a detrimental effect on pricing. Overall, however, HRC will be somewhat in an oversupply position, but still retain a healthy premium over other international markets.”

“More supply will mean lower prices unless demand grows. Where our prices are compared to the rest of the world will be a major factor in the demand equation. If our manufacturers have costs that are significantly above the costs in the rest of the world, then demand growth will be muted.”

“If domestic supply replaces imports, then it won’t impact prices. Demand is the key driver. If demand is low, then there’s already too much capacity. It may mean wilder swings since the supply side will notice changes faster, both going up and coming down.”

“Hopefully, it will pressure the outdated older mills to finally close. Those that can’t be efficient or have a high cost structure will go by the wayside.”

“It’s greatly dependent on demand, trade announcements, and current older capacity retention, but there is more risk of prices receding.”

“There is oversupply everywhere. The mills with the lowest costs will fare the best.”

“It all depends on trade restrictions. If they are still in place, the added capacity could be absorbed. If not, then oversupply domestically will surely drop steel prices.”

“Tariffs are still the wild card.”