Prices

November 14, 2019

Steel Imports Trending Down in November

Written by Tim Triplett

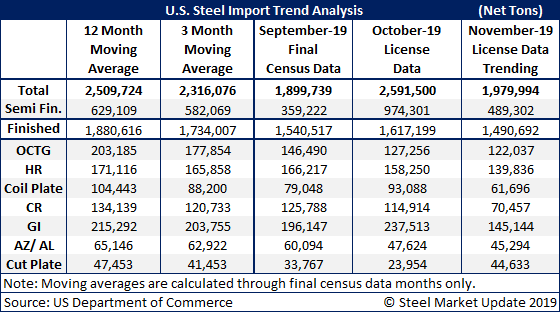

This early look at U.S. steel imports in November, projecting Commerce Department license data out through the end of the month, suggests that imports are trending down considerably.

Most of the difference is in imports of semifinished steel, on track to total less than 500,000 tons this month. This drop-off was to be expected following the jump in semifinished licenses in October totaling nearly a million tons. With imports of slabs from countries such as Brazil subject to quarterly quota limits, domestic mills were quick to secure raw material in October, the first month of the fourth quarter, in case the quota limits were reached in November or December.

Finished steel imports, trending toward 1.5 million tons, are also below average, which may reflect weaker seasonal demand in November.

Almost every product category is seeing a decline in imports so far this month, based on the preliminary license data, especially galvanized, cold rolled and coiled plate. For more detail, see the chart below.