Market Data

May 3, 2021

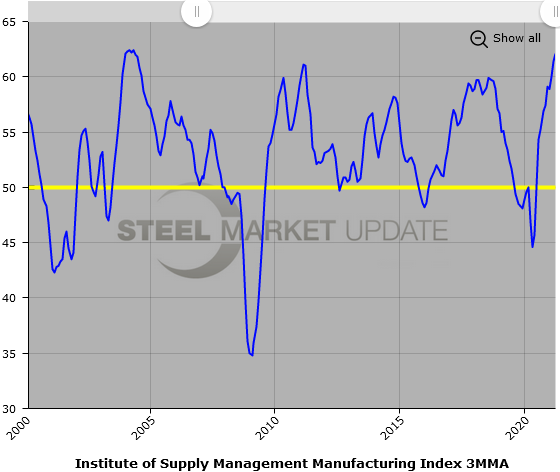

ISM PMI Remains in Expansion, But Slips Slightly in April

Written by Sandy Williams

The ISM Manufacturing Report on Business came in lower than expected in April. The PMI dipped four points to a reading of 60.7% as both the new orders and production indexes edged downward to 64.3% and 62.5%, respectively. A score above 50, however, indicates expansion, which means demand continued to improve in April. Fabricated metal products and primary metals were among the top five industries that reported growth last month.

Backlog of orders registered 0.7 points higher at a reading of 68.2. The supplier deliveries index dipped 1.6 points to 75% indicating suppliers continued to struggle to get products to manufacturers but at a marginally slower rate, said Timothy R. Fiore, chairman of the Institute for Supply Management Manufacturing Business Survey Committee.

Inventories moved back into contraction as supplier delivery rates failed to keep up with demand. Prices for raw materials continued to accelerate for an 11th month, for an index reading of 89.6%. For the last three months, the price index has been at its highest level since July 2008 when it registered 90.4%.

New export orders were up 0.4 percentage points to 54.9% in April. The index for imports decreased 4.6 points to 52.2%. “Panelists continued to note backlogs in ports of entry, as well as difficulties in arranging drayage and operating within the domestic transportation market,” said Fiore.

The employment index, at 55.1%, remained in expansion for the fifth month in a row, although slipping 4.5 points from March.

The manufacturing economy continued expanding in April, said Fiore. “Survey Committee Members reported that their companies and suppliers continue to struggle to meet increasing rates of demand due to coronavirus (COVID-19) impacts limiting availability of parts and materials. Recent record-long lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products are continuing to affect all segments of the manufacturing economy. Worker absenteeism, short-term shutdowns due to part shortages, and difficulties in filling open positions continue to be issues that limit manufacturing-growth potential. Optimistic panel sentiment increased, with 11 positive comments for every cautious comment, compared to an 8-to-1 ratio in March.”

Comments by ISM survey respondents included:

“Steel prices are crazy high. The normal checks on the domestic steel mills are not functioning — imported steel is distorted by the Section 232 tariffs.” (Fabricated Metal Products)

“The metals markets remain very challenging at best. Shortages of raw materials have increased, especially in aluminum and carbon steel. Prices continue to rapidly increase. Transportation and trucking [are] also a big challenge.” (Primary Metals)

“It’s getting much more difficult to supply production with materials that are made with copper or steel. Lots of work on the floor, but I am worried about getting the materials to support it.” (Electrical Equipment, Appliances & Components)

“Demand continues to be very strong. Supply chain delays hamper our availability and ability to sell more.” (Machinery)

“The current electronics/semiconductor shortage is having tremendous impacts on lead times and pricing. Additionally, there appears to be a general inflation of prices across most, if not all, supply lines.” (Computer & Electronic Products)

“Continued strong sales; however, we have had to trim some production due to the global chip shortage. Hasn’t affected inventories greatly yet, but a continued decrease will begin to reduce available inventories if we don’t recover chip supply shortly.” (Transportation Equipment)

“Oil production has been steady, along with market prices and capital expenditures.” (Petroleum & Coal Products)

Below is a graph showing the history of the ISM Manufacturing Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.