Prices

April 26, 2022

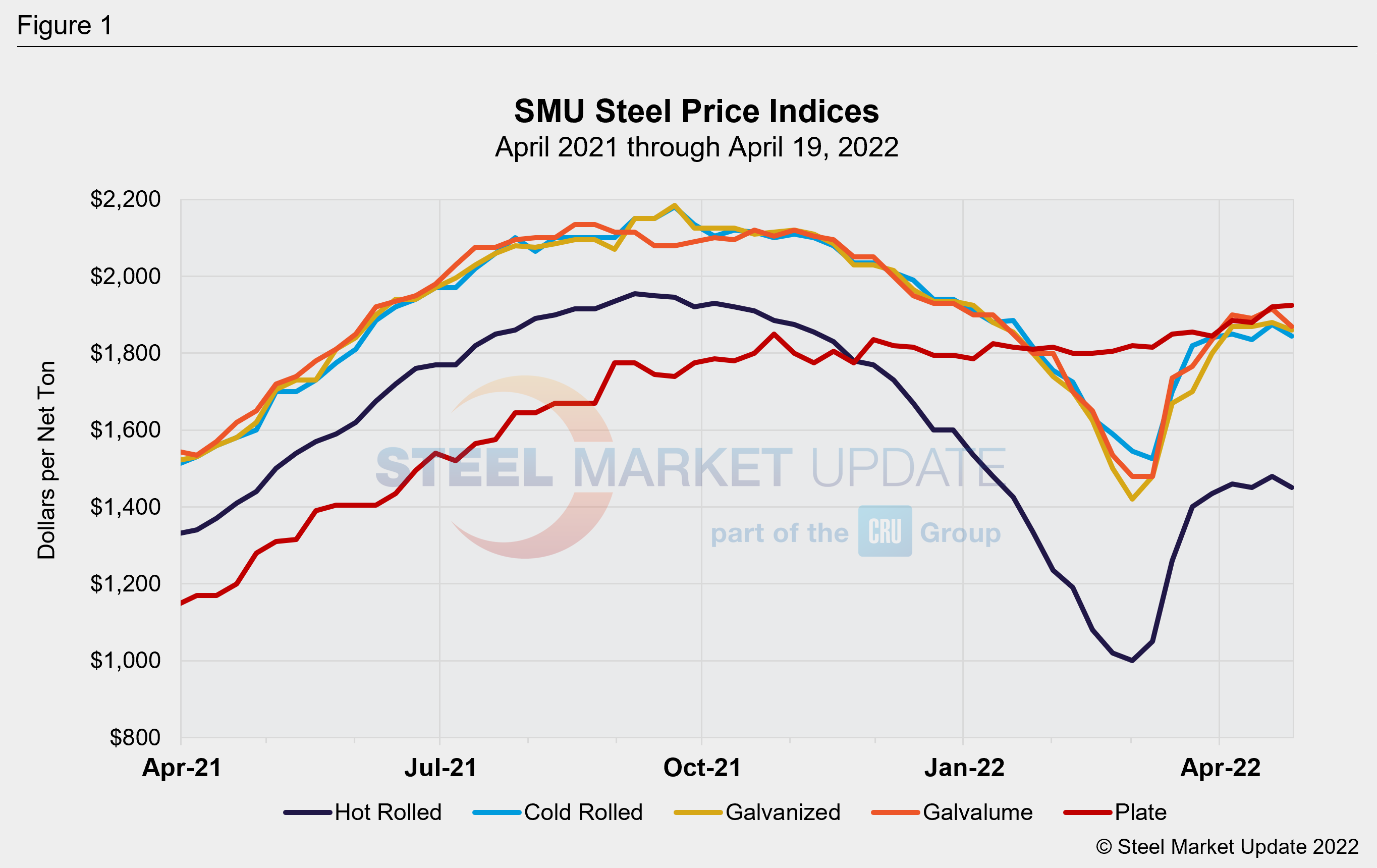

SMU Price Ranges & Indices: Sheet Slips, Will It Fall?

Written by Brett Linton

Sheet prices continue to bump around what some sources think might be the top of the market, with prices for most products down modestly week-over-week.

Hot-rolled coil and cold-rolled prices slipped $30 per ton ($1.50 per cwt). Galvanized base prices were down $20 per ton. And Galvalume prices slipped $45 per ton.

The dip comes ahead of expectations that scrap prices will move lower next month and on concerns that shortages of chips and other parts could lead to holes in mill orders books over the summer months, some sources said.

But others said that while prices might have flattened out, the market remains largely in balance thanks to strong demand in construction, HVAC and other non-automotive end markets.

Plate prices were up $5 per ton, effectively unchanged, amid rumors that mills might be set to announce yet another round of price hikes.

Hot Rolled Coil: SMU price range is $1,390-$1,510 per net ton ($69.50-$75.50/cwt) with an average of $1,450 per ton ($72.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $50 per ton compared to one week ago, while the upper end declined $10 per ton. Our overall average is down $30 per ton from last week. Our price momentum indicator on hot rolled steel points to Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 4-8 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday).

Cold Rolled Coil: SMU price range is $1,790-$1,900 per net ton ($89.50-$95.00/cwt) with an average of $1,845 per ton ($92.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $60 per ton compared to last week, while the upper end remained unchanged. Our overall average is down $30 per ton from one week ago. Our price momentum indicator on cold rolled steel points to Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 5-8 weeks*

Galvanized Coil: SMU price range is $1,800-$1,920 per net ton ($90.00-$96.00/cwt) with an average of $1,860 per ton ($93.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end decreased $40 per ton. Our overall average is down $20 per ton from last week. Our price momentum indicator on galvanized steel points to Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $1,906-$2,026 per ton with an average of $1,966 per ton FOB mill, east of the Rockies. Effective this week, we have increased the galvanized extras used in our benchmark prices from $97 to $106 per ton, in response to the revised U.S. Steel galvanized coating extras.

Galvanized Lead Times: 5-10 weeks*

Galvalume Coil: SMU price range is $1,830-$1,910 per net ton ($91.50-$95.50/cwt) with an average of $1,870 per ton ($93.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $50 per ton compared to last week, while the upper end decreased $40 per ton. Our overall average is down $45 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,149-$2,229 per ton with an average of $2,189 per ton FOB mill, east of the Rockies. Effective this week, we have increased the Galvalume extras used in our benchmark prices from $291 to $319 per ton, in response to the revised U.S. Steel Galvalume coating extras.

Galvalume Lead Times: 8-12 weeks*

Plate: SMU price range is $1,900-$1,950 per net ton ($95.00-$97.50/cwt) with an average of $1,925 per ton ($96.25/cwt) FOB mill. The lower end of our range decreased $10 per ton compared to one week ago, while the upper end increased $20 per ton. Our overall average is up $5 per ton from last week. Our price momentum indicator on plate steel points to Neutral until the market establishes a clear direction

Plate Lead Times: 5-8 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com