Market Data

June 4, 2019

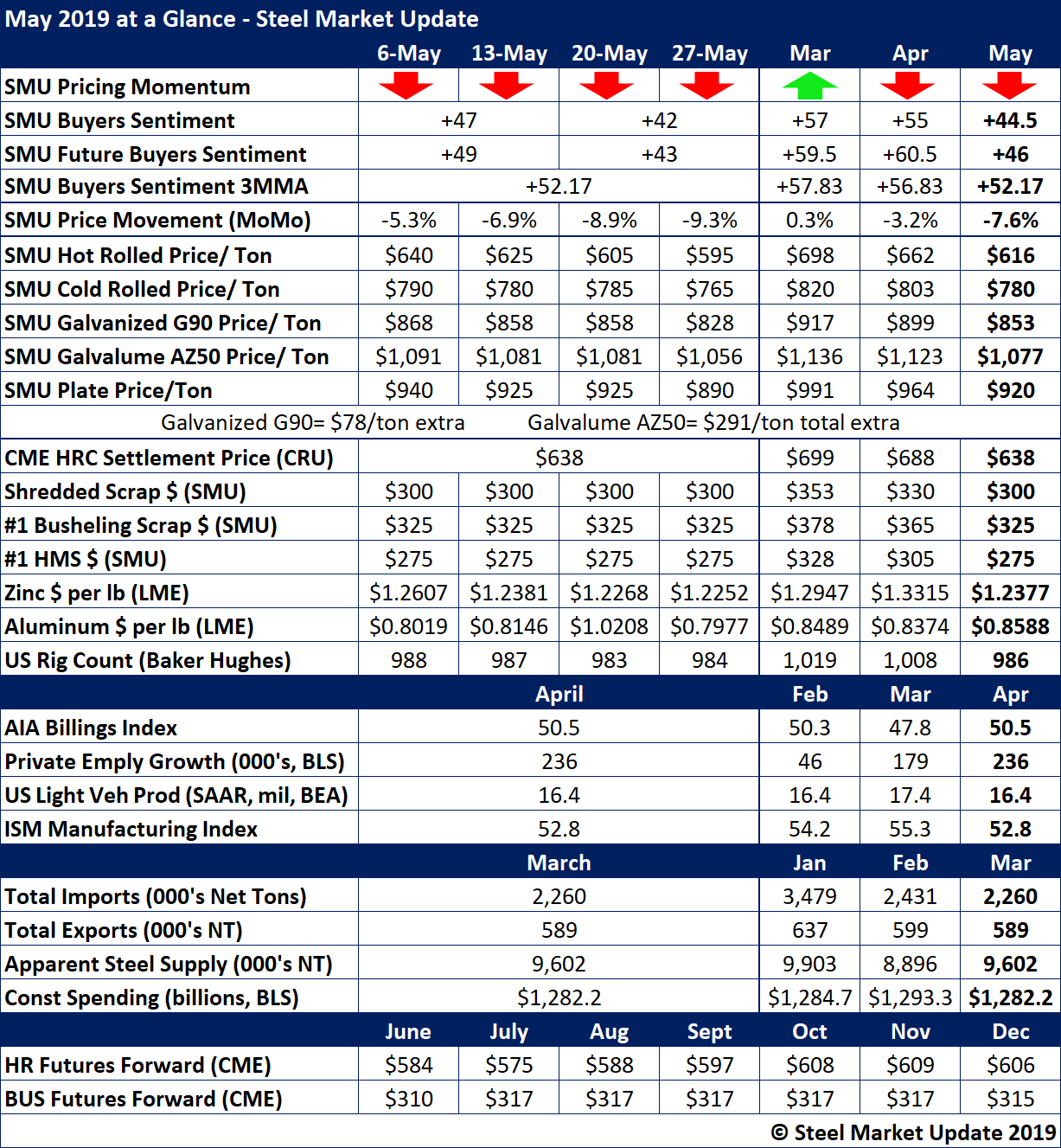

May at a Glance: Sentiment Sags

Written by Brett Linton

Steel Market Update’s Steel Buyers Sentiment Index dipped below the +50 mark and continued to erode last month as the uncertainty over tariffs and trade had a negative effect on buyers’ attitudes. With OEM and service center executives feeling less positive about their prospects for the next few months, as indicated by SMU Future Buyers Sentiment, it’s no wonder that steel price momentum remains on a downward trajectory. Buyers tell SMU they are reluctant to make purchasing decisions today when steel will be cheaper tomorrow. Buyers sentiment of +42, while still on the optimistic half of the scale, is down from a peak of +78 last year.

Steel prices declined by as much as $50 per ton during May, depending on the product. The benchmark price for hot rolled steel slid from around $640 per ton at the beginning of May to less than $600 by the end of the month. Cold rolled declined from $790 to $765, galvanized from $868 to $828 and plate from $940 to $890.

Weaker-than-expected demand for finished steel and ferrous scrap contributed to the declining steel prices in May.

To see a history of our monthly review tables, visit our website here.