Prices

January 15, 2021

Life After the Internal Combustion Engine: The Effect on Aluminum

Written by Greg Wittbecker

By CRU Analysis Advisor Greg Wittbecker

Ford announced in February that it would be all electric in Europe by 2030. This comes on the heels of General Motors stopping production of internal combustion engines (ICE) by 2035. These decisions underscore the shifting landscape in key aluminum applications and use within automotive.

Die-castings have always been the bedrock of aluminum demand within the automotive market as engine and powertrain components. These are secondary alloys such as A380 and A319 made exclusively from scrap.

In 2016, die-castings supporting ICE comprised 70% of aluminum’s total 411 pounds per vehicle. In 2020, castings had declined to 65% as total pounds rose to 490 pounds. Projections are that by 2030, castings’ share of automotive aluminum will fall to 56% of aluminum’s total 570 pounds per vehicle. This decline is a combination of changes in ICE design towards smaller displacement, higher compression engines, plus electrification.

The acceleration to electric vehicles beyond 2030 will reduce aluminum’s share to an estimated 200 pounds per vehicle. This will be offset by a gain of 400 pounds for battery electric vehicle (BEV) components such as powertrain and platform.

Who’s Winning at the Expense of Aluminum Castings?

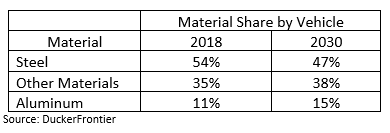

It should come as no surprise to any of our steel audience that aluminum sheet is the sector gaining share in automotive. In 2016, sheet represented 19% of aluminum’s total share or 77 pounds per vehicle. In 2020, it had climbed to 107 pounds or a 23% share. By 2030, forecasts place aluminum sheet at 30% or 171 pounds per vehicle. This shift has come at the expense of steel:

A Declining Castings Market Indirectly Hurts Steel Scrap Supply

Aluminum secondary alloys are principally made from zorba or twitch, which are derived from auto shredding. Zorba covers a multitude of sins under its ISRI description of “nonferrous scrap, predominately aluminum.” Aluminum content is by agreement of the parties. Twitch is a refined grade of zorba, which can run up to 95% aluminum.

Zorba or twitch comprises up to 6% of total metallic recovery from auto shredding. It punches above its weight on revenue, typically generating nearly 20% of total revenue.

As the share of aluminum castings declines in the automotive market, it’s reasonable to expect the demand for zorba and twitch to slump. When the Chinese imposed their embargo on U.S. imports of obsolete scrap in 2018, we saw zorba and twitch prices fall to 30-year lows. That may have been a taste of what’s to come over the next 10-15 years when domestic automotive demand shrinks.

That in turn, could make weaken the overall auto shredding business case. Ferrous auto shredding is high volume, low margin in the best of times. When zorba and twitch’s contribution to total shredding revenues declines, that could push out some marginal shredding capacity.

Greg Wittbecker joined CRU in January 2018 after retiring from Alcoa, where he was Vice President of Industry Analysis and Managing Director of Alcoa Beijing Trading, based in Shanghai, China. His career spans 35 years in the aluminum industry, having also held senior commercial and management roles at Cargill, Wise Metals and Koch Supply and Trading. Greg brings perspective on the entire aluminum supply chain from bauxite to aluminum finished products and will be a regular contributor to SMU going forward. He can be reached at gregory.wittbecker@crugroup.com