Prices

April 27, 2021

SMU Price Ranges & Indices: “Some Scary Level for Steel”

Written by Brett Linton

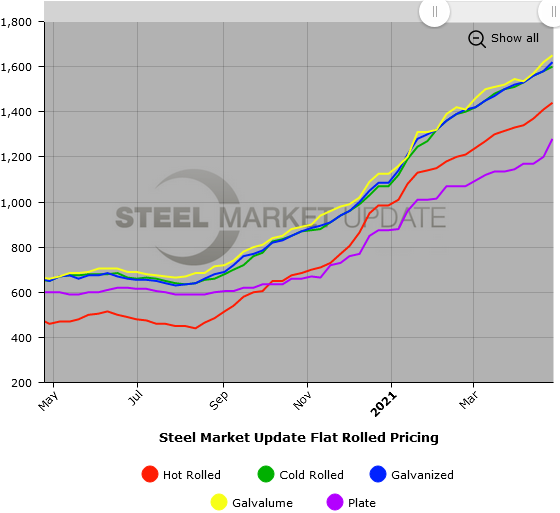

Hot rolled steel offers ranged as high as $1,500 per ton this week as steel tags just keep rising to levels never seen before. Steel Market Update’s check of the market this week puts the average HR price at a record $1,440 per ton, up another $30 per ton over last week and 35% higher than the previous peak reported by SMU in 2008. Cold rolled and coated steel prices saw similar inflation of $20-40 per ton week over week as demand accelerates in the post-pandemic economic rebound and steel supplies remain in short supply. “This is some scary level for steel. Prices have been increasing by at least $100 per ton each month. So the coming peak could be even higher than we think,” said one buyer. Added another: “How can anyone argue that hot rolled won’t get to $1,500 per ton. We are already seeing above those numbers in the spot market. The indices will get there, guaranteed!”

Plate prices were more difficult to gauge this week as it is sometimes difficult to separate the FOB mill prices that we request from the delivered prices that we receive. A common price for plate, before delivery and extras, is likely around $1,220 per ton, in line with the minimum announced this week by Nucor. But some sources reported base prices as high as $1,340 per ton, putting the midpoint of the range higher at $1,280 per ton. So we leave it to readers to draw your own conclusions on plate. Steel Market Update’s Price Momentum Indicators continue to point toward higher prices on all steel products over the next 30 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,380-$1,500 per net ton ($69.00-$75.00/cwt) with an average of $1,440 per ton ($72.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago, while the upper end increased $50. Our overall average is up $30 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 7-12 weeks

Cold Rolled Coil: SMU price range is $1,550-$1,650 per net ton ($77.50-$82.50/cwt) with an average of $1,600 per ton ($80.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week, while the upper end increased $30. Our overall average is up $20 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 8-14 weeks

Galvanized Coil: SMU price range is $1,560-$1,680 per net ton ($78.00-$84.00/cwt) with an average of $1,620 per ton ($81.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $60. Our overall average is up $40 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,629-$1,749 per ton with an average of $1,689 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-15 weeks

Galvalume Coil: SMU price range is $1,600-$1,700 per net ton ($80.00-$85.00/cwt) with an average of $1,650 per ton ($82.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end increased $60 per ton. Our overall average is up $30 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,891-$1,991 per ton with an average of $1,941 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 10-15 weeks

Plate: SMU price range is $1,220-$1,340 per net ton ($61.00-$67.00/cwt) with an average of $1,280 per ton ($64.00/cwt) FOB mill. The lower end of our range increased $70 per ton compared to one week ago, while the upper end increased $90. Our overall average is up $80 from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-10 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.