Market Data

September 1, 2020

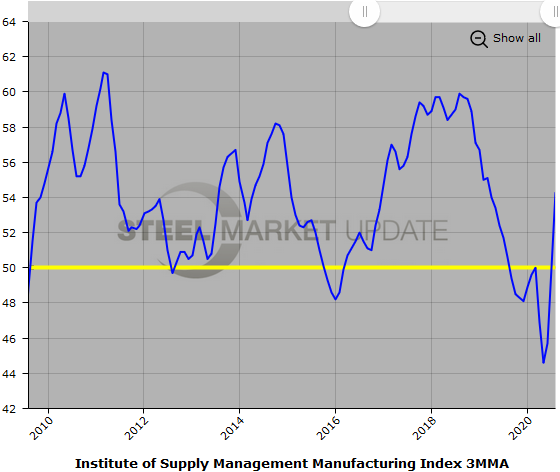

ISM's PMI Hits 56 for Highest Reading of the Year

Written by Sandy Williams

The U.S manufacturing sector expanded faster in August, according the Manufacturing ISM Report on Business. The August PMI rose 1.8 points to 56.0 in August for the highest reading of the year and indicated a fourth month of expansion after a contraction in April.

The new orders Index jumped 6.1 points to 67.6 percent, while production rose 1.2 points to 63.3.

Backlogs increased in August as did the employment index. The Supplier Deliveries Index registered 58.2 percent, up 2.4 percentage points from July, but suppliers continue to struggle to deliver due to labor and transportation challenges.

Inventories moved lower to 44.4 percent and the prices index increased 6.3 points to register 59.9. Imports and export indexes both moved higher, at 55.6 and 53.3 percent, respectively.

“After the coronavirus (COVID-19) brought manufacturing activity to historic lows, the sector continued its recovery in August, the first full month of operations after supply chains restarted and adjustments were made for employees to return to work,” said Timothy Fiore, chairman of the Institute for Supply Management. “Survey Committee members reported that their companies and suppliers operated in reconfigured factories, with limited labor application due to safety restrictions. Panel sentiment was generally optimistic (1.4 positive comments for every cautious comment), though to a lesser degree compared to July.

“Demand and consumption continued to drive expansion growth, with inputs representing near- and moderate-term supply chain difficulties,” added Fiore.

Many of the companies in the ISM survey said they will hold off on capital investments for the rest of the year. Demand is low and expected to remain low in commercial aerospace equipment companies, office furniture and commercial office building sub-suppliers, and companies and suppliers in the oil and gas markets.

Comments from survey respondents include:

- “Rolling production forecasts are increasing each week compared to the prior forecast.” (Primary Metals)

- “Current sales to domestic markets are substantially stronger than forecasted. We expected a recession, but it did not turn out that way. Retail and trade customer markets are very strong and driving shortages in raw material suppliers, increasing supplier orders.” (Fabricated Metal Products)

- “Airline industry continues to be under great pressure.” (Transportation Equipment)

- “Strong demand from existing and new customers for our products, stable-to-decreasing input costs for our operations, and record numbers of new business opportunities from prospective customers’ reshoring measures. All trends continuing from the first quarter of fiscal year 2017.” (Electrical Equipment, Appliances & Components)

- “Capital equipment new orders have slowed again. Quoting is active. Many customers are waiting for the fourth quarter to make any commitments.” (Machinery)

- “Homebuilder business continues to be robust, with month-over-month gains continuing since May. Business remains favorable and will only be held back by supply issues across the entire industry.” (Wood Products)

Below is a graph showing the history of the ISM Index on a three month moving average (3MMA). You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.