Product

March 15, 2022

SMU Price Ranges & Indices: Ukraine War Spark’s Biggest Week-Over-Week Gains Ever

Written by Brett Linton

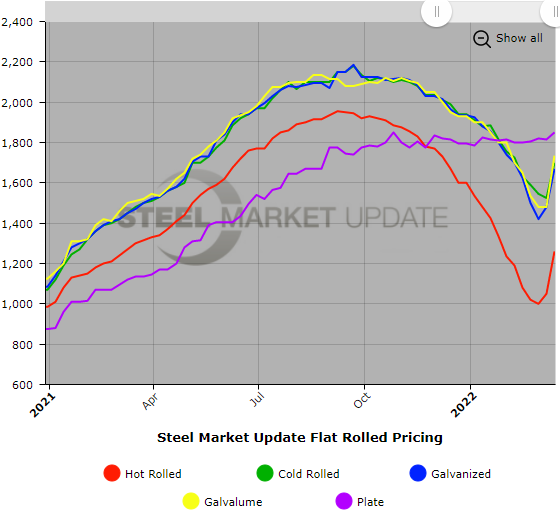

Sheet prices saw their biggest week-over-week gains – and by a wide margin – since Steel Market Update’s foundation in 2008. Case in point: SMU’s average hot-rolled coil price jumped to $1,260 per ton this week ($63 per cwt), up $210 per ton (20%) from $1,050 per ton last week. That is more than double the prior record for a weekly gain: $85 per ton, recorded on Dec. 15, 2020. An unexpected snapback in demand following the outbreak of the Covid-19 pandemic drove prices sharply higher in late 2020. The shock to the system this time came from Russian forces invading Ukraine on Feb. 24. That led to an almost immediate supply squeeze in raw materials – pig iron, slab and ferroalloys, for example – and sharply higher finished steel prices in Europe. Those increases have now flown through to North American pricing as well. Even plate prices, which have been largely flat since the beginning of this year, are now up. SMU adjusted its HRC price momentum indicator from neutral to higher last week. Price momentum indicators for all products have been adjusted to higher this week.

Hot Rolled Coil: SMU price range is $1,170-$1,350 per net ton ($58.50-$67.50/cwt) with an average of $1,260 per ton ($63.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $270 per ton compared to one week ago, while the upper end increased $150 per ton. Our overall average is up $210 per ton from last week. Our price momentum on hot rolled steel continues to point toward Higher prices over the next 30 days.

Hot Rolled Lead Times: 3-8 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday).

{loadposition reserved_message}

SMU subscribers have access to updated cold rolled, galvanized, Galvalume, and plate price indices.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.