CRU

October 24, 2021

CRU: Zinc Market Keeps Getting Tighter, Spot Premia Up Again

Written by Eoin Dinsmore

By CRU Research Manager Eoin Dinsmore, from CRU’s January Zinc Monitor

Buyers who are unfortunate enough to find themselves in the spot market are paying 18-23¢ /lb for SGH zinc. The most recent deals have all been at 20¢ /lb or higher. Buyers are fearful of being left short metal, while suppliers are either sold out for 2022 or in no rush to sell.

The Flin Flon smelter is set to close at the end of 2022 Q2 and buyers who contracted from Hudbay for 18 months through to June 2022 will be in the market in H2. That could make for an active spot market in the second half. There are also reports of some quality issues at another North American smelter, which puts buyers further on edge.

Imports to the Rescue in Q2?

Spot premia of 20¢ /lb ($441 /t) start to make it attractive to import material from Asia. We should start to see imports from Asian warehouses in Q2. However, container rates remain very high and only the biggest traders can take on the volume required to make the trade profitable (breakbulk), which will limit the flows.

Exports from British Columbia to Asia are also in focus, given the high U.S. premium. Refined zinc exports from British Columbia to Asia have been falling in recent months, from over 5,000 t/month in 2021 H1 to 2,400 t in November. Sales to the U.S. offer a much higher netback and exports to Asia could fall further.

Underlying Demand Drivers are Improving

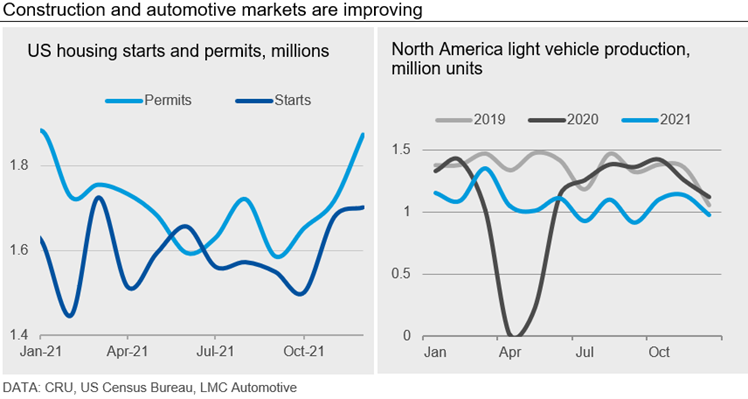

The U.S. housing market remains strong, as permits and starts both improved in 2021 Q4. On the automotive side, it has been slow to improve and while y/y automotive production looks better, that is really because 2020 Q4 was weak.

Investments in North American steel galvanizing capacity are a major boost to zinc demand. CRU’s steel team forecast that North American galvanized sheet production will increase by nearly 11% y/y in 2022, putting it more than 9% above the 2018 high.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com