Prices

August 9, 2021

Raw Steel Production Sees Small Declines: AISI

Written by David Schollaert

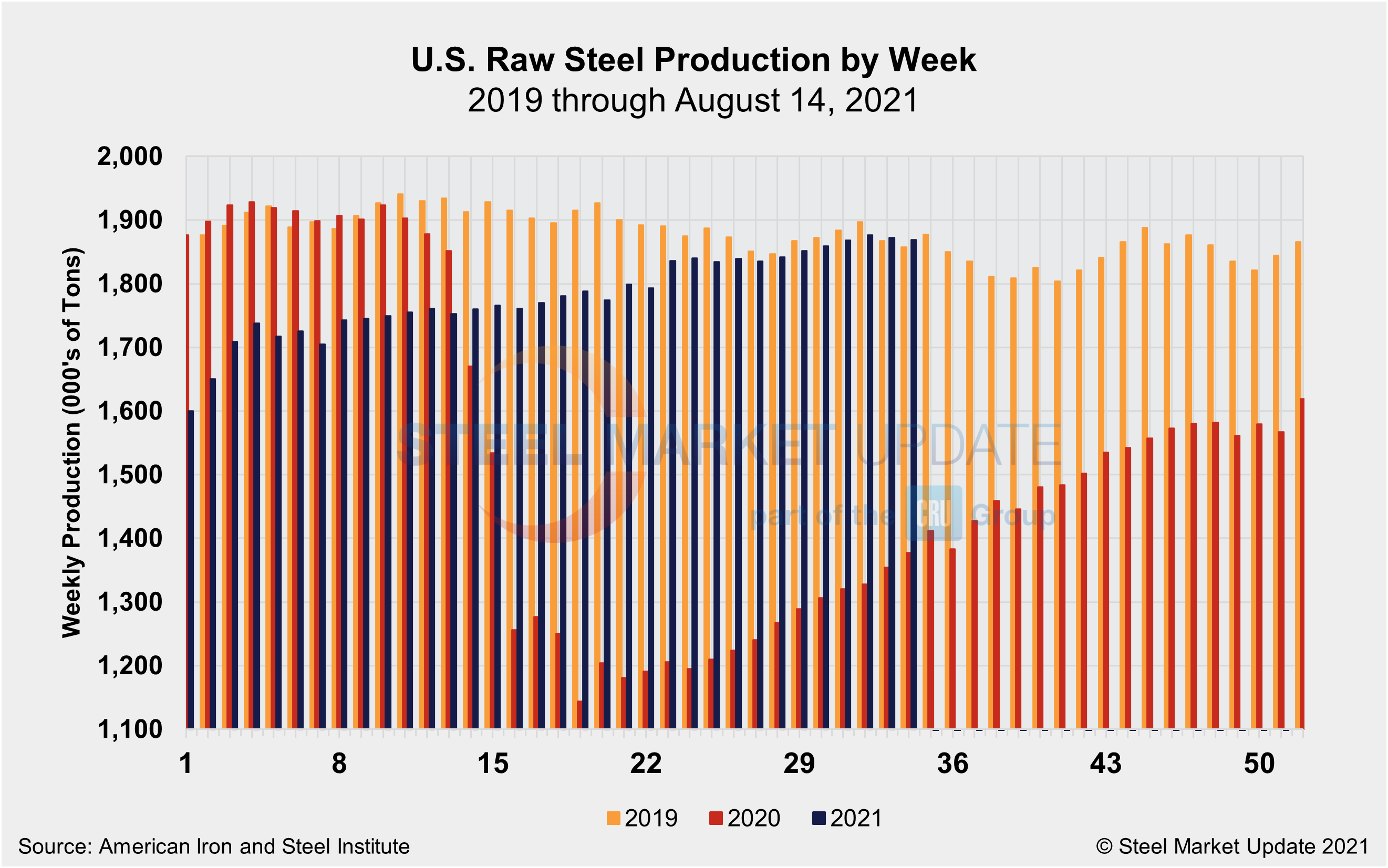

Weekly raw steel production by U.S. mills contracted slightly for the second straight week. The average utilization rate was 84.7%, while production totaled 1,869,000 net tons in the week ending Aug. 14, according to the American Iron and Steel Institute (AISI).

The dip, though minor, was the second in as many weeks after domestic production pushed utilization up to 85.0% for six straight weeks. Despite the small declines, U.S. mills continue to produce steel near full capacity. Weekly output eased down 0.2% compared to the week prior when production was 1,872,000 net tons and average utilization was 84.8%. Last week’s production total represents a 26.6% increase from year-ago levels, when output was reduced to 1,476,000 net tons and utilization to 65.9% because of the pandemic.

Adjusted year-to-date production through Aug. 14 was 58,296,000 net tons, at an average utilization rate of 80.3%. That’s up 19.5% from the same period last year when the utilization rate was 66.6% and production was 48,767,000 net tons, AISI said.

Production increased in just one out of the five districts in the past week. The 6,000-ton gain in the Midwest was offset by a 9,000-ton decrease across the remaining districts. Following is production by district for the Aug. 14 week: North East, 157,000 tons; Great Lakes, 638,000 tons; Midwest, 202,000 tons; South, 799,000 tons; and West, 73,000 tons, for a total of 1,869,000 net tons.

Note: The raw steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage provided by approximately 50% of the domestic production capacity combined with the most recent monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI production report “AIS 7,” published monthly and available by subscription, provides a more detailed summary of steel production based on data supplied by companies representing 75% of U.S. production capacity. Given the large number of changes to steelmaking capability in the current rapidly evolving market environment, AISI is undertaking a comprehensive review of its raw steel production and capability utilization statistics to ensure that they accurately reflect market conditions. Any updates to capability will be phased in over several weeks.

By David Schollaert, David@SteelMarketUpdate.com