CRU

January 15, 2021

CRU: Longs Prices Continue to Rise, But Downside Pressures Emerging

Written by Dave Thewlis

By CRU Analyst Dave Thewlis, from CRU’s Steel Long Products Monitor

U.S. long product prices continued to surge into the month of February due to ongoing market tightness and strong demand. Imports remain too costly to seriously consider for the majority of buyers, given high international steel prices coupled with costly shipping rates and tariffs. Rebar prices gained another 8% m/m, while LC wire rod prices are up 18% m/m. For the latter, prices have now far surpassed the highest point reached in late 2018. Mill discounts at this point in the current price cycle are either very slim or simply nonexistent.

Long product demand in the U.S. has been robust throughout the fall and winter months of last year through 2021 Q1. Per U.S. Census Bureau data, December 2020 construction spending rose 1% m/m and was up 5.7% over December 2019 figures. This closes a strong 2020 overall in the U.S. construction sector, where total year spending in 2020 was up 4.7% over 2019 spending. Infrastructure and industrial project activity remain drivers for rebar. Additionally, we continue to hear about strong conditions in agriculture and automotive markets that have impacted demand for wire rod products.

Supply for certain long products continues to be a challenge for buyers. We have heard of relative difficulty in securing rebar in the southern U.S. versus from Midwest mills, though these lead times are more broadly aligned with a typical four-week waiting period. LC wire rod is a different story, where we have heard of lead times extended out into April, and in some cases into early May. Providing further upside price sentiment was the implementation of preliminary duties by the U.S. Commerce Department on welded mesh wire products imported from Mexico. These new tariff margins range from ~24% to ~153%, though the final determination has not yet been settled.

Outlook: Prices Should Stabilize Moving into March

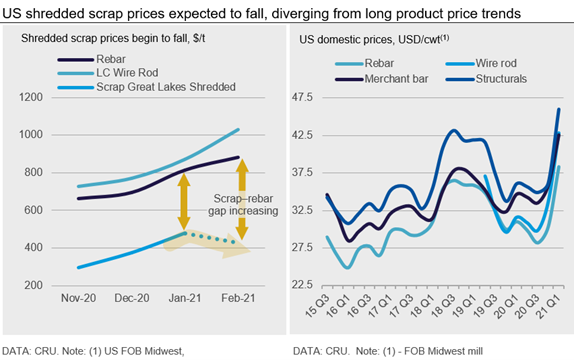

As scrap prices begin to diverge from finished steel prices, we expect to see long product prices hold for at least another month.

While a sharp increase in U.S. scrap prices contributed upside pressure to longs prices last month, an expected decline in February should bring the onset of stabilization. For example, Great Lakes shredded scrap prices rose 27% m/m in January, while a reduction of roughly 11% is expected in February. Most expectations we’ve heard suggest a drop in scrap prices by $50/l. ton or more. This should slow or stop additional upward steel price movements.

Buyers are, wherever possible, increasingly hesitant to stock expensive inventory in the short term, as many expect some downside pressure on prices towards the end of the month. Demand is likely to slow going forward, both domestically and in China as the Chinese New Year holiday approaches. Additionally, longs prices are beginning to soften in Europe, which may result in more imports becoming a viable alternative for U.S. buyers.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com