Prices

January 13, 2022

CRU: U.S. Sheet Surplus Worsens on Relaxed Tariffs and New Mills

Written by Josh Spoores

By CRU Principal Analyst Josh Spoores, from CRU’s Steel Sheet Products Monitor, Feb. 9

Sheet prices in the North American sheet market have continued to collapse due to a temporary supply surplus. Since prices peaked in late September/early October, the price decline for HR and HDG coil has been at a larger amount in USD than what was seen after the 2008 peak.

![]() At $1,123 /s.ton, CRU’s current HR coil price assessment fell $147 /s.ton w/w and is now down $835 /s.ton since the peak less than five months ago. While this price fall is larger than the full peak to trough decline of 2008-09, HR coil prices today remain at a premium over both costs as well as global prices that do not fall under the S232 purview.

At $1,123 /s.ton, CRU’s current HR coil price assessment fell $147 /s.ton w/w and is now down $835 /s.ton since the peak less than five months ago. While this price fall is larger than the full peak to trough decline of 2008-09, HR coil prices today remain at a premium over both costs as well as global prices that do not fall under the S232 purview.

This decline in HR coil has been larger than what has come about for CR and HDG coil products as these have not fallen as fast. Each of these products are individual markets with different pressures on supply and demand, yet we expect CR and HDG coil prices to come back in line with the recent spread over HR coil over the next several months as margins here remain more attractive for mills.

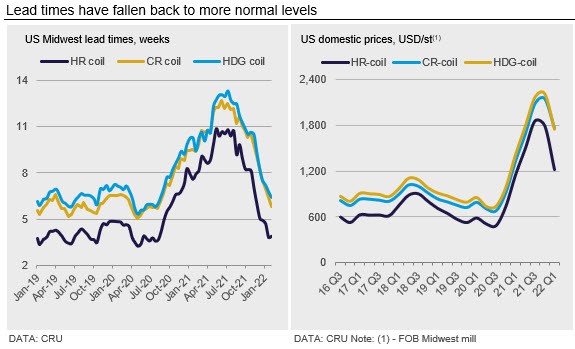

The weakness in sheet prices has intensified as supply remains in a surplus. Various maintenance outages in late 2021 have ended, which has helped to bring mill lead times down to more normal levels (see chart). In addition, due to the extremely wide spread of domestic versus global prices in 2021 H2, import arrivals remain high, even though new import orders have slowed. At service centers, inventories have been fully rebuilt and are at a large surplus to outbound demand. Lastly, we are now seeing the new EAFs start to come online in the USA. The ramp-up of these three furnaces will be slow for now, yet production should be nearing 80% of capacity in 2022 H2.

On the U.S. West Coast, after two weeks of decline, sheet prices here stabilized this week. HR coil prices have fallen $200 /s.ton m/m, while CR coil and HDG coil prices have fallen $190 /s.ton m/m. Despite the recent price decreases, most companies are still confident that demand will remain strong in 2022, but they are carefully watching how component shortages may affect their customers’ forecasts. Buyers reported Mexican and southern U.S. mills are pursuing their business more aggressively, with short lead times and attractive pricing.

In Mexico, prices have continued to fall, but now at a faster rate, with a decrease m/m of 17% for HR coil and 14% for CR coil. On the demand side, the production of light vehicles started the year in January with an increase of 19% m/m but a decrease of 9% y/y, with the main issues affecting the sector being the Omicron variant of Covid-19 and the global semiconductor chip shortage. On the supply side, the new hot rolling mill of Ternium located in Pesqueria, Mexico, reached its first million tonnes of production in January, after six months of operation. This plant has a total capacity of 4.4 million tonnes per year.

Outlook: Further Price Falls Ahead, But Mills May Try to Slow the Decline

In our price forecast, sheet prices in the U.S. Midwest market will continue to fall through most of the year, returning back towards more historical levels versus costs and global prices. Over the coming weeks, we may see mills attempt to slow the price decline. We have heard of a couple of mill maintenance outages taking place in 2022 Q1 and at least one EAF that is running at a slower than normal pace. In addition, demand from the automotive market is expected to slowly increase.

Also, multiple prices in other markets such as Asia and Europe have increased m/m due to higher raw material costs, which may provide some support in North America. However, these factors are likely not enough to bring a balance to this market, and we expect that any price stabilization will prove to only be temporary and slowdowns in mill production will come at the expense of lost market share.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com