Prices

April 15, 2021

February Import Market Share for Tubular and Long Products

Written by David Schollaert

This report examines the import share of tubular and long products shipments. Imports’ share of total tubular products rose to 44.6% in February, up from 42.5% the month prior, but primarily due to a 9.7% decrease in domestic tubular shipments overall. Tubular imports decreased for the third consecutive month in February. Long products import market share dipped from 11.7% in January to 11.2% in February, as both imports and domestic shipments edged down month on month.

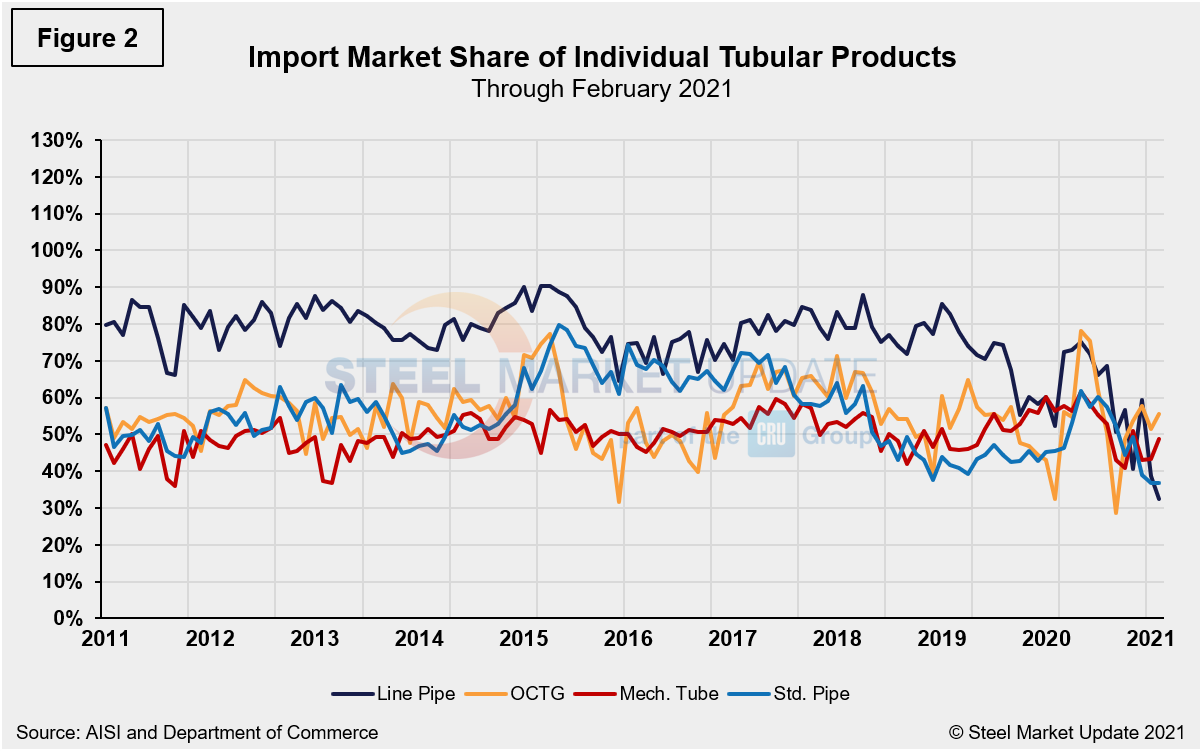

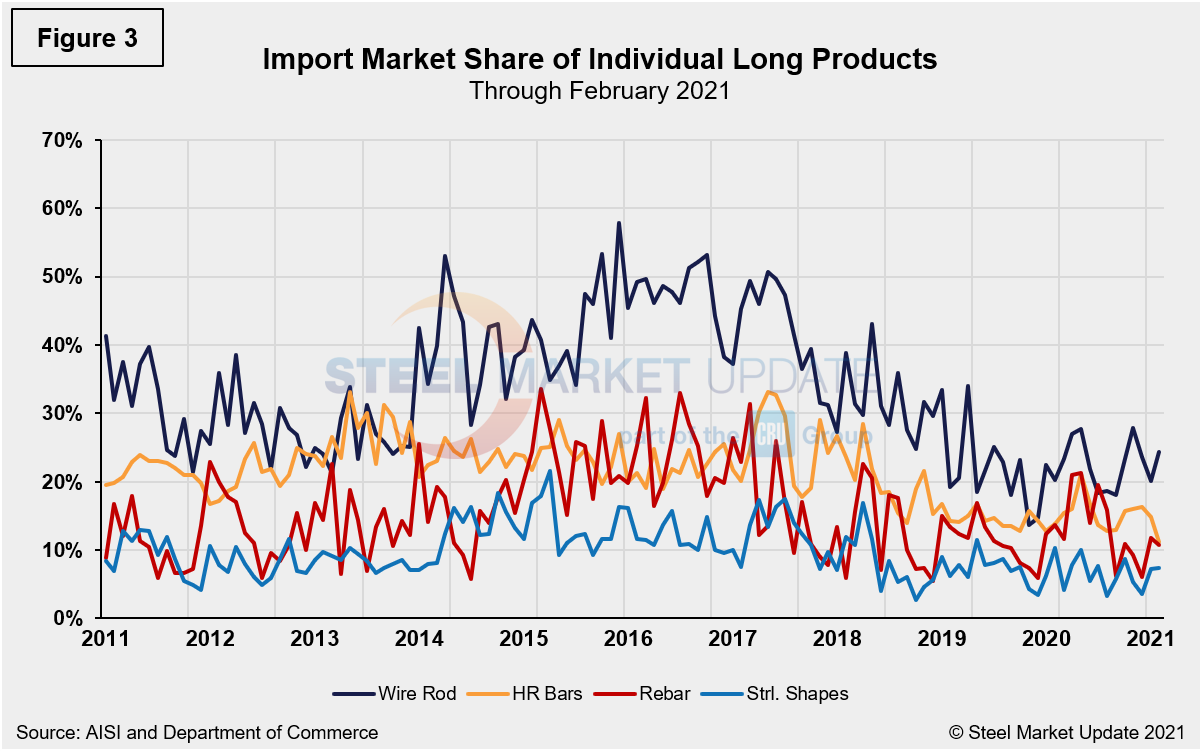

The import share of wire rod rose to 24.4% in February, up from 20.1% in January, mainly due to an increase of 19.3% in imports month on month. OCTG saw its import share rise to 55.6% in February, up from 51.3% in January, while mechanical tubing rose to 48.7% in February from 43.4% the month prior.

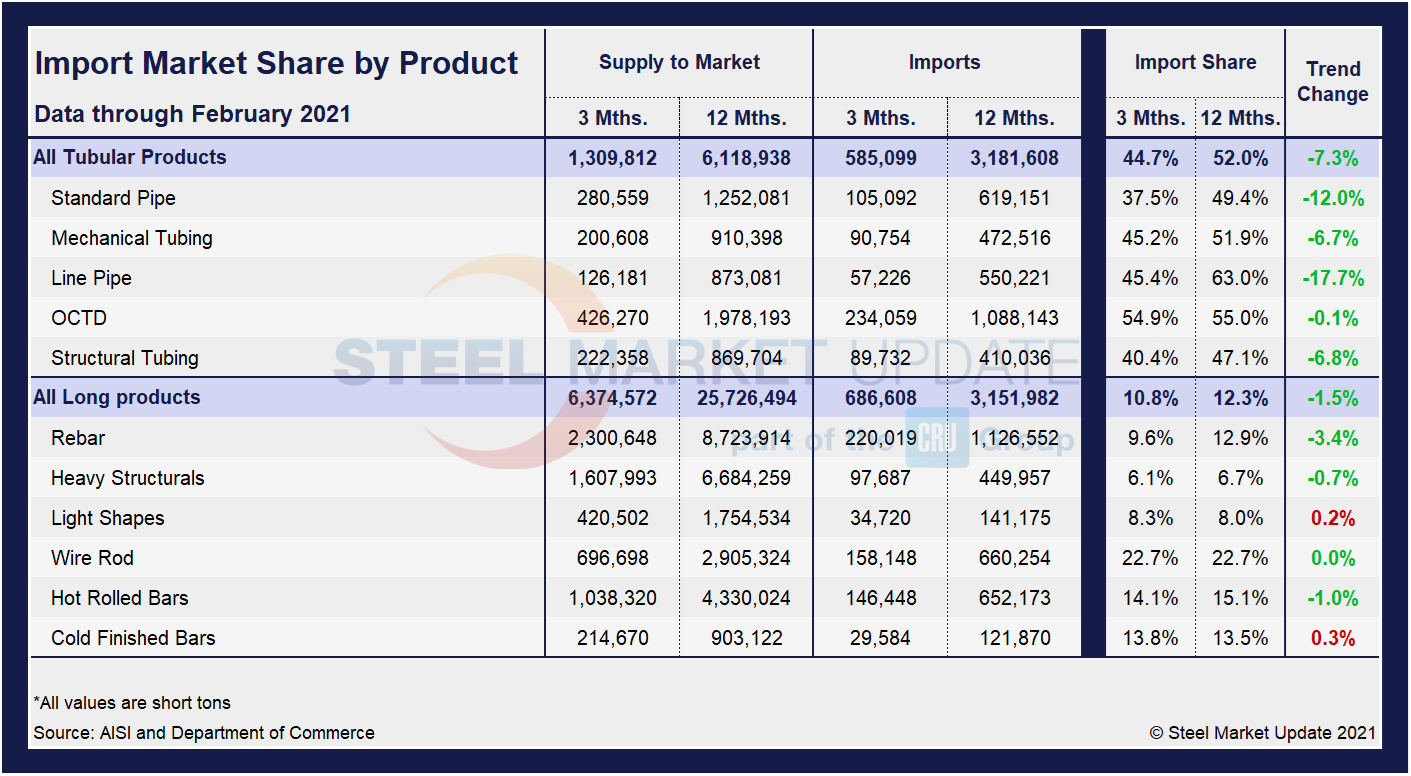

The table below shows total supply to the market in three months and 12 months through February 2021 for the four product groups and 17 subcategories. Supply to the market is the total of domestic mill shipments plus imports. It shows imports on the same three- and 12-month basis and then calculates import market share for the two time periods for 17 products. Finally, it subtracts the 12-month share from the three-month share and color codes the result green or red according to gains or losses. If the result of the subtraction is positive, it means that the import share is increasing, and the code is red. Most importantly, in regard to tubular and long products, the import market share has decreased in three months compared to 12 months across all product groups except for light shapes (0.2%) and cold finished bars (0.3%), which saw inconsequential increases through February 2021.

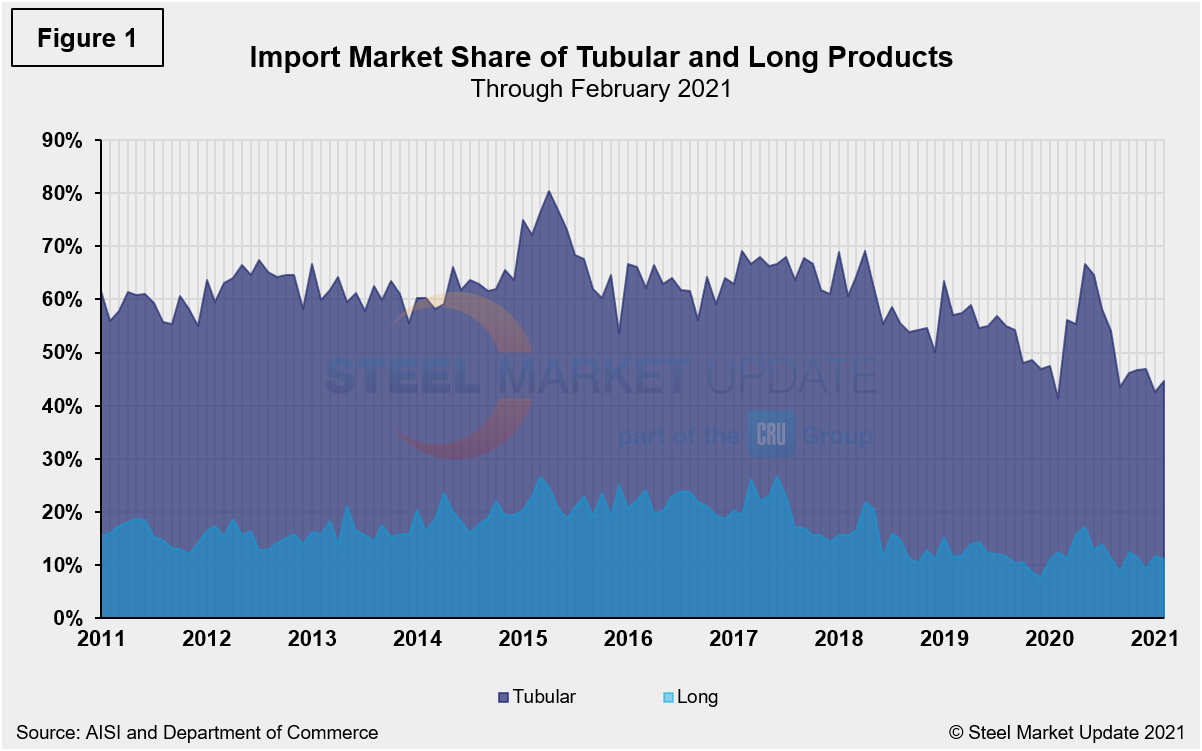

The historical import market share of tubular and total long products is shown in Figure 1, while the import market share of the four major tubular products is displayed in Figure 2. Lastly, the import market share of individual long products is shown in Figure 3. The import share of tubular products is more than triple that of long products. Both were impacted by COVID-19 mitigation efforts and have yet to return to pre-pandemic levels; however, tubular product shipments have been far more impacted than long products over that period. In February, wire rod was the sole long product to see a month-on-month increase in imports (19.3%), while mechanical tubing (19.1%) and OCTG (5.3%) were the only tubular products to see additional imported volumes in February when compared to the prior month.

SMU Comment: Imports of tubular goods and long products have not experienced increases as significant as those of sheet and plate products over the past year. With a pending new infrastructure bill, however, and overall rising demand, added volumes of foreign long products and tubular goods should be seen in the near-term.

By David Schollaert, David@SteelMarketUpdate.com