Analysis

May 10, 2022

Final Thoughts

Written by Michael Cowden

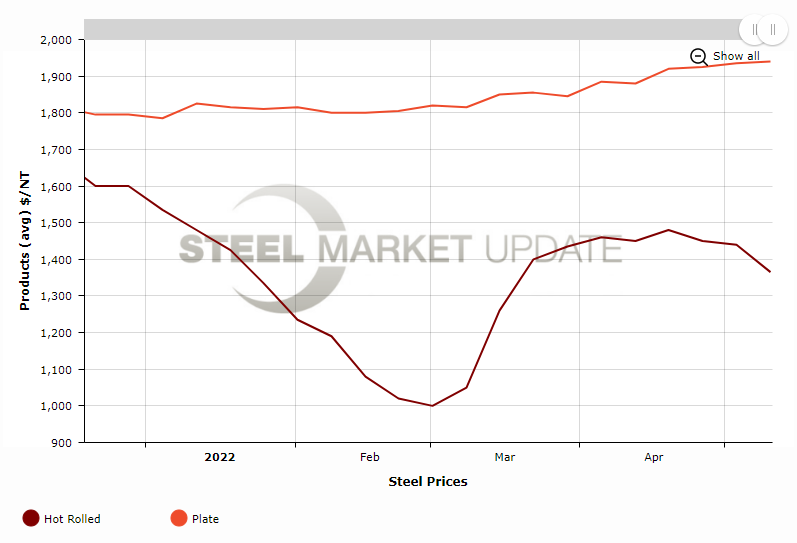

Sheet prices fell hard this week after bouncing around between about $1,440-1,480 per ton ($72-74 per cwt) for much of April.

Our average hot-rolled coil price dropped to $1,365 per ton this week, down $75 per ton (5.2%) from $1,440 per ton a week ago and down $115 per ton (7.8%) from $1,480 per ton in mid/late April.

We have also adjusted our sheet momentum indicators from neutral to lower. Plate remains at neutral. But more on that in a minute.

I’ve written before that you usually see a few weeks of small declines before the market “capitulates” and makes a big move lower. I realize some of you will disagree sharply with the idea that we’re anywhere near capitulation. But let’s not forget that the market was falling fast in January and February before the war in Ukraine sent tags sharply higher in March. (Mills had announced price hikes. But it was the war that made them stick.)

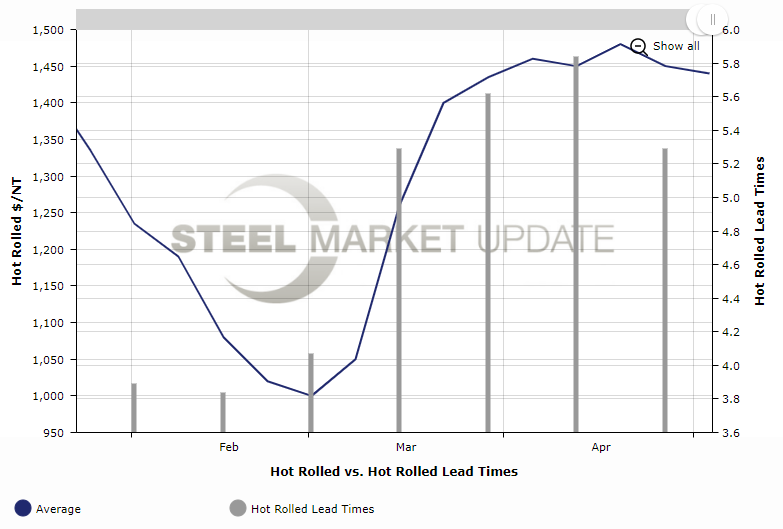

The big decline this week shouldn’t come as a total shock if you were paying attention to our lead time data. Look at the chart below, which you can recreate using SMU’s interactive pricing tool.

HRC lead times were at 3.84 weeks in mid-February. Russian forces invaded Ukraine on February 24, and HRC lead times extended to 4.07 weeks by March 1. They peaked in mid-April at 5.84 weeks, and fell then 9.4% to 5.29 weeks by the end of last month.

We still haven’t crunched the numbers on lead times for this week. We’ll do that on Thursday. But you get the point: lead times fell sharply before prices did, again providing an advance indicator of market direction.

Another advance indicator I’d keep an eye on in the weeks ahead is extras – whether for zinc, grade or freight.

The price patterns we’ve seen in steel are echoed in other commodities. The shock of the war sent prices skyrocketing, and they have since adjusted downward – sharply so in some cases.

As Brett Linton noted earlier this month, the Kitco spot price for zinc was $1.97 per pound on April 1, it reached a high of $2.05 per pound on the 19th, and it ended the month at $1.89 per pound.

Remember all those announcements about higher coating extras in March and in April? I haven’t seen any signs of them being adjusted lower yet. But an official announcement would probably be a lagging indicator. Mills trying to hold the line on base prices but willing to reduce extras or equalize freight are what to watch out for.

And then there is the chatter in the marketplace. This comment from a purchasing exec stands out: “I’m talking with my mill guy but not pushing it. Because the longer I wait, the better the deal I think I’ll get.”

We’ve all been worrying about inflation for a while now. But that’s pretty much the textbook definition of deflation.

Again, I hope I’m wrong about sheet prices being in for an extended drop. Maybe demand was held back by a wet, cold spring across much of the US.

And maybe plate has a story to tell that we should be paying more attention to. After all, plate, unlike coil has been slowly but steadily rising all year even as HRC – which it usually trends along with plate – has plunged, recovered, and then fallen again more recently.

Is that because the plate market is more consolidated than the sheet market, resulting in plate mills having more pricing power? Or has there been an increase in nonresidential construction activity that might not be in the official government data yet?

I ask that latter question because we’ve been hearing about shortages of cement and concrete. Is that because of production or supply chain issues, or is it because of strong demand? Let us know if you know.

And thanks from all of us at SMU for your business.

By Michael Cowden, Michael@SteelMarketUpdate.com