Prices

December 3, 2019

CRU: Upward Iron Ore Price Momentum Halts, But It Could be Temporary

Written by Dmitry Popov

By CRU Senior Analyst Dmitry Popov, from CRU’s Iron Ore Market Outlook

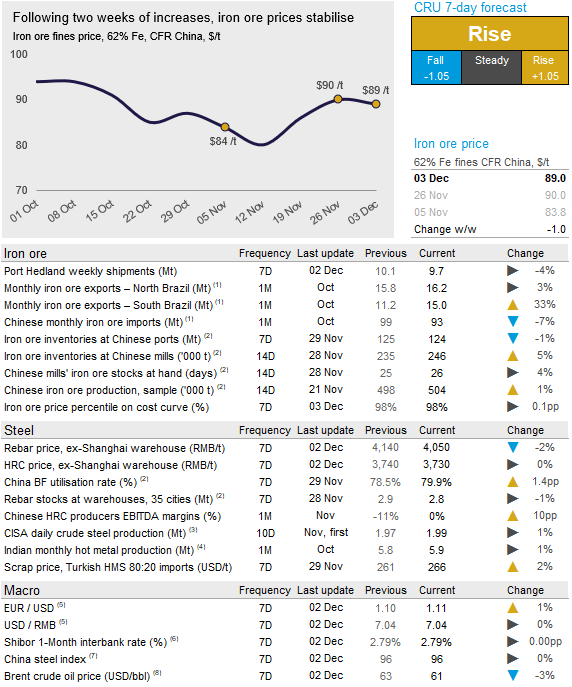

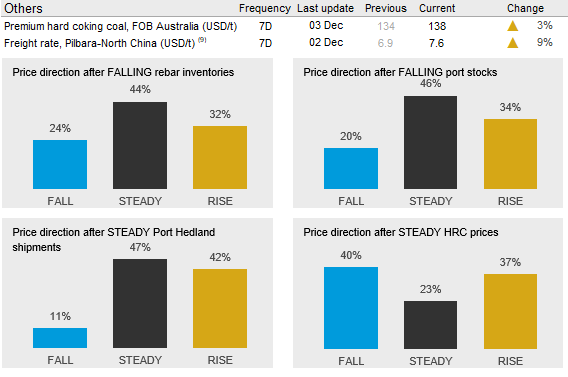

After two weeks of increases, iron ore prices moved marginally lower this week by $1 /t w/w as CRU has assessed the 62% Fe fines price at $89 /t, CFR China. The end of the upward momentum in iron ore prices was primarily the result of the change in direction in Chinese domestic steel prices over the past week. Following the sharp increases through November for both rebar and HR coil, over the past week rebar prices declined by 2.2 percent w/w, while HR coil prices remained unchanged w/w. These changes were mainly the result of weakening construction activity in northern China due to cold weather, as well as rising supply.

Margins of steel producers remain at good levels and some steel mills with low iron ore inventory have been restocking, preferring higher grade material as focus on efficiency has returned with improvement in margins. However, many mills hold bearish views for the coming months and therefore have been restocking only at a slow pace.

On the supply side, shipments from Port Hedland have remained high at 9.7 Mt over the past week, although this is the first time they were below 10.0 Mt since early November. However, the most notable news in the past week has been the partial suspension of tailings disposal at Vale’s Brucutu site. After resuming operations in June, Brucutu has been producing at a ~30 Mt/y rate, of which CRU estimates that nearly 20 Mt is pellet feed for the pellet plants in Tubarão. The suspension will affect 60 percent of output, mostly pellet feed, while the remaining operations will produce primarily fines through dry processing. The suspensions are expected to last up to two months, with pelletizing in Tubarão likely to be impacted the most.

Iron ore futures prices in China increased by 1.7 percent d/d today, which could be the result of the news about this suspension.

Another important supply-side development over the past week is that Indian iron ore mining auctions have been delayed by one month as the government saw some cartelization in the initial rounds of bidding. CRU has earlier anticipated these kind of delays in the auction process and its impact on the Indian iron ore market as illustrated in its Insight recently published on the Iron Ore Market Outlook and the Steelmaking Raw Materials Monitor.

As a result of these supply-side developments, as well as still firm demand in China, we believe there is potential for iron ore prices to rise again in the next week above $90 /t.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com