Prices

November 23, 2021

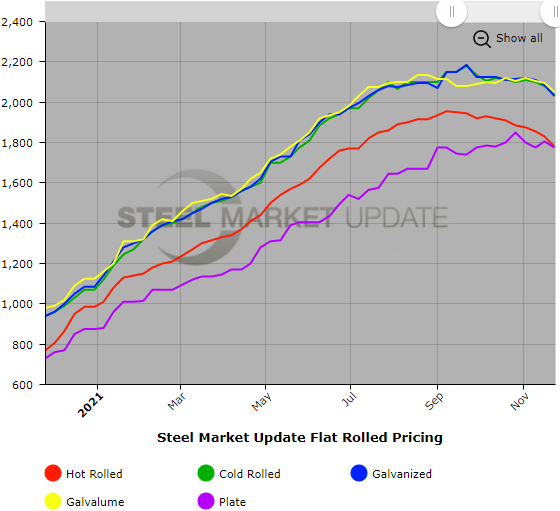

SMU Price Ranges & Indices: Hot Rolled Dips Below $1,800

Written by Brett Linton

Flat rolled and plate steels all saw double-digit decreases this week as the price trend appears be gaining downward momentum The average price for hot rolled dropped by $50 to $1,780 per ton, the first time that benchmark has been below $1,800 since early July. Prices for cold rolled and coated products saw declines of $45-55 per ton as well, according to Steel Market Update’s poll of buyers on Monday and Tuesday. The price correction that began from the peak in early September had seen small, gradual dips until lately when the effects of import competition and seasonal factors appear to have taken hold. SMU is now adjusting its Price Momentum Indicator to Lower for all flat rolled products, not just hot rolled. Plate remains at Neutral until the price direction is more clearly established.

Hot Rolled Coil: SMU price range is $1,660-$1,900 per net ton ($83.00-$95.00/cwt) with an average of $1,780 per ton ($89.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $100 per ton compared to last week, while the upper end remained unchanged. Our overall average is down $50 per ton from one week ago. Our price momentum on hot rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-9 weeks

Cold Rolled Coil: SMU price range is $1,910-$2,160 per net ton ($95.50-$108.00/cwt) with an average of $2,035 per ton ($101.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $90 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $45 per ton from last week. Our price momentum on cold rolled steel is now at Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 7-12 weeks

Galvanized Coil: SMU price range is $1,900-$2,160 per net ton ($95.00-$108.00/cwt) with an average of $2,030 per ton ($101.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $70 per ton compared to last week, while the upper end decreased $40. Our overall average is down $55 per ton from one week ago. Our price momentum on galvanized steel is now at Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,978-$2,238 per ton with an average of $2,108 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-15 weeks

Galvalume Coil: SMU price range is $1,920-$2,180 per net ton ($96.00-$109.00/cwt) with an average of $2,050 per ton ($102.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $110 per ton compared to one week ago, while the upper end increased $20. Our overall average is down $45 per ton from last week. Our price momentum on Galvalume steel is now at Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,211-$2,471 per ton with an average of $2,341 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-12 weeks

Plate: SMU price range is $1,740-$1,810 per net ton ($87.00-$90.50/cwt) with an average of $1,775 per ton ($88.75/cwt) FOB mill. The lower end of our range decreased $35 per ton compared to last week, while the upper end decreased $25. Our overall average is down $30 per ton from one week ago. Our price momentum on plate steel remains at Neutral until the market establishes a clear direction.

Plate Lead Times: 5-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.