Prices

June 8, 2021

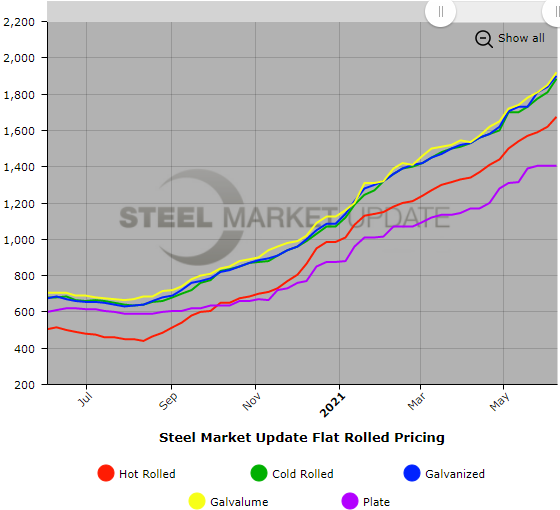

SMU Price Ranges & Indices: Hot-Rolled Coil Closes in on $1,700 per Ton

Written by Brett Linton

Hot-rolled coil prices charged higher yet again even as lead times stretched into August, a typically slower time of the year. Is a year-long hot streak for sheet possible? The answer in ordinary times would be ‘no’. But these are not ordinary times. Hot-rolled coil prices have hit a new all-time high of $1,675 per ton, up $55 per ton compared to a week ago and up $1,235 per ton from August of last year. Cold-rolled coil prices were up $65 per ton week-over-week, galvanized base prices gained $20 per ton, and Galvalume prices were up $70 per ton. The increases came after June prime scrap prices settled up $60 per gross ton. Plate prices, meanwhile, were unchanged. Will flat-rolled steel prices continue to move up with early predictions that July scrap might be sideways? Time will tell. SMU’s Price Momentum Indicators, in the meantime, continue to point toward higher prices for the next 30 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,600-$1,750 per net ton ($80.00-$87.50/cwt) with an average of $1,675 per ton ($83.75/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $110 per ton. Our overall average is up $55 per ton from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 8-12 weeks

Cold Rolled Coil: SMU price range is $1,800-$1,970 per net ton ($90.00-$98.50/cwt) with an average of $1,885 per ton ($94.25/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end increased $150 per ton. Our overall average is up $75 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 11-14 weeks

Galvanized Coil: SMU price range is $1,800-$2,000 per net ton ($90.00-$100.00/cwt) with an average of $1,900 per ton ($95.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $120 per ton. Our overall average is up $60 per ton from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,869-$2,069 per ton with an average of $1,969 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 12-16 weeks

Galvalume Coil: SMU price range is $1,840-$2,000 per net ton ($92.00-$100.00/cwt) with an average of $1,920 per ton ($96.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week, while the upper end increased $100. Our overall average is up $70 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,131-$2,291 per ton with an average of $2,211 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 12-16 weeks

Plate: SMU price range is $1,320-$1,490 per net ton ($66.00-$74.50/cwt) with an average of $1,405 per ton ($70.25/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.