Market Segment

October 6, 2019

New Mill Capacity and Equipment Update

Written by John Packard

With U.S. Steel buying almost 50 percent of Big River Steel and holding an option on the remainder over the next four years, SMU thought it an appropriate time to review the list of announced changes being made by the mills in the United States, Canada and Mexico. We reviewed this listing with the four mills who spoke on the subject at the 2019 SMU Steel Summit Conference in order to make sure we were not double counting or missing items.

The key for flat rolled buyers (and consumers) is the total tonnage of new flat rolled capacity (melt) being added to the market. Most likely there will be corresponding old capacity that will no longer be justified. With the move by U.S. Steel, that scenario became even more likely in the years ahead.

The key capacity additions (flat rolled) will be: Big River Steel 1.65 million tons, JSW Ohio (up and running) 1.5 million tons, North Star Bluescope 900,000 tons, Nucor Gallatin 1.40 million tons, and Steel Dynamics Texas 3.0 million tons. The total of these additions (compared to 2018) is 8.45 million tons. From this we need to recognize AK Steel removing 2.0 million tons from the market by shutting down Ashland Works. So the net gain is 6.45 million tons of new flat rolled melt production.

U.S. consumers of flat rolled should not overlook the Mexican steel mills who are building new facilities, as well. Ternium has 5.0 million tons of projects in the works, none of which are new melt. Even though they are not producing new steel, they will be moving slabs up from their slab mill in Brazil. In the process they will be adding at least 4.0 million tons to the Mexican market, a portion of which could make its way into the U.S. market.

At the time this chart was orginally produced, U.S. Steel was bringing back up their two furnaces at Granite City. I would ignore the 2.8 million tons mentioned there as this is existing production and not new melt.

When it comes to plate, there are two plants we need to look at: Nucor Brandenburg is building a new greenfield plate mill rated to produce 1.2 million tons. JSW Texas is building an EAF with a 1.0 million-ton capability, which will replace imported slabs. Therefore, the net gain in the U.S. will be 1.2 million tons of new plate capacity.

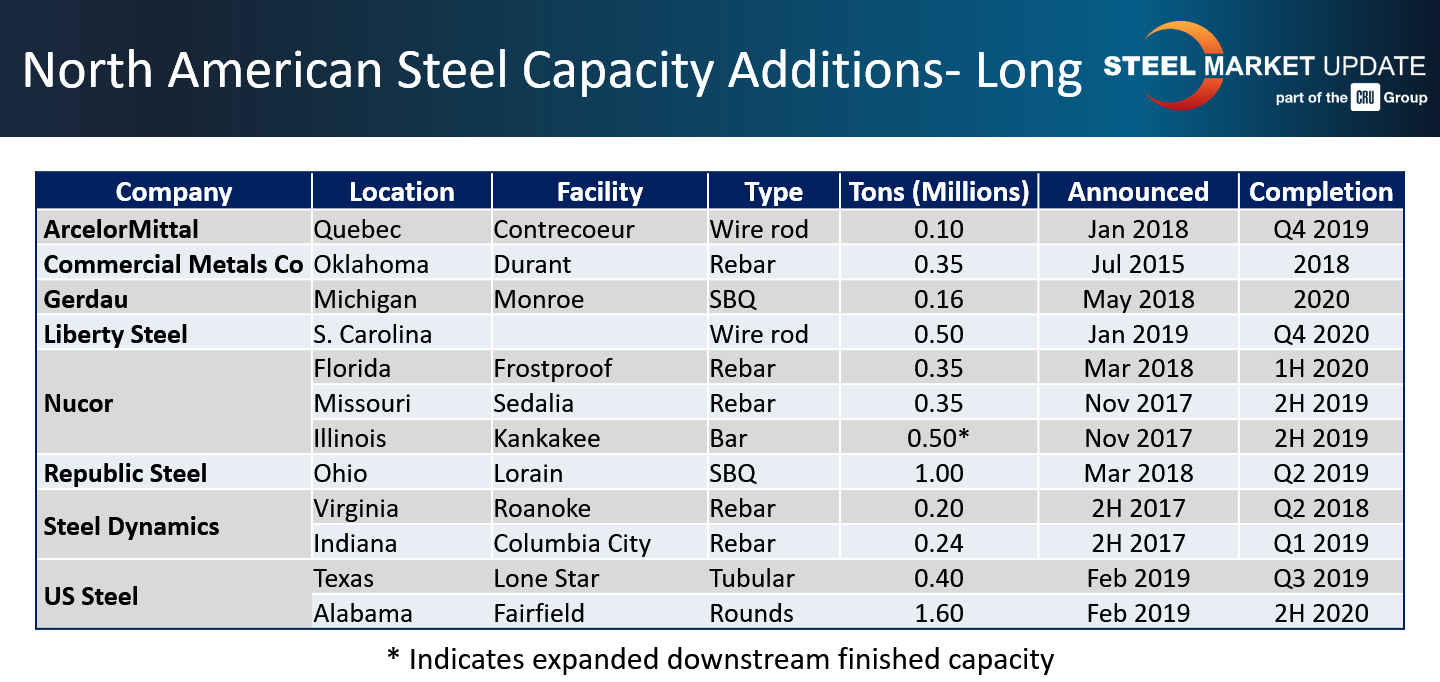

Even though SMU does not cover the long products markets, for our conference we did list the new mills being launched by a variety of mills.