CRU

September 7, 2021

CRU: Global Metallics Prices Continue on Downward Trajectory

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Metallics Monitor

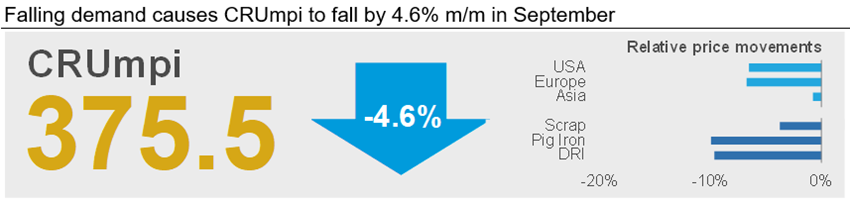

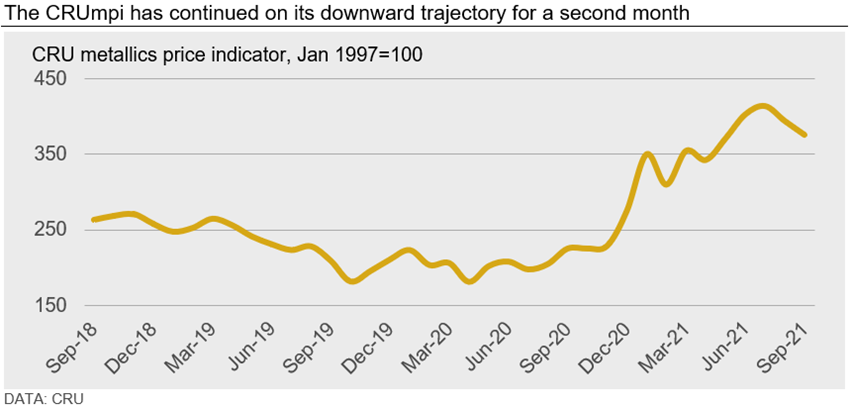

The CRU metallics price indicator (CRUmpi) fell by 4.6% in September to 375.5, marking a second straight month of decline. Scrap prices were down in nearly every market we cover, although pig iron and HBI prices again fell by more than scrap. Lower demand drove prime grade scrap and ore-based metallic price declines, while seasonally higher availability caused obsolete grade scrap prices to fall.

Demand for metallics, especially ore-based scrap substitutes and prime grade scrap, was notably weaker m/m in September, resulting in substantial price declines in many regions. The largest decline occurred for shredded scrap in Brazil, where prices fell by more than 25% m/m. In North America, U.S. #1 busheling prices fell by $50 /l.ton m/m, which is the largest decrease since at least January 2018. In Europe, a decrease in Turkish scrap demand caused obsolete grade pricing to decline by ~€30 /t, while somewhat more limited supply of prime grades cause a smaller decline of ~€10 /t m/m. In Asia (excl. China) recent price declines slowed as lockdown measures begin to ease, but weakness in underlying demand is still present. Meanwhile, in China, scrap prices rose slightly m/m due to easing Covid-19 control measures, which allowed for somewhat higher steel output. Still, finished steel prices have fallen as have other raw material costs. Global pig iron prices also fell in September because mills stocked up ahead of Russia’s export tariff in August and now have little buying interest.

With Brazilian finished steel prices having peaked in recent weeks, mills there have now put immense pressure on domestic scrap prices. Scrap sellers in the country had little opportunity to send scrap abroad amid this domestic weakness due to international shipping constraints, and this resulted in the Brazilian scrap market undergoing the largest price decline in the world m/m.

Demand weakness also caused U.S. scrap prices to fall by more than was expected, especially for prime grades. In fact, #1 busheling prices fell by the largest amount m/m in multiple years, although part of this decline was driven by large price decreases in global pig iron prices. Obsolete prices also declined but varied from region to region. Even within regions, price decreases were not uniform as shown by a $25 /l.ton price fall in shredded scrap in Detroit and a $10 /l.ton fall in Chicago—both in the Great Lakes region.

Scrap price declines were not as large in Europe, although they still fell across the board. Mills in Europe were still sufficiently stocked from orders made in August, resulting in lower domestic demand overall. This was compounded by weakening prices and demand in Turkey, where steel long product producers are now concentrated on serving their domestic market given weakness is Asian steel importing markets and freight challenges.

In Asia, the relaxing of Covid-19 lockdowns in some countries has decelerated scrap price falls, but weakness in automotive output has put downward pressure on finished steel prices and resulted in yet more m/m price weakness. In China, scrap prices rose somewhat m/m as production restrictions eased and adverse weather hampered collection, but overall prices remain under pressure.

Purchasers of pig iron were generally reluctant to buy material as they awaited a clearer direction on iron ore and scrap pricing. Ultimately, this lowered demand and allowed U.S. buyers to secure CFR New Orleans prices at $520 /t (-$56 /t m/m). HBI transactions were virtually non-existent, although this is likely because producers are currently sold out.

Outlook: Prices to Remain Under Pressure in October

Sentiment remains bearish across essentially all regions we cover. Finished steel prices continue to decline in most markets or are likely to do so soon in those where this has not occurred. Meanwhile, other raw material costs, especially iron ore, continue to rapidly decline and we expect this to keep pressure on pig iron, and consequently prime grade scrap pricing, moving into October.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com