Plate

November 30, 2021

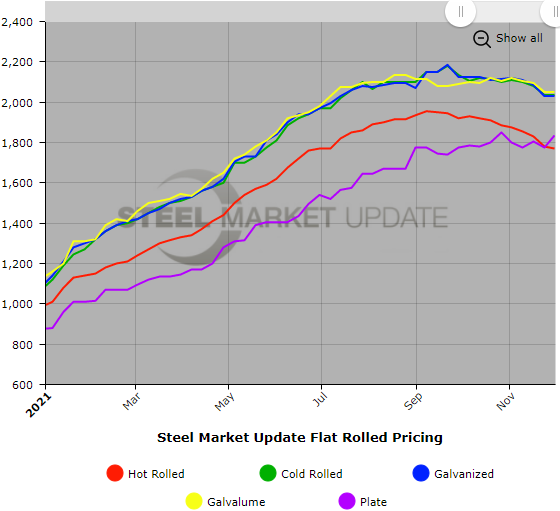

SMU Price Ranges & Indices: HR Down, CR/Coated Flat, Plate Up

Written by Brett Linton

Plate prices moved up this week as recent mill price increases gained some traction, but prices for sheet products were flat to down, based on Steel Market Update’s check of the market on Monday and Tuesday. The plate price was up $60 to an average of $1,835 per ton, while hot rolled coil was down another $10 to $1,770 per ton. The downtrend for HRC that began in early September appears to be continuing, though at a modest pace. Asked if they were seeing any acceleration in the pace of steel price declines, most buyers responding to SMU’s survey described it as “a slow slide” or “subtle softness.” Commented one: “Still no panicked calls from the mills looking for orders.” SMU’s Price Momentum Indicators are pointing Lower for all flat rolled products – meaning we anticipate further price declines in the next 30 days – but plate momentum remains at Neutral until the price direction is more clearly established.

Hot Rolled Coil: SMU price range is $1,700-$1,840 per net ton ($85.00-$92.00/cwt) with an average of $1,770 per ton ($88.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week, while the upper end decreased $60 per ton. Our overall average is down $10 per ton from one week ago. Our price momentum on hot rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-9 weeks

Cold Rolled Coil: SMU price range is $1,910-$2,160 per net ton ($95.50-$108.00/cwt) with an average of $2,035 per ton ($101.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from last week. Our price momentum on cold rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 7-12 weeks

Galvanized Coil: SMU price range is $1,900-$2,160 per net ton ($95.00-$108.00/cwt) with an average of $2,030 per ton ($101.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to last week. Our overall average is unchanged from one week ago. Our price momentum on galvanized steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,978-$2,238 per ton with an average of $2,108 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-15 weeks

Galvalume Coil: SMU price range is $1,950-$2,150 per net ton ($97.50-$107.50/cwt) with an average of $2,050 per ton ($102.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago, while the upper end decreased $30. Our overall average is unchanged from last week. Our price momentum on Galvalume steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,241-$2,441 per ton with an average of $2,341 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-12 weeks

Plate: SMU price range is $1,815-$1,855 per net ton ($90.75-$92.75/cwt) with an average of $1,835 per ton ($91.75/cwt) FOB mill. The lower end of our range increased $75 per ton compared to last week, while the upper end increased $45. Our overall average is up $60 per ton from one week ago. Our price momentum on plate steel remains at Neutral until the market establishes a clear direction.

Plate Lead Times: 5-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.