Analysis

January 23, 2022

Final Thoughts

Written by Tim Triplett

How anxious is the steel market in the face of sharply declining steel prices? Based on Steel Market Update’s survey this week, anxiety levels are not as high as one might think. As more than one steel exec has commented recently, “Demand will be our saving grace.”

![]()

SMU asked service center and manufacturing executives in this week’s questionnaire: How are you seeing demand for your products? About 59% reported their demand as stable, and 17% as improving. But a significant 24% see demand declining. Here are a few of their comments:

“It’s very slow right now with customers full of inventory and waiting for prices to fall further.”

“The downward pricing is hiding the fact that our order volumes are OK.”

“Demand is improving with OEMs, and we’re seeing more inquiries from those who have been on the sidelines.”

In another question, SMU asked: Are you an active buyer or on the sidelines? Nearly half of the respondents, 44%, said they are postponing purchases today in the hope of buying it cheaper tomorrow. Here’s what some of them had to say:

“We have sufficient inventory, so we can wait to place additional orders.”

“Our customers are flush with steel and not in a hurry to place any orders.”

“We are waiting to see how the market picks up. It’s been a very slow start to the year.”

“We are really only active on the foreign side. Otherwise, we’re sitting on our hands for a bit.”

Optimists vs. Pessimists

Our survey also asked: Would you describe yourself as optimistic or pessimistic about your prospects in the first half of 2022? A strong 72% called themselves optimists, just 28% pessimists.

Some comments from the optimists:

“I still expect profits to be off-the-charts for the first half. New capacity won’t be up yet, and imports won’t be too brutal. Likewise, demand seems strong enough even with COVID hanging around.”

“We still have a very big backlog. Orders are strong.”

“COVID will burn itself out. Customers will start requesting steel for the pent-up demand.”

“I still think demand overall is good and could increase. We just need to get inventories balanced.”

“Inventories will level and the price will correct to fight foreign.”

“We’re buying cheaper steel as prices fall. This works well for our business model.”

“We are staying busy; we just need employees.”

Some comments from the pessimists:

“With dropping prices, we are poised to lose thousands of dollars with overpriced inventories.”

“We have more cash flow issues as steel market prices fall.”

“Prices are dropping – they need to find a floor. I’m not sure if that will happen in the first six months of the year.”

“Pricing is going to fall steeper in a compressed timeframe vs. previous declining markets due to the sharp run-up in 2021.”

“It is inevitable that prices will decline. Things are going to be very competitive.”

“There are still too many fingers in the pie for there to be orderly, fundamental market drivers.”

“There are too many supply chain issues, and commodity pricing is still high.”

“We think Q1 will be very slow.”

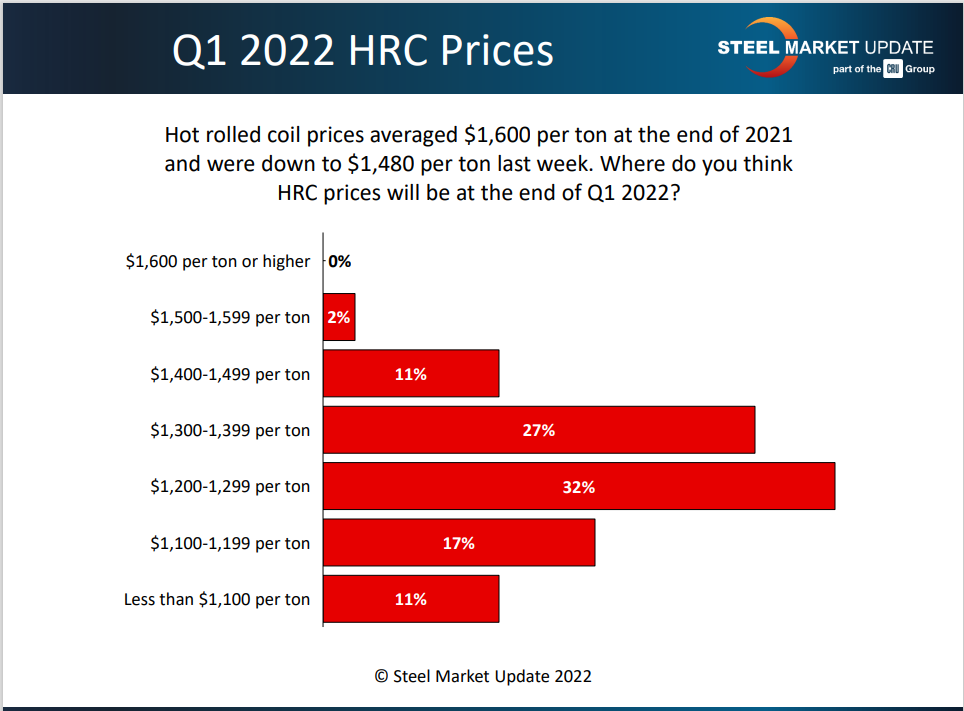

Price Predictions

How do these buyer attitudes translate in terms of steel prices? SMU also asked: Where do you think hot rolled coil prices will be at the end of Q1 2022? A clear majority of respondents, 60%, believe the HRC price will be somewhere south of $1,300 per ton. SMU’s check of the market this week put the average price at $1,425 per ton. Calculated as a weighted average of all the responses, the prevailing prediction is for an HRC price around $1,265 per ton two months from now. That’s a total decline of another $160 per ton, or roughly $20 per ton per week. Keep in mind, though, that such a price would still be double the average HRC price of the last several years.

Here are some of buyer observations on prices:

“More pain is coming.”

“I was initially hoping it would be north of $1,400/ton, but I don’t see that happening anymore.”

“HRC prices are falling like a rock. Have the fundamentals really changed? I think not, it’s just that people stopped buying, and the mills are reacting as mills always do.”

“Just look at the futures curve.”

“Prices will probably be back on an upward trajectory at the end of Q1.”

“As always, this is like throwing darts in the dark. No one has any idea.”

Hard to argue with that last point.

SMU Events

There’s still time to register for the 2022 Tampa Steel Conference which is just three weeks away (Feb. 14-16). You can learn more about our program by clicking here or going to www.tampasteelconference.com

As always, we appreciate your business.

Tim Triplett, SMU Executive Editor, Tim@SteelMarketUpdate.com