Market Data

September 17, 2019

SMU Seeks Data Providers for Service Center Inventories Report

Written by Tim Triplett

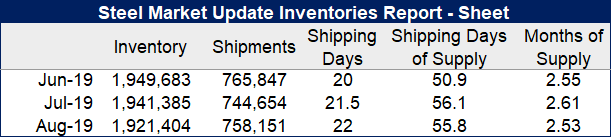

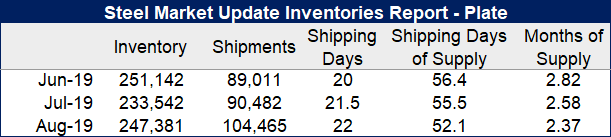

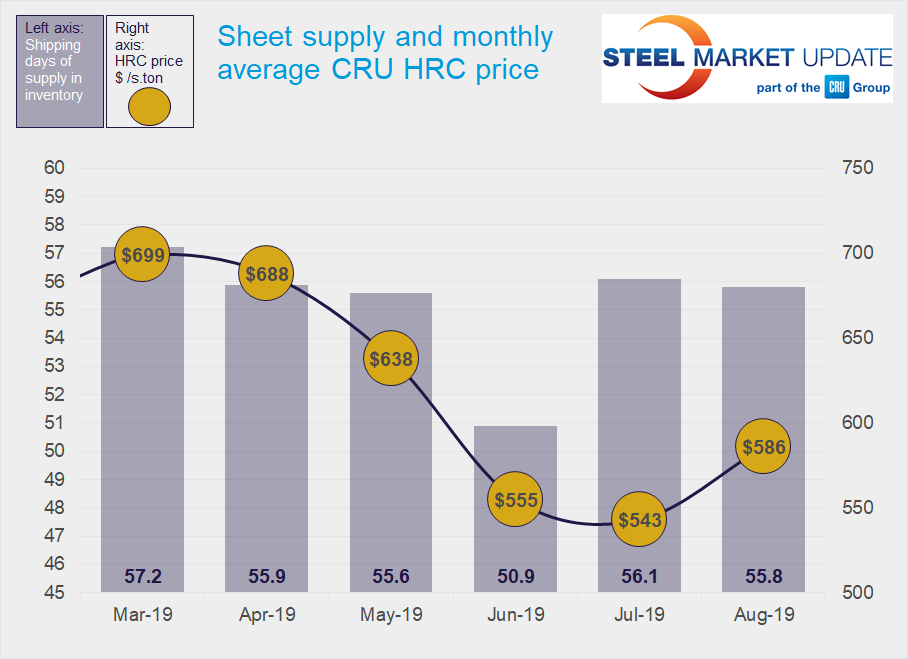

Steel Market Update’s analysis of flat rolled and plate inventories and shipments shows flat rolled inventories of 55.8 days of supply, and plate inventories of 52.1 days, as of the end of August. Service center flat rolled inventories remained elevated, while plate saw a reduction in supply last month to the lowest level seen all year.

Steel Market Update surveys key data providers each month to gather the latest information on steel sheet and plate inventories. The results are summarized in the SMU Service Center Inventories Report, which is distributed to Premium subscribers around the 10th business day of each month. Data providers also receive a Flash Report with preliminary data about a week prior to other subscribers.

SMU’s Service Center Inventories Report includes:

• Total inventory levels from the data providers

• Total monthly shipments by the data providers

• Shipping days of supply

• Months of supply on hand

• SMU Inventories Report Analysis, which includes expert commentary on the month-to-month changes in flat rolled and plate inventories, with forecasts based on industry pricing trends and other market factors.

Data providers receive additional information on the average daily shipping rate, tons on order, shipping days of supply on order, percentage of inventory on order, as well as the percentage of inventory committed to contracts vs. available to the spot market.

Premium members have access to our new Service Center Inventories webpage with an expanded history of the below tables.

For more information on how to become a data provider or to renew a Premium subscription and qualify to continue receiving the inventories report each month, contact Paige Mayhair at 724-720-1012 or email Paige@SteelMarketUpdate.com.