Prices

May 28, 2021

Raw Materials Prices: Iron Ore, Coking Coal, Pig Iron, Scrap, Zinc

Written by Brett Linton

Prices for all of the steelmaking raw materials tracked in this SMU analysis increased from April to May, with most products following large gains seen in previous months. Over the last 30 days, pig iron and coking coal prices have increased 17-19%, respectively. In that same period, prices increased for iron ore 9%, zinc 6%, scrap 5% and aluminum 2%.

Table 1 summarizes the price changes of the seven materials considered in this analysis. It reports the month/month, three months/three months and year/year changes as a percentage.

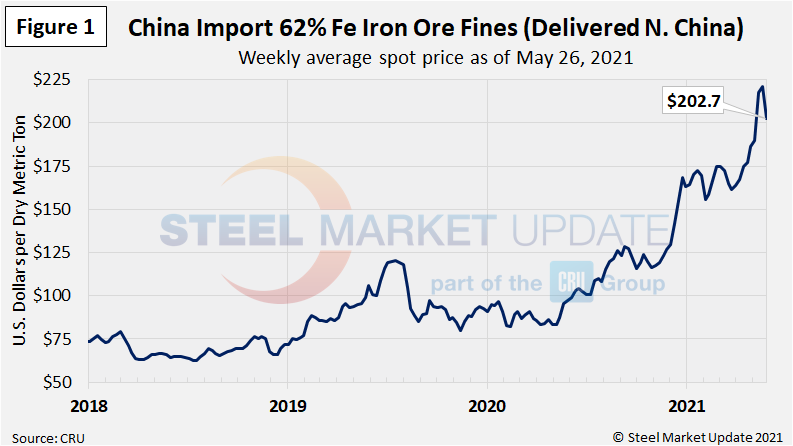

Iron Ore

The Chinese import price of 62% Fe content iron ore fines has been moving upward since May 2020. Figure 1 shows the price of 62% Fe delivered North China at $202.7/dmt as of May 26, up 9% over one month prior and over two times as high as the May 2020 price.

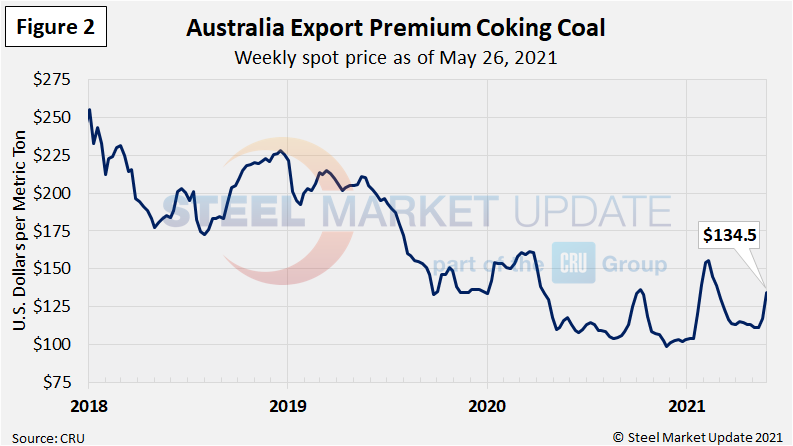

Coking Coal

The price of premium low volatile coking coal FOB east coast of Australia declined throughout much of 2020, briefly rising to a 10-month high in early 2021. Prices had declined through mid-May but have since jumped, reaching $134.5 dollars per dry metric ton as of May 26 (Figure 2). Although up, recent coking coal prices remain low compared to years prior.

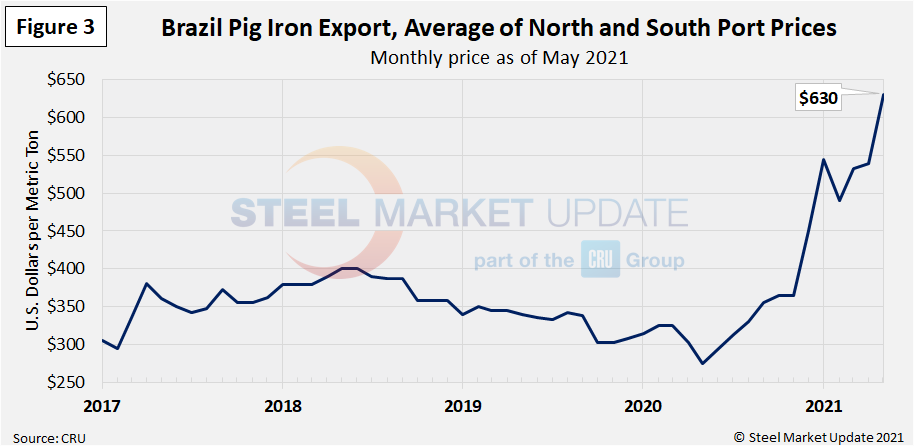

Pig Iron

Most of the pig iron imported to the U.S. currently comes from Russia, Ukraine and Brazil. This report summarizes prices out of Brazil and averages the FOB value from the north and south ports. The latest data through May shows an average pig iron price of $630 per metric ton. Pig iron prices have remained historically high for the past six months and are up 129% from levels one year ago. Pig iron prices reached a low of $275 per metric ton in May 2020, with prices increasing each month thereafter through January 2021. After February’s slight dip, pig iron prices resumed their upwards climb in March and have remained strong since (Figure 3).

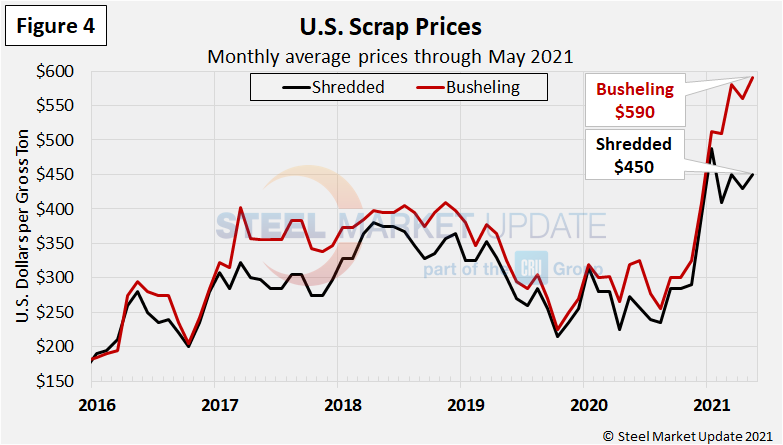

Scrap

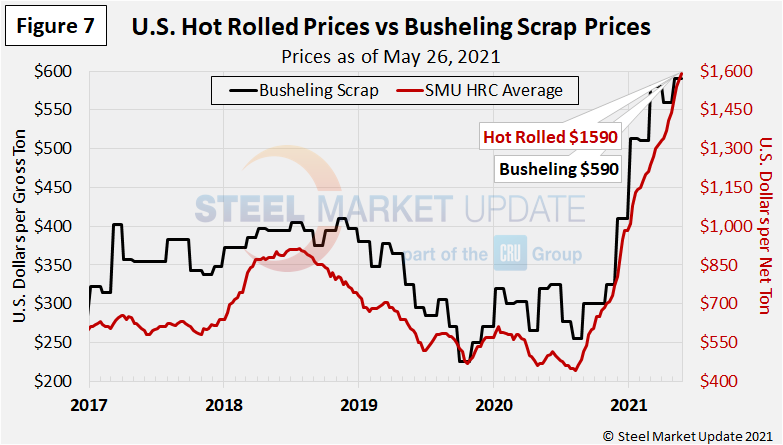

Hot rolled steel prices fluctuate up and down with the price the mills must pay for their raw materials. Changes in the relationship between scrap and iron ore prices offer insights into the competitiveness of integrated mills, whose primary feedstock is iron ore, versus the minimills, whose primary feedstock is scrap. Figure 4 shows the spread between shredded and busheling, both priced in dollars per gross ton in the Great Lakes region. May scrap prices remain strong, up 5% from the month prior and 65-84% higher than May 2020 prices. Busheling scrap prices have now surpassed the previous record high of $580 in March 2020. Prior to the last few months, the previous record-high busheling price was $510 per ton in December 2011.

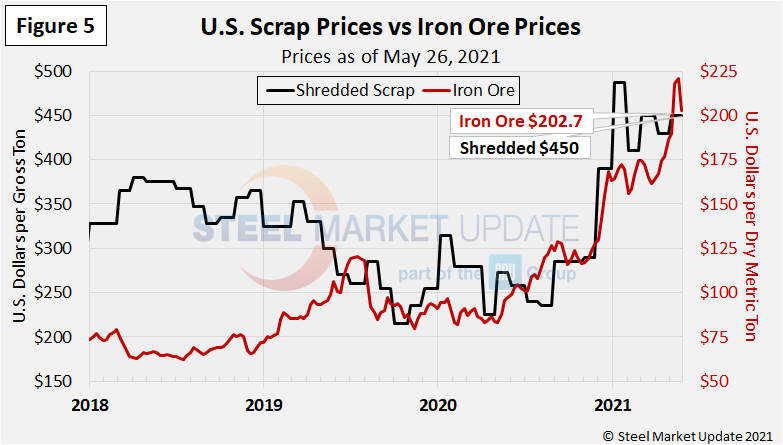

Figure 5 shows the similar uptrend in the prices of mill raw materials over the past year as the price of iron ore hit $203 per dry metric ton and shredded scrap hit $450 per gross ton this week.

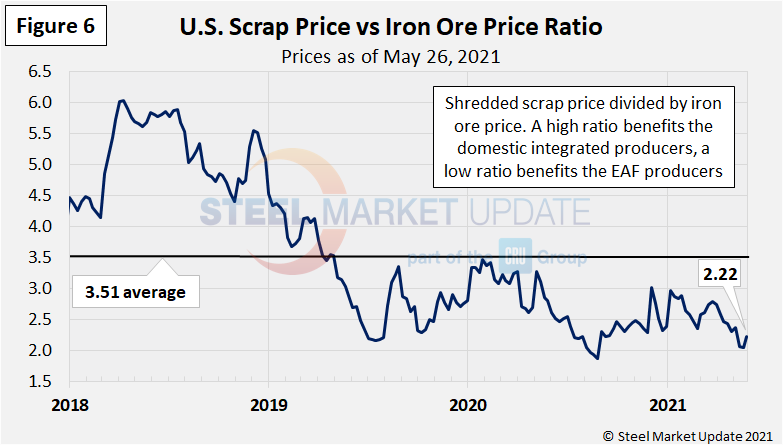

To compare the two, Steel Market Update divides the shredded scrap price by the iron ore price to calculate a ratio (Figure 6). A high ratio favors the integrated/BF producers, a lower ratio favors the minimill/EAF producers. At the current 2.22 ratio shown below, minimills continue to hold a more competitive cost advantage. This ratio hit an all-time low of 1.86 in August 2020 (within SMU’s 12-year limited data history).

Figure 7 shows how the price of hot rolled steel generally tracks with the price of busheling scrap. Bush rose by $30 per ton from April to May, up $78 from January. Hot rolled prices continue to rise each week, with the latest SMU average at $1,590 per ton as of May 25; this is up $150 over the past month and up $580 since the start of the year.

Zinc and Aluminum

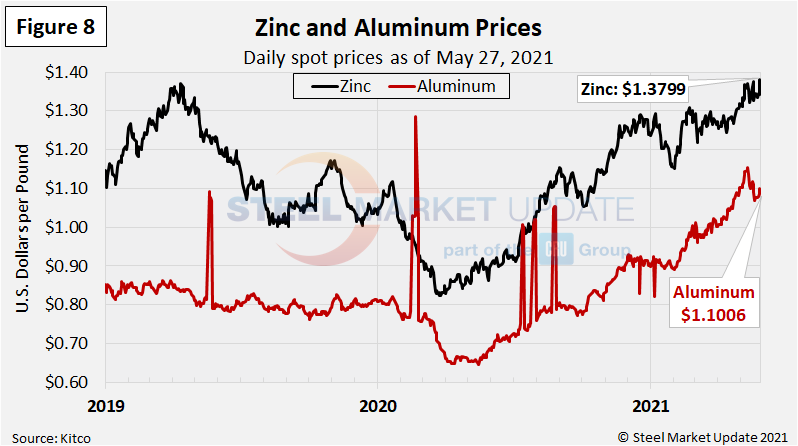

Zinc, used to make galvanized and other products, has began to increase in price over the last month and is nearing the high levels previously seen in early-2019 (Figure 8). The LME cash price per pound of zinc as of May 27 was $1.3799, up 9% from three months prior and up 64% from the April 2020 low of $0.8236. The price of zinc factors into the coating extras charged by the mills for galvanized products. California Steel recently revised its coating extras upwards to reflect the higher zinc price, and many mills had adjusted their extras on the sharp rise in zinc back in late-2020. Aluminum prices, which factor into the price of Galvalume, have been trending upwards since May 2020 and reached a multi-year high just two weeks ago. Note that aluminum prices often have large swings and return to typical levels within a few days, as seen in the graphic below. The LME cash price per pound of aluminum was $1.1006 as of May 27, up 12% over three months ago and up 62% over one year prior.

By Brett Linton, Brett@SteelMarketUpdate.com