Prices

May 10, 2022

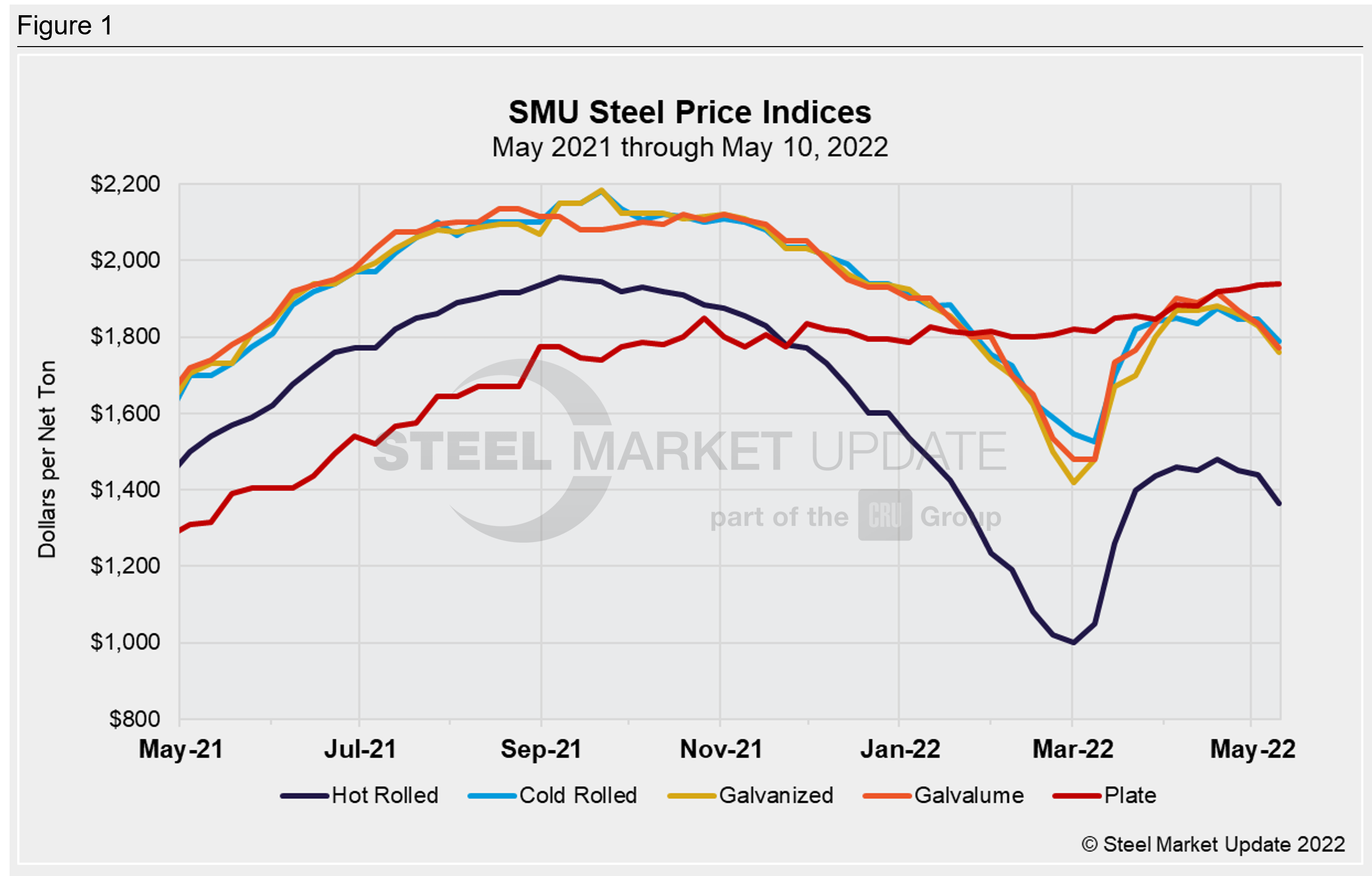

SMU Price Ranges & Indices: Sheet Falls Out of Bed

Written by Brett Linton

Sheet prices have fallen sharply following weeks of more modest declines. The big drops this week prompted SMU to shift all its sheet price momentum indicators from neutral to lower.

SMU’s hot-rolled coil price plunged $75 per ton ($3.75 per cwt) week-over-week, falling well below the $1,400-per-ton threshold. Cold rolled fell $55 per ton, galvanized dropped $70 per ton, and Galvalume was off $65 per ton.

Plate prices are roughly unchanged, and SMU’s momentum indicator for plate remains at neutral.

The sheet declines come on expectations of sharply lower scrap prices and amid concerns about end market use demand running out of steam in the second half of the year.

SMU adjusted its hot-rolled coil momentum indicator to higher on March 8 following the outbreak of the war in Ukraine. We adjusted our HRC momentum indicator to neutral roughly a month later on April 12.

We last moved our HRC momentum indicator to lower on October 19, 2021. Prices then had been up and down since hitting a 2021 peak of $1,955 per ton a month earlier. They proceeded to fall throughout the fourth quarter and into January and February before the war in Ukraine sent tags higher again.

Hot Rolled Coil: SMU price range is $1,310-$1,420 per net ton ($65.50-$71.00/cwt) with an average of $1,365 per ton ($68.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $90 per ton compared to one week ago, while the upper end declined $60 per ton. Our overall average is down $75 per ton from last week. Our price momentum indicator on hot rolled steel now points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-6 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold Rolled Coil: SMU price range is $1,720-$1,860 per net ton ($86.00-$93.00/cwt) with an average of $1,790 per ton ($89.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $80 per ton compared to last week, while the upper end declined $30 per ton. Our overall average is down $55 compared to one week ago. Our price momentum indicator on cold rolled steel now points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 5-8 weeks*

Galvanized Coil: SMU price range is $1,720-$1,800 per net ton ($86.00-$90.00/cwt) with an average of $1,760 per ton ($88.00/cwt) FOB mill, east of the Rockies. The lower end of our range declined $60 per ton compared to one week ago, while the upper end decreased $80 per ton. Our overall average is down $70 per ton from last week. Our price momentum indicator on galvanized steel now points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,826-$1,906 per ton with an average of $1,866 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-8 weeks*

Galvalume Coil: SMU price range is $1,740-$1,800 per net ton ($87.00-$90.00/cwt) with an average of $1,770 per ton ($88.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $40 per ton compared to last week, while the upper end decreased $90 per ton. Our overall average is down $65 per ton from one week ago. Our price momentum indicator on Galvalume steel now points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,059-$2,119 per ton with an average of $2,089 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-8 weeks*

Plate: SMU price range is $1,910-$1,970 per net ton ($95.50-$98.50/cwt) with an average of $1,940 per ton ($97.00/cwt) FOB mill. The lower end of our range was unchanged compared to one week ago, while the upper end increased $10 per ton. Our overall average is up $5 per ton from last week. Our price momentum indicator on plate steel continues to point to Neutral until the market establishes a clear direction.

Plate Lead Times: 4-7 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com