Prices

March 1, 2022

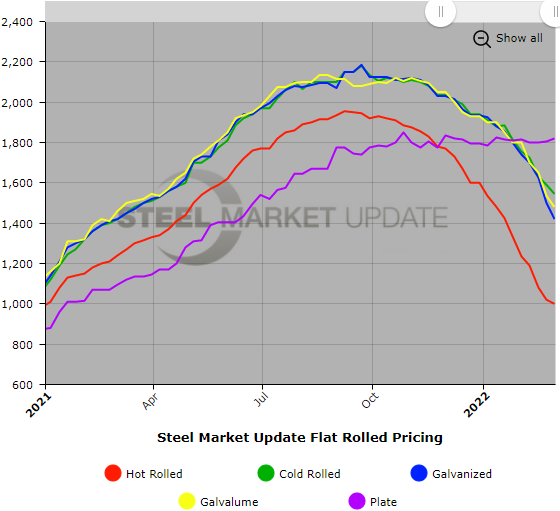

SMU Price Ranges & Indices: Price Hikes, War Concerns Slow HRC Declines

Written by Brett Linton

Sheet prices fell again this week. But price declines for hot-rolled coil have slowed, with HRC tags down $20 per ton ($1 per cwt) and coalescing around $1,000 per ton. While some mills were reported to be cutting deals as low as $900 per ton, others were said to be mulling price hikes. Cold-rolled and coated prices, which have lagged HRC price trends in recent months, fell more sharply than HRC for a second week. The wide spread between our highs and lows on cold-rolled and coated products are unusual but not unprecedented when a market is inflecting up or down. Declines for cold-rolled and coated had been anticipated because record spreads between HRC and base prices for value-added products were not seen as sustainable. But it’s not clear whether price declines will continue for much longer. Raw material prices – pig iron and ferroalloys, for example – are already rising sharply because of the war in Ukraine, which has sparked concerns about availability. And while some sources think North American finished steel markets won’t see any significant impact from sanctions or potential raw material shortages, others are no longer so certain. We held our sheet price momentum indicators neutral for a second week. It’s possible they could shift to higher in the weeks ahead.

Hot Rolled Coil: SMU price range is $900-$1,100 per net ton ($45.00-$55.00/cwt) with an average of $1,000 per ton ($50.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $40 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $20 per ton from last week. Our price momentum on hot rolled steel is at Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 2-7 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold Rolled Coil: SMU price range is $1,450-$1,640 per net ton ($72.50-$82.00/cwt) with an average of $1,545 per ton ($77.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $50 per ton compared to last week, while the upper end decreased $40 per ton. Our overall average is down $45 per ton from one week ago. Our price momentum on cold rolled steel is at Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 4-10 weeks*

Galvanized Coil: SMU price range is $1,270-$1,570 per net ton ($63.50-$78.50/cwt) with an average of $1,420 per ton ($71.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $130 per ton compared to one week ago, while the upper end decreased $30 per ton. Our overall average is down $80 per ton from last week. Our price momentum on galvanized steel is at Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $1,357-$1,657 per ton with an average of $1,507 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-8 weeks*

Galvalume Coil: SMU price range is $1,360-$1,600 per net ton ($68.00-$80.00/cwt) with an average of $1,480 per ton ($74.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $110 per ton compared to last week, while the upper end remained unchanged. Our overall average is down $55 per ton from one week ago. Our price momentum on Galvalume steel is at Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,651-$1,891 per ton with an average of $1,771 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks*

Plate: SMU price range is $1,810-$1,830 per net ton ($90.50-$91.50/cwt) with an average of $1,820 per ton ($91.00/cwt) FOB mill. The lower end of our range increased $30 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $15 per ton from last week. Our price momentum on plate steel remains at Neutral until the market establishes a clear direction.

Plate Lead Times: 3-6 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.