Prices

June 2, 2020

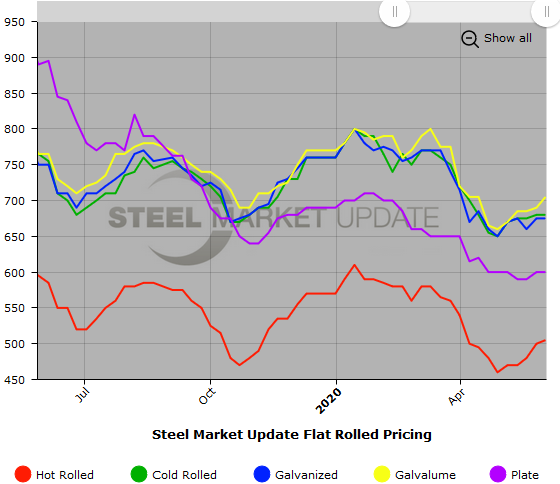

SMU Price Ranges & Indices: Marching in Place

Written by Brett Linton

Steel prices saw little movement this week, except for a small bump in hot rolled and a slightly bigger bump in Galvalume, as the market marches in place while it waits to see what happens to demand in June as more companies ramp up production following the coronavirus shutdowns. Steel Market Update’s Price Momentum Indicators remain at Neutral.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $490-$520 per ton ($24.50-$26.00/cwt) with an average of $505 per ton ($25.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago, while the upper end remained the same. Our overall average is up $5 per ton over last week. Our price momentum on hot rolled steel is Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 3-4 weeks

Cold Rolled Coil: SMU price range is $660-$700 per ton ($33.00-$35.00/cwt) with an average of $680 per ton ($34.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on cold rolled steel is at Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU price range is $650-$700 per ton ($32.50-$35.00/cwt) with an average of $675 per ton ($33.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on galvanized steel is at Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $719-$769 per net ton with an average of $744 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3-6 weeks

Galvalume Coil: SMU price range is $690-$720 per ton ($34.50-$36.00/cwt) with an average of $705 per ton ($35.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week, while the upper end rose $20 per ton. Our overall average is up $15 per ton compared to one week ago. Our price momentum on Galvalume steel is at Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $981-$1,011 per net ton with an average of $996 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $590-$610 per ton ($29.50-$30.50/cwt) with an average of $600 per ton ($30.00/cwt) FOB delivered to the customer’s facility. The lower end of our range increased $10 per ton compared to one week ago, while the upper end declined $10. Our overall average is unchanged over last week. Our price momentum on plate steel is at Neutral until the market establishes a clear direction.

Plate Lead Times: 3-5 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.