Prices

December 1, 2020

Update on U.S. Steel Imports

Written by Brett Linton

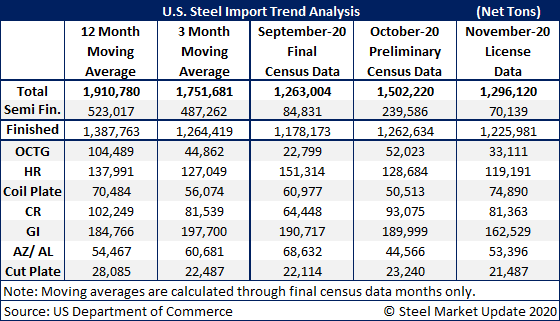

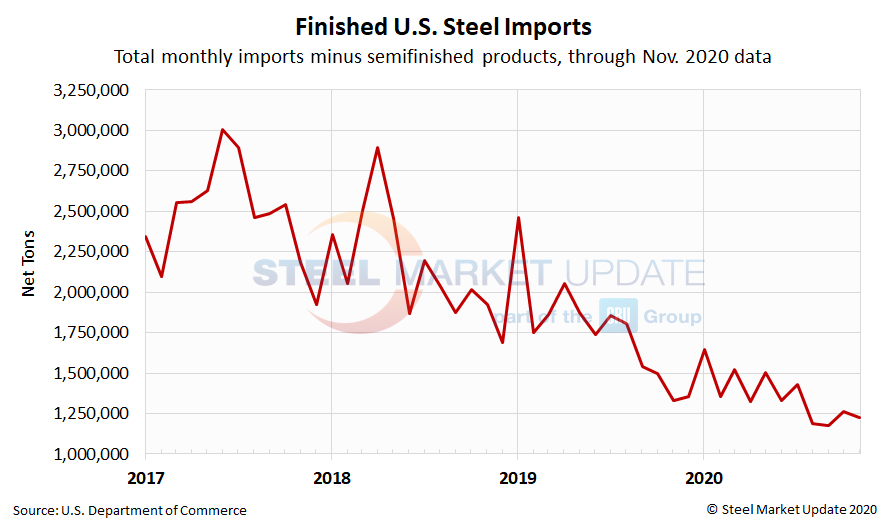

Preliminary census data shows October imports totaling 1.50 million net tons, up 19 percent over the 11-year low seen in September. For comparison, the lowest monthly import level in the past two decades occured in June 2009 at 862,000 tons.

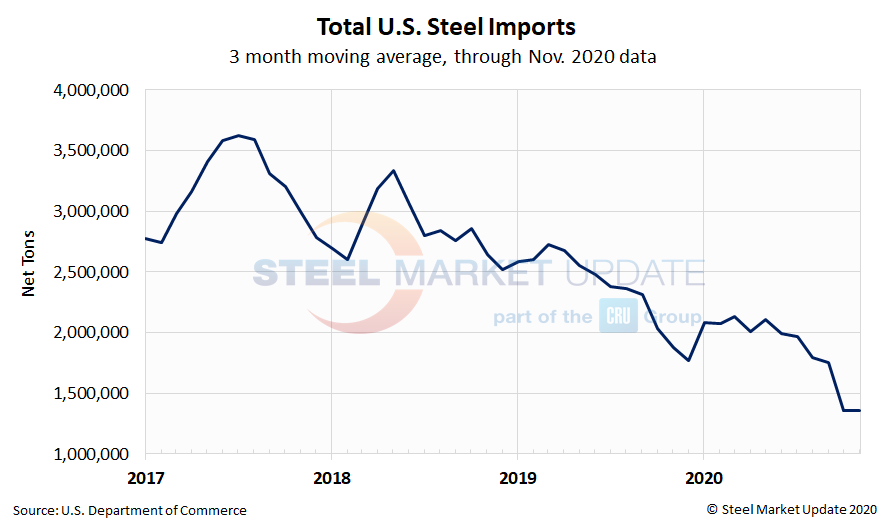

Due to large month-to-month swings in semifinished imports, the chart below shows total monthly imports on a three month moving average (3MMA) basis in an attempt to more accurately display the U.S. steel import trend. The 3MMA for November is now 1.35 million tons, almost idential to October. The average monthly import level for 2020 is now 1.86 million tons.

Total finished imports in October are up seven percent over the prior month, up to 1.26 million tons. Imports of semifinished products (mostly slabs) were 240,000 tons, up from 85,000 tons in September.

November import licenses are now at 1.30 million tons, with 70,000 tons being semifinished and 1.23 million tons being finished products.

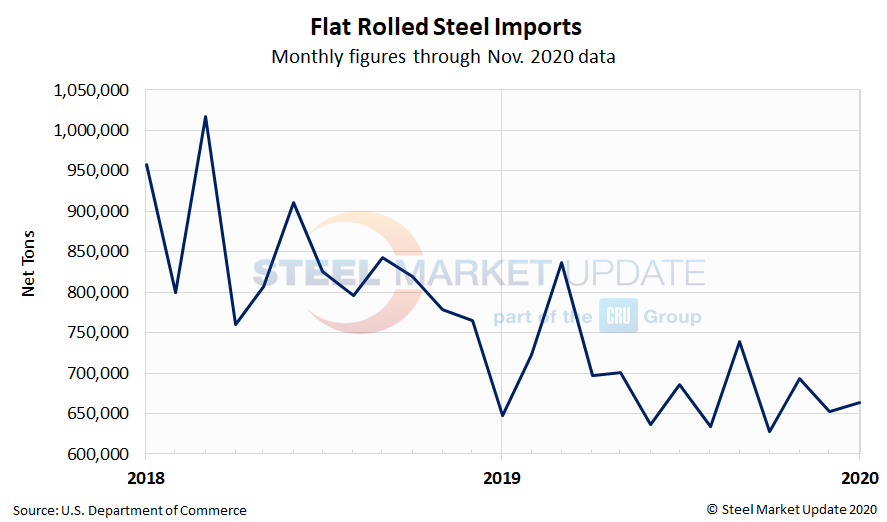

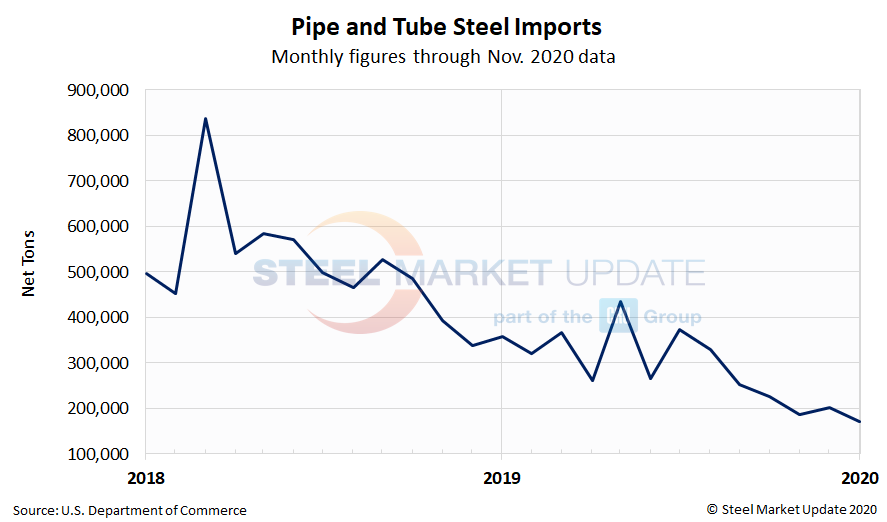

The two charts below show monthly imports grouped by product category- flat rolled imports and pipe and tube imports. Both charts show 2020 levels are down over the previous year, much more so in the pipe and tube category than flat rolled. We have limited data here but hope to expand in the future.