Prices

April 8, 2021

U.S. Finished Steel Imports Move Up in February and March

Written by Brett Linton

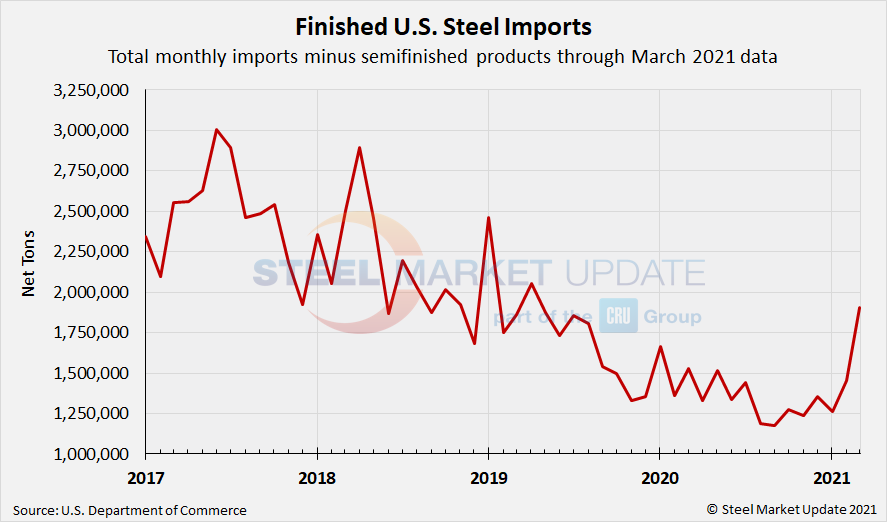

Final Census data shows that finished steel imports rose 15% in February to 1.45 million tons, as more U.S. buyers sought relief from climbing domestic prices and limited supply. This is the highest finished-steel import level seen since May 2020.

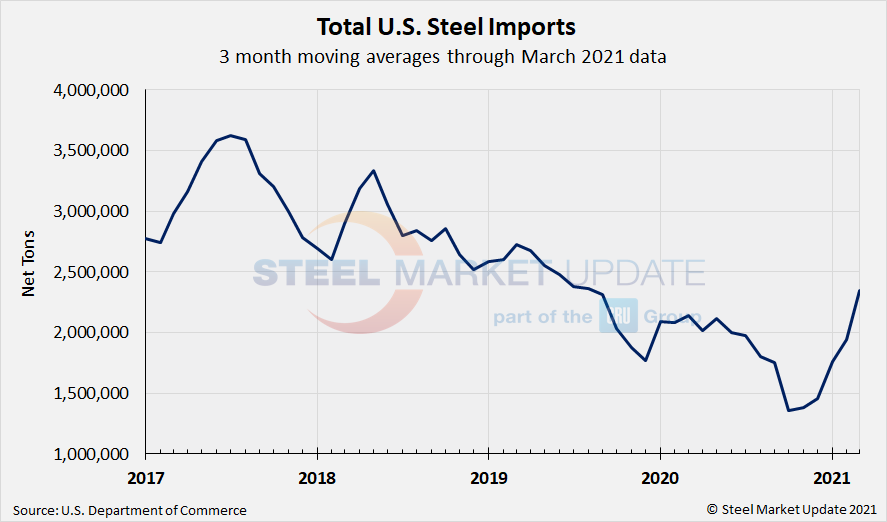

Total steel imports were 1.90 million tons in February, down 22% month-over-month, due to January’s bump in semifinished imports as buyers attempted to maximize quarterly quota limits in the first month of the quarter. Total March import licenses are currently at 2.72 million tons as of data through April 7, up 43% from February and up 12% from January. For comparison, the average monthly import level for 2020 was 1.84 million tons, down from 2.32 million tons in 2019 and 2.81 million tons in 2018.

March finished steel import licenses are currently at 1.90 million tons, up 31% over February and up 51% over January. March finished-steel imports are now approaching levels not seen since April 2019.

Due to large month-to-month swings in semifinished imports, the chart below shows total monthly imports on a three-month moving average (3MMA) basis in an attempt to more accurately display the U.S. steel import trend. The 3MMA through March license data is 2.35 million tons, up from 1.94 million tons in February and up from 1.76 million tons in January. The March 3MMA is now the higest seen since August 2019.

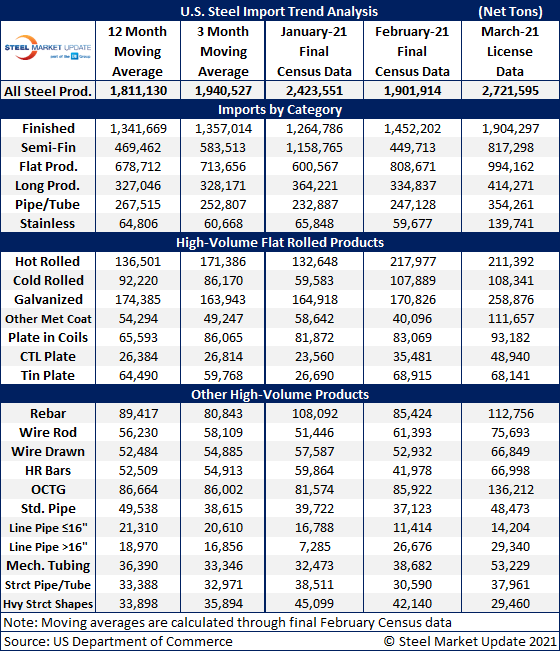

The below table now includes other high-volume products in addition to our normal focus on flat rolled products; we now show a brief history on products such as rebar, tin plate, wire rod, structural pipe and tube, and other long products. We also provide data on categorized imports, divided into semifinished, finished, flat rolled, longs, pipe and tube, and stainless products.

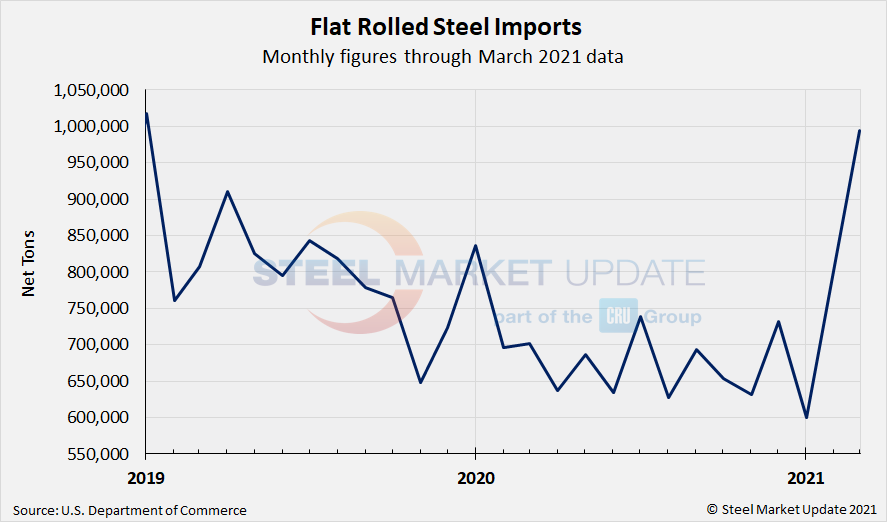

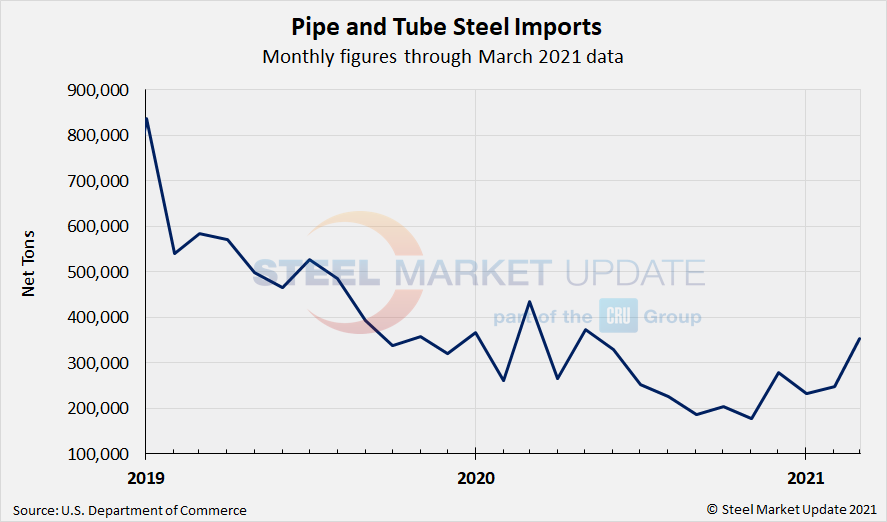

The two charts below show monthly imports grouped by product category: flat rolled imports and pipe and tube imports. Both product groups showed gains in February and March, with flat rolled imports ramping up from January’s multi-year low and approaching levels not seen in over two years. March data suggests a 43% spike in pipe and tube imports over February, up 52% from the January low and back in line with pre-pandemic levels of late-2019 and early-2020.

By Brett Linton, Brett@SteelMarketUpdate.com