Prices

May 7, 2019

CRU: Further Disruption to Vale Supply Keeps Iron Ore Prices High

Written by Tim Triplett

By CRU Analyst Michelle Liu

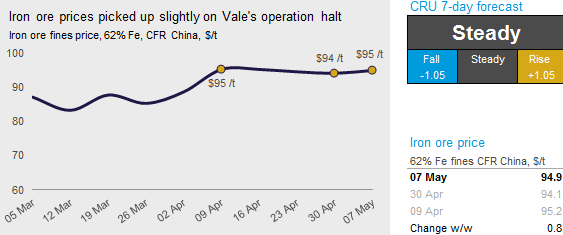

Vale confirmed the suspension of tailings disposal at its Brucutu mine on Tuesday, May 7. After prices fell initially, there was a price rebound and the iron ore price ended up rising by $0.80 /t w/w to $94.90 /t for our assessed 62% Fe fines.

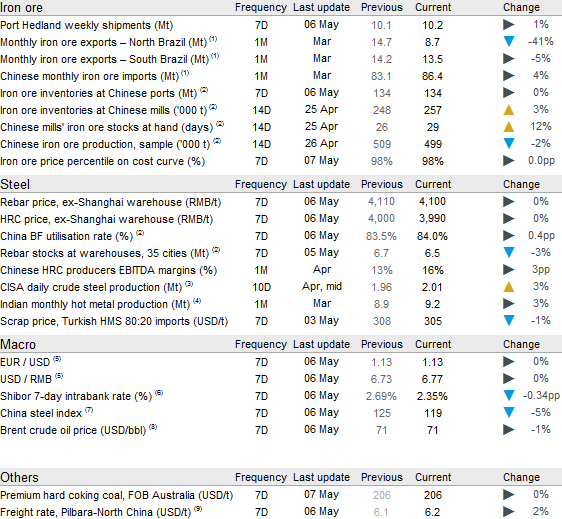

On Tuesday, Brazil’s higher court overwrote its lower court’s ruling for the resumption of tailings disposal at the Laranjeiras tailings dam, which is used by the Brucutu mine. Consequently, wet beneficiation operations for Brucutu were stopped, but mine production is still in place, although with reduced output and lower quality as a result of limited beneficiation. Brucutu is the second largest iron ore mine belonging to Vale, producing 30 Mt in 2018. A large part of the production is pellet feed to its Tubarão pellet plants. In contrast to the supply disruption in Brazil, Australian miners are exerting all efforts to get shipments back to maximum levels after weather-related disruptions in March. Port Hedland shipments continued to inch up over the week, led by strong supply by FMG.

Robust demand from China contributed to the price increase as well. BF utilizations were at a multi-year high last week, but steel prices remained stable, indicating healthy underlying steel consumption.

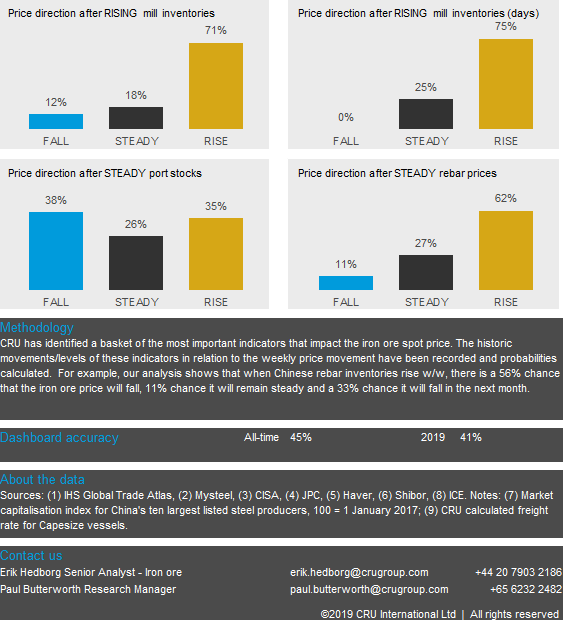

However, hiccups in the China-U.S. trade talks have encouraged speculation that a new round of tariffs on Chinese exports to the U.S. could take effect as early as this week. Upon this news, the RMB hit a four-month low against the U.S. dollar, depreciating by half a percent in the past two days—a big daily movement for the Chinese currency. Weakened RMB is likely to put downward pressure on imported prices and make buyers hold off purchases of oversea goods. Hence, we expect iron ore prices to be STEADY in the next week with weaker demand from China offsetting weaker supply from Brazil.

Explore this topic further with CRU.