Prices

May 21, 2019

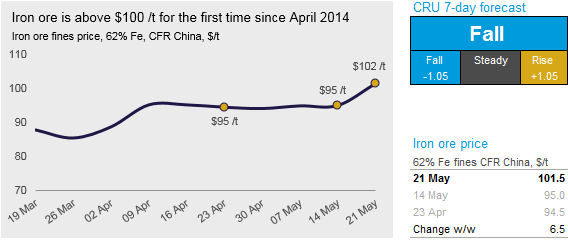

CRU: Iron Ore Above $100 /t for the First Time in Five Years

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

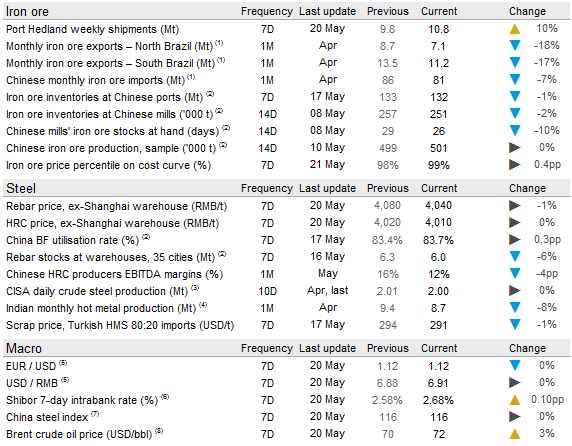

Iron ore prices have risen sharply in the past week as the strong Chinese demand has continued and fears of further supply disruptions have emerged in Australia and Brazil. On Tuesday, May 21, CRU has assessed the 62% Fe fines price at $101.5 /t, which translates to a $6.5 /t increase w/w.

In the past week, Vale has announced that a mine wall at the depleted Gongo Soco mine pit is likely to collapse, which could trigger the failure of yet another tailings dam. However, the mine and dam are not in operation and they are also located far away from Vale’s other production. The nearby village was evacuated in February, so the risk to human lives is minimal. Rail transportation passing by the town has been suspended, which is affecting passenger traffic as well as some iron ore transportation. In Australia, there has also been news circulating in the market about BHP carrying out maintenance in July, which has caused further supply fears. However, maintenance takes place in July every year and we do not expect this round of maintenance to be much more extensive than in previous years. Furthermore, there has been a mine accident in China’s Heilongjiang province at a new 0.9 Mt capacity mine and beneficiation plant. The impact on iron ore mining activities elsewhere in China remains unclear.

Seaborne supply from Australia and northern Brazil has been strong in the past week. Port Hedland shipments have been at their highest level since before the cyclone, led by strong shipments particularly from BHP. Rio Tinto’s shipments from Cape Lambert have also recovered, and improved weather conditions in Brazil’s Para state have resulted in significant improvements to shipments.

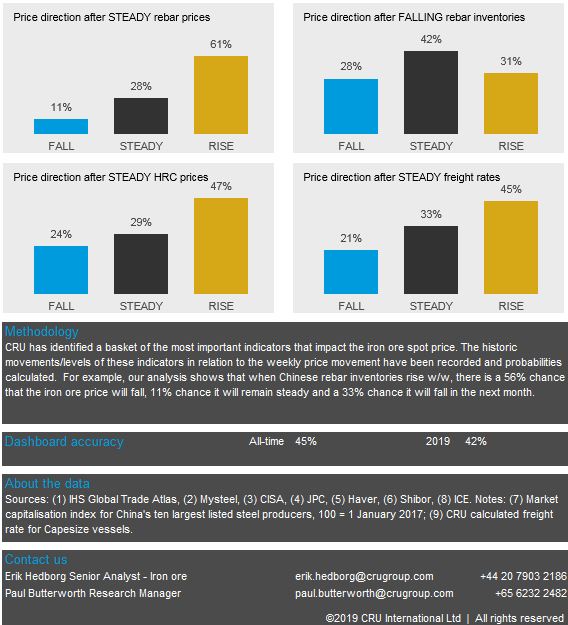

There is talk in the market about further stimulus in China as a measure to counter trade war uncertainty. The market will also continue to closely monitor the development in Brazil and the risk of another dam failure. These two factors have created plenty of uncertainty regarding the price direction for iron ore. However, we expect the current price surge to stop and we see potential for a slight correction in the coming week.