Prices

January 25, 2022

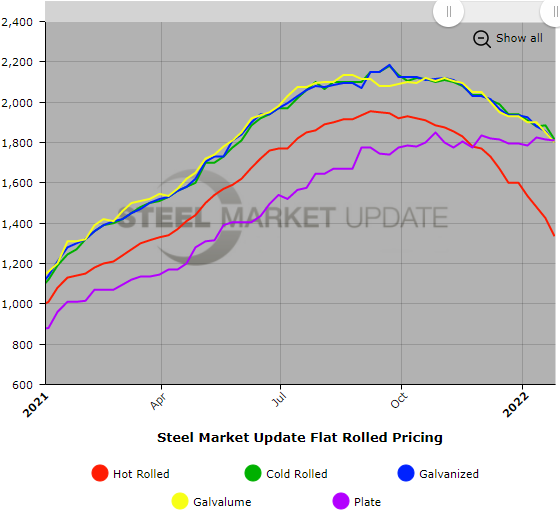

SMU Price Ranges & Indices: Another Big Drop

Written by Brett Linton

Steel prices saw a big dip this week as the benchmark hot rolled price dropped to $1,335 per ton. That’s down more than 30% since the September peak and the lowest HR has been since the end of March 2021. Except for plate, which was pretty stable, flat rolled prices declined anywhere from $50-90 per ton, based on the responses to Steel Market Update’s survey this week. Roughly seven out of 10 respondents said they have seen an acceleration in the pace of the steel price declines. “Absolutely, and in shocking fashion. It might not be accelerating, per se, but down $3/cwt each week is wild!” Added another: “Hot Rolled seems to be moving too fast. Cold rolled and coated are moving down, but at a slower pace.” SMU’s Price Momentum Indicators on flat rolled remain at Lower, meaning prices can be expected to decline further in the next 30 days. SMU’s Momentum Indicator on plate remains at Neutral until the market establishes a clearer direction.

Hot Rolled Coil: SMU price range is $1,250-$1,420 per net ton ($62.50-$71.00/cwt) with an average of $1,335 per ton ($66.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $100 per ton compared to one week ago, while the upper end declined $80 per ton. Our overall average is down $90 per ton from last week. Our price momentum on hot rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 2-6 weeks

Cold Rolled Coil: SMU price range is $1,730-$1,900 per net ton ($86.50-$95.00/cwt) with an average of $1,815 per ton ($90.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range decreased $70 per ton compared to last week. Our overall average is down $70 per ton from one week ago. Our price momentum on cold rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 5-8 weeks

Galvanized Coil: SMU price range is $1,700-$1,900 per net ton ($85.00-$95.00/cwt) with an average of $1,800 per ton ($90.00/cwt) FOB mill, east of the Rockies. The lower end of our range declined $60 per ton compared to one week ago, while the upper end decreased $50 per ton. Our overall average is down $55 per ton from last week. Our price momentum on galvanized steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,787-$1,987 per ton with an average of $1,887 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-10 weeks

Galvalume Coil: SMU price range is $1,700-$1,900 per net ton ($85.00-$95.00/cwt) with an average of $1,800 per ton ($90.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $100 per ton compared to last week, while the upper end remained unchanged. Our overall average is down $50 per ton from one week ago. Our price momentum on Galvalume steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,991-$2,191 per ton with an average of $2,091 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-8 weeks

Plate: SMU price range is $1,790-$1,830 per net ton ($89.50-$91.50/cwt) with an average of $1,810 per ton ($90.50/cwt) FOB mill. The lower end of our range decreased $10 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $5 per ton from last week. Our price momentum on plate steel remains at Neutral until the market establishes a clear direction.

Plate Lead Times: 3-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.