Market Segment

April 8, 2021

Schnitzer Earnings Soar on High Scrap Prices

Written by Sandy Williams

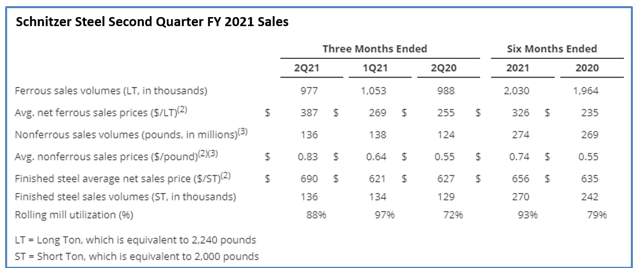

Schnitzer Steel tripled its net income from first to second quarter FY 2021 to $46 million, supported by robust revenues of $600 million. Strong demand for recycled metals, higher finished steel prices and elevated scrap pricing resulted in expanded metal spreads and operating margins. Net income per ferrous ton increased to $47 from $14 per ton in Q1 and $5 per ton in Q2 2020.

Schnitzer reported its second highest finished steel volumes since Q2 2008. Volumes increased 1% sequentially and 5% from Q2 FY 2020

Chairman and CEO Tamara Lundgren stated, “We are exceptionally pleased with our performance during the quarter, reflecting our best operating income per ton since 2008. This is a testament to the strength and agility of our team in leveraging positive market conditions while delivering on our operational and strategic initiatives. Since the end of the second quarter, we have commissioned two of the advanced metal recovery technology systems, which are key to the execution of our strategic plan and the achievement of our sustainability goals.”

The new plants, plus another under construction, will recover nonferrous metals. Five other systems are currently in the permitting or engineering phases. Schnitzer hopes to complete installation by the end of FY 2022 and be fully operational by the second quarter of that fiscal year.

Ferrous scrap volumes were flat year-over-year year and down 7% from the previous quarter due to severe weather that delayed three February shipments. Ferrous volumes were sold to 10 countries in the quarter with one-third exported to the Americas, a record for the areas which have suffered tight scrap availability due to a slower COVID recovery. Domestic sales increased sequentially due to export delays. Average selling price for ferrous scrap rose 43 percent from Q1 and 51 percent from a year ago.

“The strong global demand for recycled ferrous is being driven by both cyclical and structural factors, including continuing economic recovery, benefits of government stimulus, tight supply, growth in EAFs and the increased use of scrap in steelmaking,” said Richard Peach, CFO and Chief Strategy Officer.

Schnitzer is expecting ferrous scrap volumes in the third quarter to increase sequentially 15% to 20% and nonferrous to increase 10% to 15%. Finished steel volumes are expected to be similar to the second quarter and rolling mill utilization to remain high despite a planned maintenance outage, said Peach.

Lundgren said so far China has not imported much ferrous scrap from the U.S. or the EU, favoring scrap from Asia. Two issues are affecting China’s scrap imports.

“One is there are still some significant scrap metal content questions that are outstanding, and there are complex import procedures. But I would expect that those will be resolved because there is demand,” said Lundgren. “There is demand that’s underpinned by carbon reduction goals, among other things. So, I think that this is just a matter of time.”

A U.S. infrastructure bill is more a “question of when, not if” and the impact to the scrap and steel industries will be significant, said Lundgren. She suggested that rather than trying to calculate tonnage that may be generated by infrastructure, a broader view is required.

“Yes, there will definitely be an increase in steel usage. And we also project there will be a significant increase in GDP growth. And those growth drivers have multiplier effects. They have multiplier effects in terms of jobs, in terms of consumer activity. The more consumer activity you see, the more scrap generation you see.

“And then you have to take into account the transition to low-carbon technologies, specifically the commitment on the part of the major auto producers to transition from ICEs to EVs. That in and of itself will result in significant demand for new vehicles and probably the encouragement of replacement of existing ICEs. So, we see the infrastructure bill as being a long-cycle underlying demand driver for both recycled metals as well as for steel.”