Market Data

September 16, 2021

Steel Mill Lead Times: Finally Trending Down

Written by Tim Triplett

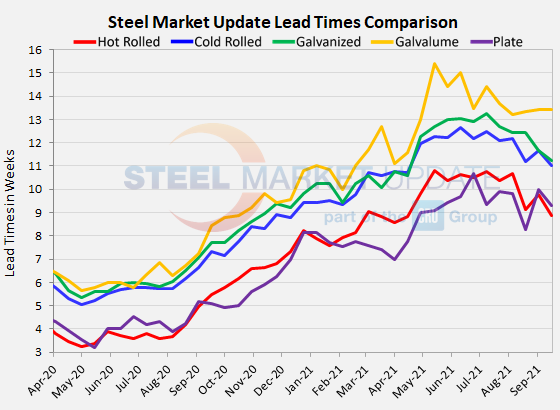

Lead times for spot orders of flat rolled and plate products from the mills have all seen notable declines this month, with the exception of Galvalume, according to Steel Market Update’s check of the market this week. The average lead time for hot rolled is now less than nine weeks, down from more than ten and a half weeks in early August. While lead times are still much longer than historical averages, shortening lead times are consistent with the trend in steel prices, which are beginning to level out.

Buyers reported mill lead times ranging from 6-13 weeks for hot rolled, 8-14 weeks for cold rolled, 6-16 weeks for galvanized, 12-16 weeks for Galvalume, and 5-14 weeks for plate.

The average lead time for spot orders of hot rolled declined by nearly a full week to 8.89 weeks, down from 9.79 weeks at the beginning of September.

Cold rolled lead times moved down to 11.00 weeks from 11.67 in the same period. Galvanized lead times dipped to 11.22 weeks from 11.67 weeks. The average Galvalume lead time was basically unchanged at 13.43 weeks.

Like flat rolled products, mill lead times for plate have also shortened. The average plate lead time moved down to 9.30 weeks from the 10.00 weeks seen in SMU’s poll of the market two weeks ago.

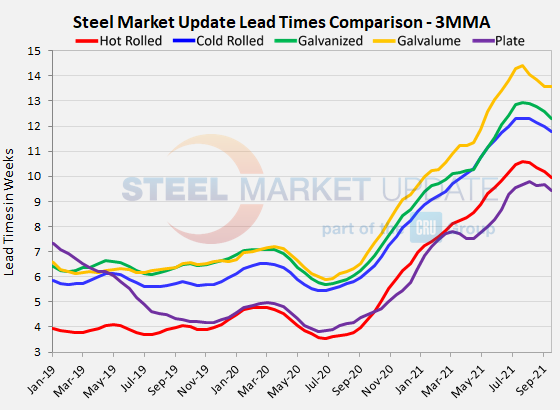

Three-month moving averages, which smooth out the weekly volatility of the lead times data, also show the trend toward shorter lead times. The 3MMA for hot rolled lead times now averages 9.93 weeks, cold rolled 11.76 weeks, galvanized 12.28 weeks, and Galvalume 13.59 weeks. Plate’s 3MMA is 9.44 weeks.

Lead times tend to be a leading indicator of steel prices. The shorter the lead times, the less busy the mills and the more likely they are to discount prices to win orders. Lead times still remain highly extended at roughly double those of a typical year, but have been widely expected to normalize as steel prices near a peak.

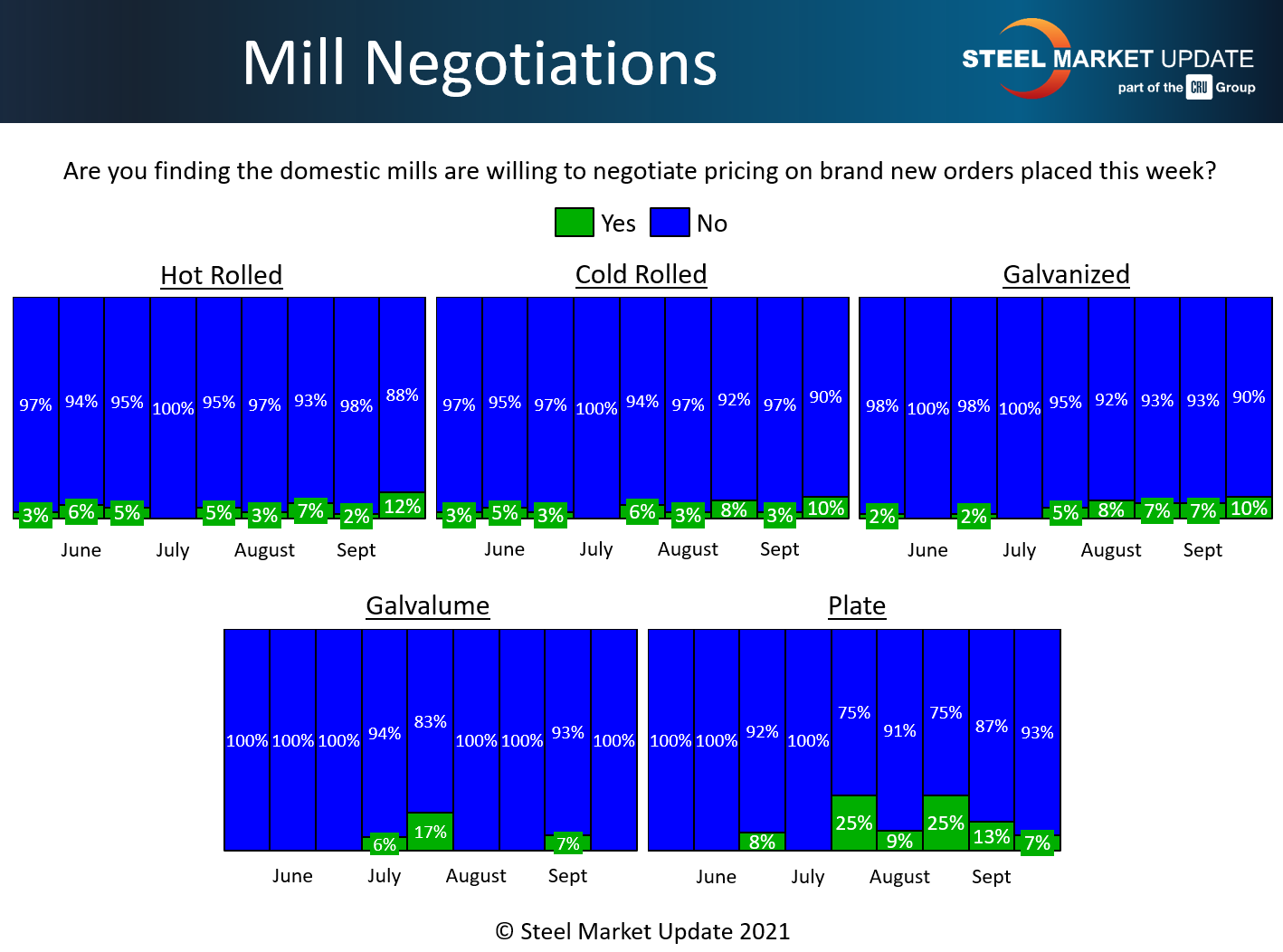

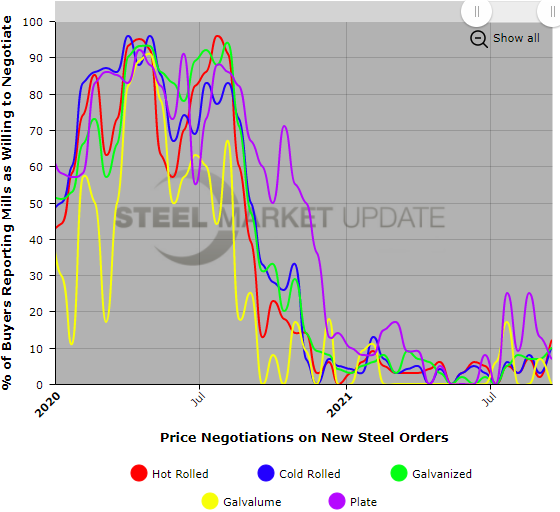

Negotiations

While the mills definitely still have the upper hand in price negotiations, buyers may finally be gaining some leverage. SMU asks buyers every two weeks if the mills are willing to talk price on spot orders. The percentage of hot rolled buyers answering “yes” has been in the single digits since November 2020, meaning more than 90% of the time the mills “just say no.” That is until this week when 12% indicated that some mills are now willing to consider discounts to secure HR orders. Cold rolled and galvanized have seen a similar shift, with 10% now reporting mills being more flexible on price. While subtle, this change in the tone of negotiations may reflect mills’ shrinking lead times and growing competition from imports.

By Tim Triplett, Tim@SteelMarketUpdate.com