Analysis

November 18, 2021

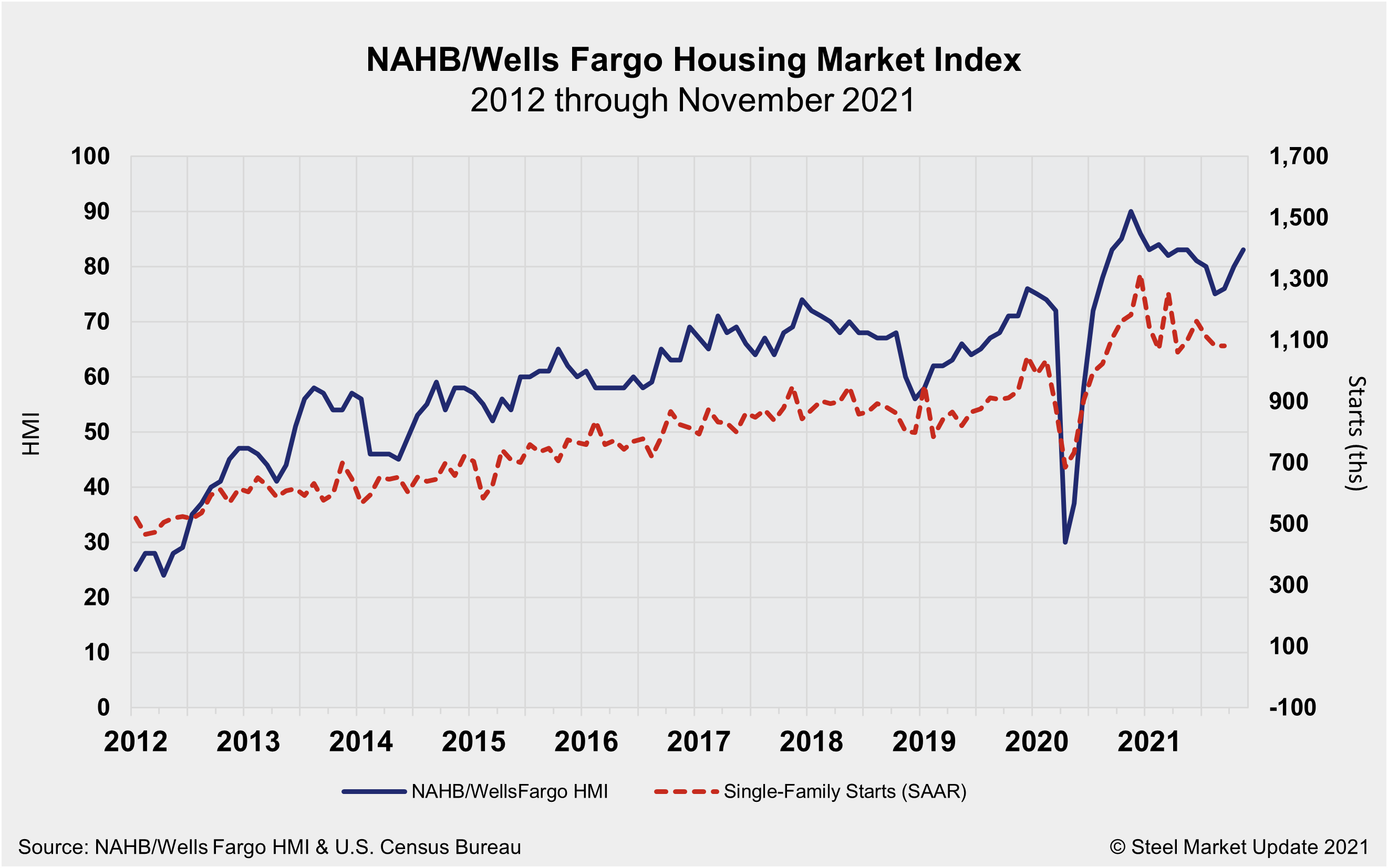

NAHB: Strong Demand Sustains Builder Confidence Despite Supply-Chain Issues

Written by David Schollaert

Strong consumer demand and low inventories helped push builder confidence higher in November for the third consecutive month despite continued supply-side challenges. Even though the construction sector continues to wade through building material bottlenecks and lot and labor shortages, builder sentiment for newly built single-family homes moved three points higher to an index reading of 83 this month, according to the National Association of Home Builders/Wells Fargo Housing Market Index.

“The solid market for home building continued in November despite ongoing supply-side challenges,” said Chuck Fowke, NAHB’s chairman. “Lack of resale inventory combined with strong consumer demand continues to boost single-family home building.”

The NAHB/Wells Fargo HMI survey gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Two out of the three major HMI indices posted gains in November. The index gauging current sales conditions rose three points to 89 and the gauge charting traffic of prospective buyers posted a three-point gain to 68. The component measuring sales expectations in the next six months held steady at 84.

“In addition to well publicized concerns over building materials and the national supply chain, labor and building lot access are key constraints for housing supply,” said Robert Dietz, NAHB’s chief economist. “Lot availability is at multi-decade lows and the construction industry currently has more than 330,000 open positions. Policymakers need to focus on resolving these issues to help builders produce more housing to meet strong market demand.”

Looking at the three-month moving averages for regional HMI scores, the Midwest rose four points to 72, the South registered a four-point gain to 84 and the West rose one point to 84. The Northeast fell two points to 70.

By David Schollaert, David@SteelMarketUpdate.com