Prices

March 28, 2019

Steel Imports Up and Down in First Quarter

Written by Brett Linton

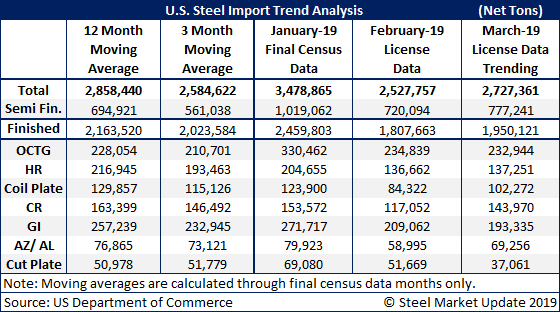

Since hitting an eight-year low in December of just 1,893,568 tons, imports of steel into the United States have been up and down, according to Commerce Department data. Final January imports jumped to 3,478,865 net tons, up 83.7 percent over December—a nearly 1.6 million ton increase. Then in February, based on license data for the full month, steel imports receded by 27 percent to 2,527,757 tons. With March nearly complete, imports for the month are “trending” up again by nearly 8 percent to more than 2.7 million tons (based on license data through the 27th and projected out for the entire month).

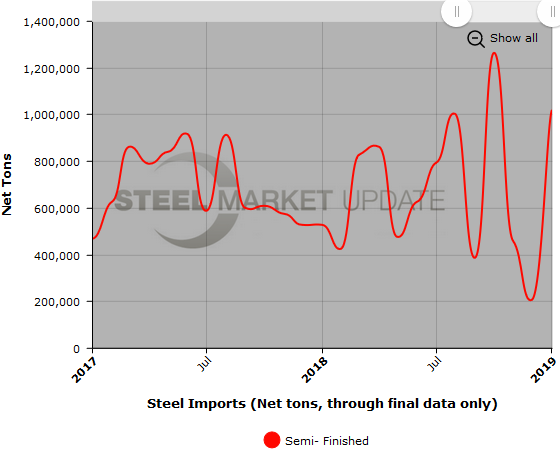

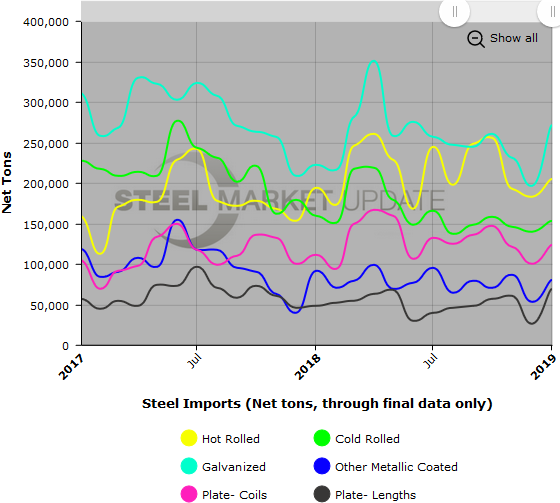

The big jump in January was largely attributable to imports of semi-finished steel, mostly slabs, up 392.3 percent or 812,071 tons over December. Also in January, OCTG imports were up 197,505 tons or 148.5 percent, and imports of cut plate were up 42,712 tons or 162.0 percent. In February, semi-finished imports slowed to around 720,000 tons before picking up the pace again in March to around 777,000 tons. Imports this month have remained flat for hot rolled and oil country tubular goods, with small declines for galvanized and cut plate and increases for cold rolled and coiled plate.

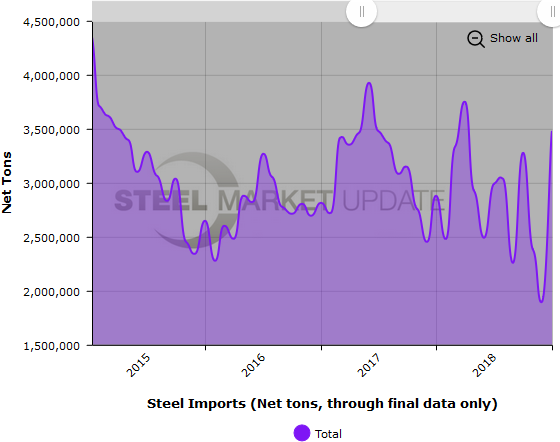

Below are three graphs showing the history of U.S. steel imports: total imports, semi-finished and flat rolled products. To use their interactive features, view the graphs on our website by clicking here. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.