Distributors/Service Centers

February 10, 2022

Russel Sees Big Improvement in 2021 Sales, Earnings

Written by Tim Triplett

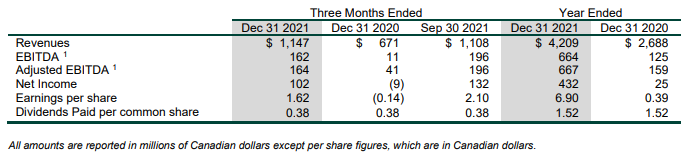

After the close of the market today, Canada’s Russel Metals reported net earnings of $432 million (U.S. $340 million) on annual revenues of $4.2 billion (U.S. $3.3 billion) for fiscal year 2021. That’s a big improvement from earnings of just $25 million (U.S. $20 million) on revenues of $2.7 billion (U.S. $2.1 billion) in 2020 during the worst year of the pandemic.

![]() The steel distributor’s earnings for the fourth quarter totaled $102 million (U.S. $80 million) on sales of $671 million (U.S. $527 million), a big rebound from a small loss in the prior-year quarter.

The steel distributor’s earnings for the fourth quarter totaled $102 million (U.S. $80 million) on sales of $671 million (U.S. $527 million), a big rebound from a small loss in the prior-year quarter.

“Revenues during the quarter benefited from the continued strong steel price environment and good demand in the metals service centers and steel distributors segments, as well as an improvement in energy activity,” the company said in its earnings release. “Steel markets were very strong through most of 2021 as a result of favorable demand and constrained supply. Prices rose during the year and remained well above historical levels for the 2021 fourth quarter.”

Russel’s service centers saw a 62% increase in their selling price per ton, and a 5% increase in same-store shipments, compared to the prior year. Its steel distributors segment also experienced an increase in demand and selling prices. Russel’s energy products segment recovered modestly throughout 2021 as a result of higher energy prices and capital spending.

During 2021, Russel reduced the capital employed in its OCTG/line pipe segment by approximately $300 million by merging its Canadian operation with a subsidiary of Marubeni-Itochu to form TriMark Tubulars. In another big move during 2021, Russel acquired Boyd Metals and its five service centers, expanding Russel’s reach in the U.S. Midwest and South.

“Steel availability has improved and inventory in the supply chain has increased since the industry experienced extreme supply challenges in mid-2021. We expect this improvement in availability to continue in 2022, albeit with certain ongoing constraints due to COVID-related staffing and transportation issues,” the company said.

Russel expects demand to continue to improve into 2022 as a result of a recovery in nonresidential construction, infrastructure projects and general manufacturing. Activity in the energy sector is also expected to increase due to further recovery in oil and natural gas prices and higher capital spending programs by energy producers.

“As a result, we expect a favorable supply and demand balance in 2022, although steel prices are expected to remain volatile,” the company said.

Toronto-based Russel carries on business in three segments: service centers, steel distributors and energy products. It operates 46 Canadian locations and 17 U.S. locations. It was ranked No. 6 in the latest Metal Center News Service Center Top 50 with annual revenues last year around $2 billion.

By Tim Triplett, Tim@SteelMarketUpdate.com