Prices

July 6, 2021

SMU Price Ranges & Indices: What Summer Doldrums?

Written by Brett Linton

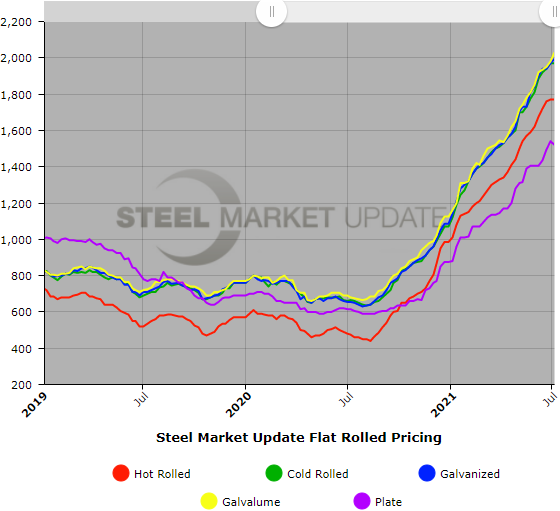

SMU found no evidence of a summer lull in our latest check of the market. Sheet prices were flat or up in a post-holiday period that in prior years has seen them slip. Hot-rolled coil and cold-rolled coil prices were unchanged. Galvanized and Galvalume prices were up $25 per ton and $50 per ton, respectively.

That means SMU’s Galvalume price is above $2,000 per ton for the first time ever. And galvanized prices are just below that threshold.

Despite continued record high sheet prices, we still haven’t seen much evidence of demand destruction. And supplies could tighten in the weeks ahead because of outages – planned and otherwise – that have occurred recently or that are upcoming in the fall.

Plate prices dipped by $20 per ton. But we’re not prepared to call a new trend based on a modest week-over-week decline following Independence Day.

Are we at a peak? Probably not this week.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,700-$1,840 per net ton ($85.00-$92.00/cwt) with an average of $1,770 per ton ($88.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 8-12 weeks

Cold Rolled Coil: SMU price range is $1,920-$2,020 per net ton ($96.00-$101.00/cwt) with an average of $1,970 per ton ($98.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to last week, while the upper end increased $30 per ton. Our overall average is unchanged from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 12-14 weeks

Galvanized Coil: SMU price range is $1,940-$2,050 per net ton ($97.00-$102.50/cwt) with an average of $1,995 per ton ($99.75/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $50 per ton. Our overall average is up $25 per ton from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $2,009-$2,119 per ton with an average of $2,064 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 12-14 weeks

Galvalume Coil: SMU price range is $1,960-$2,100 per net ton ($98.00-$105.00/cwt) with an average of $2,030 per ton ($101.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to last week, while the upper end increased $40 per ton. Our overall average is up $50 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,251-$2,391 per ton with an average of $2,321 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 12-14 weeks

Plate: SMU price range is $1,440-$1,600 per net ton ($72.00-$80.00/cwt) with an average of $1,520 per ton ($76.00/cwt) FOB mill. The lower end of our range remained unchanged compared to one week ago, while the upper end decreased $40 per ton. Our overall average is down $20 per ton from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 8-10 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.