Prices

September 29, 2021

August Preliminary Steel Imports Slip from July's High

Written by Brett Linton

Preliminary Census data shows that total foreign steel imports declined 10% in August, easing from July’s 18-month high down to 2.77 million tons. September import licenses are currently at 2.50 million tons as of Sept. 27, a 10% decline from August and down 19% compared to July.

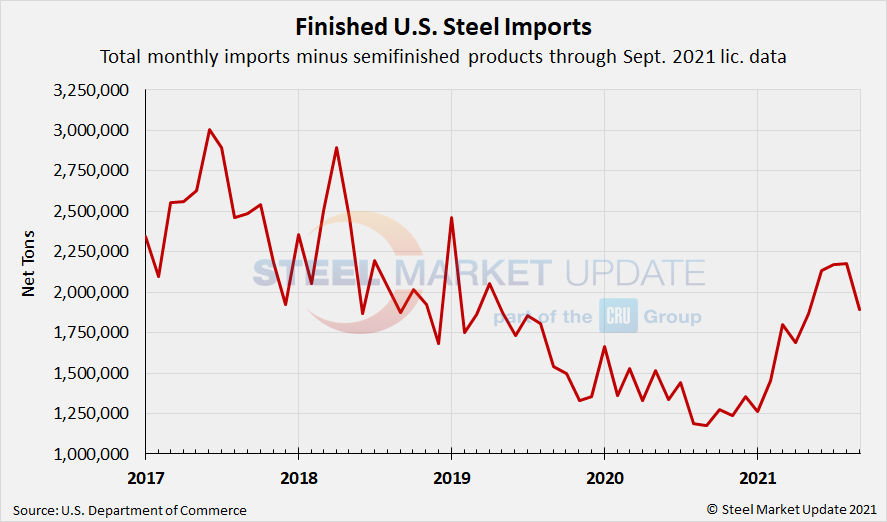

Total finished imports are preliminarily at 2.18 million tons in August, which would be the highest level seen since January 2019 (31 months) when they reached 2.46 million tons. Finished steel import licenses for September are currently at 1.89 million tons.

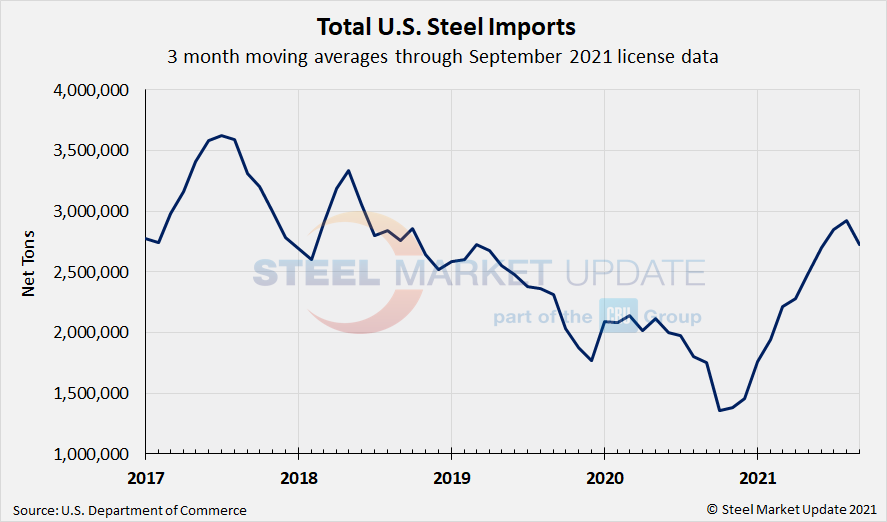

Due to large month-to-month swings in semifinished imports, the chart below shows total monthly imports on a three-month moving average (3MMA) basis in an attempt to more accurately display U.S. steel import trends. The 3MMA through preliminary August data is 2.93 million tons, up from 2.85 million tons in July and up from 2.70 million tons in June. August marks the highest 3MMA import level seen since June 2018 when it was 3.06 million tons. The lowest 3MMA level in our recent history was October 2020 at 1.36 million tons. Looking at September license data, the September 3MMA is currently a 2.72 million tons.

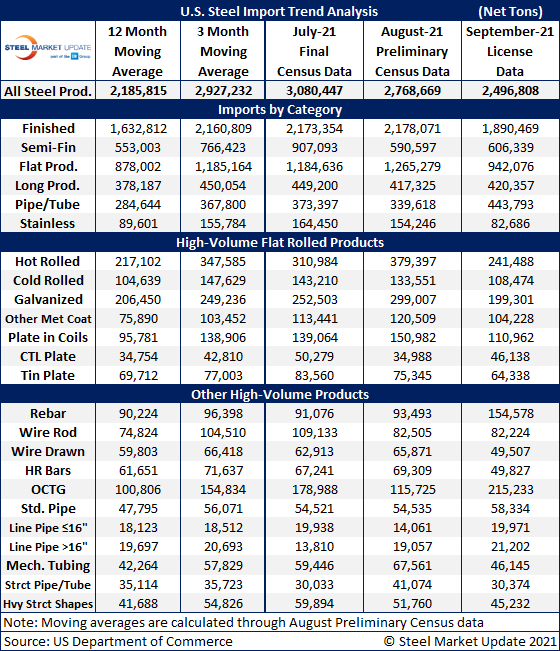

The table below displays flat rolled product imports as well as other high-volume products, including rebar, tin plate, wire rod, structural pipe and tube, and other long products. We also provide data on categorized imports divided into semifinished, finished, flat rolled, longs, pipe and tube, and stainless products.

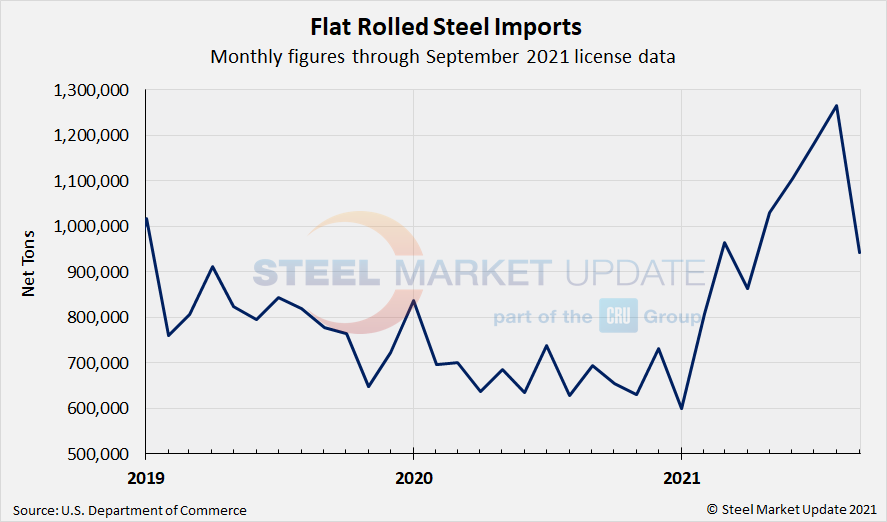

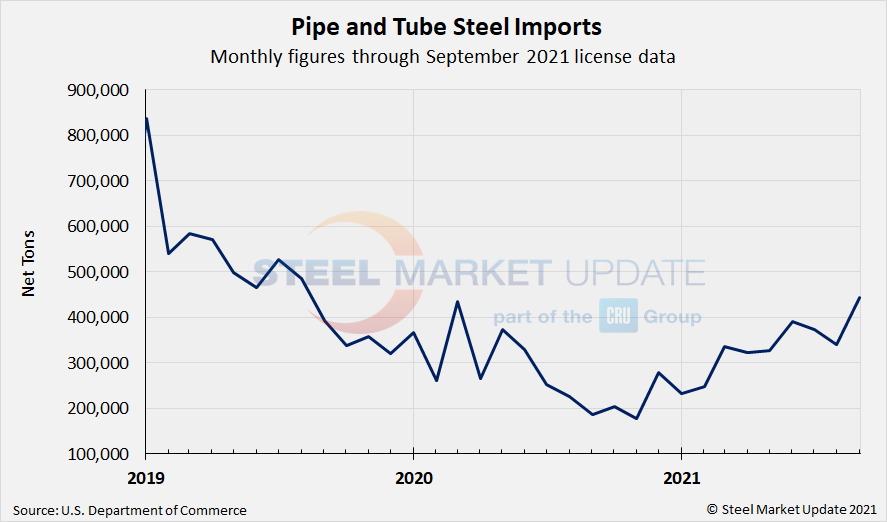

The two charts below show monthly imports grouped by product category: flat rolled imports and pipe and tube imports. Flat rolled imports surged to a multi-year high in August to 1.27 million tons, with the latest September license data showing 942,000 tons coming into the country. Pipe and tube imports slipped to 340,000 tons in August, while September licenses are currently at 444,000 tons.

By Brett Linton, Brett@SteelMarketUpdate.com