Market Data

April 1, 2021

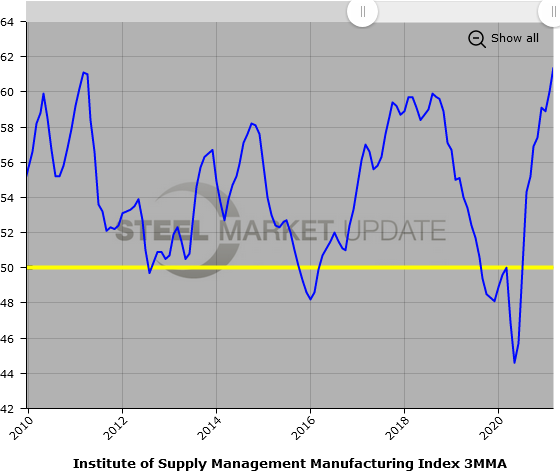

ISM Manufacturing Index Shows Gains in March

Written by Sandy Williams

U.S. manufacturing is on a solid path to recovery, according to the latest report from the Institute for Supply Management. The March 2021 Manufacturing ISM Report on Business posted a PMI of 64.7, a gain of 3.9 points from February.

Expanding demand resulted in new orders, production and employment growing at a faster rate in March. New import orders continued to expand with a slight increase from February. ISM noted that backlogs at ports were at record levels along with difficulties arranging drayage and domestic transportation for goods. Export orders expanded for a ninth consecutive month but at a slower pace.

To meet growing demand and rising backlogs, manufacturers stepped up hiring in March. The employment index gained 5.2 points last month, for its highest reading since February 2018.

Rising input prices and slower supplier deliveries continued to challenge manufacturers. Several survey respondents mentioned difficulties dealing with late-winter storms across the country. Inventories were relatively stable but unable to achieve traction to grow to preferred levels. Customers reported their inventories as at an “all-time low.”

“The manufacturing economy continued its recovery in March,” said Timothy Fiore, chairman of the ISM Manufacturing Business Survey Committee. “However, Survey Committee Members reported that their companies and suppliers continue to struggle to meet increasing rates of demand due to coronavirus (COVID-19) impacts limiting availability of parts and materials. Extended lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products are affecting all segments of the manufacturing economy. Worker absenteeism, short-term shutdowns due to part shortages, and difficulties in filling open positions continue to be issues that limit manufacturing-growth potential.”

Manufacturers were optimistic about future business conditions, with positive versus cautious comments at an 8-to-1 ratio in March, as compared to 5-to-1 in February.

Below is a graph showing the history of the ISM Manufacturing Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.