Analysis

May 31, 2022

Final Thoughts

Written by Michael Cowden

Sheet and plate prices continue to fall. That’s not a surprise, as there is little reason for them to do otherwise.

What is surprising when you step back is just how quickly prices have fallen, and how much further they could continue to fall.

SMU’s hot-rolled coil price now stands at $1,255 per ton ($62.75 per cwt), down $225 per ton (15.2%) from a post-Ukraine war peak of $1,480 per ton in April.

And we know of larger buyers able to secure material in the mid-$1,100s per ton. One Midwest service center source said a domestic mill approached him “begging for business.” They said if he was interested, the price would be in the $50s per cwt. “That’s not a good sign. … But what’s to stop it. Scrap is moving down, capacity is up, demand is OK – so what’s going to change?”

To be clear, that price is not available to everyone. It helps if you’re buying by the barge load. Or if you’re dealing with a mill in a coastal area. Why? Because big buyers can command a discount in a falling market, and mills along the coast are under pressure to compete with imports. Recall too that domestic prices remain much higher than prices in the rest of the world.

True, there will be fewer imports coming in months ahead because falling US prices (and patchy demand) will give buyers pause. But a lot has already arrived. And supplies will increase further as all that new domestic capacity we’ve been talking about for the past few years ramps up over the summer.

Some sources went so far as to predict that lead times now in July could retract into June. “With lead times as short as they are, I fear that pricing will continue to drop like a rock,” one Ohio Valley service center source said. “History unfortunately repeats itself. … Once again, the service centers are stuck with high-cost inventory on the floor and coming in. And now we have to sell at a loss.”

So where is the floor? Sources contacted by SMU generally said $800–1,000 per ton, or roughly where prices had fallen to earlier this year before the war in Ukraine sent tags sharply higher in March and April. Why not back to the $400–600 per ton level that had characterized down cycles in years past? For starters, raw material costs remain substantially higher than in the past. And integrated mills are far more likely now to idle facilities than to produce at cost or at a loss, market participants said.

That’s cold comfort for most. And sentiment along with other key data we collect in our surveys has shown a clear deterioration over the last few weeks.

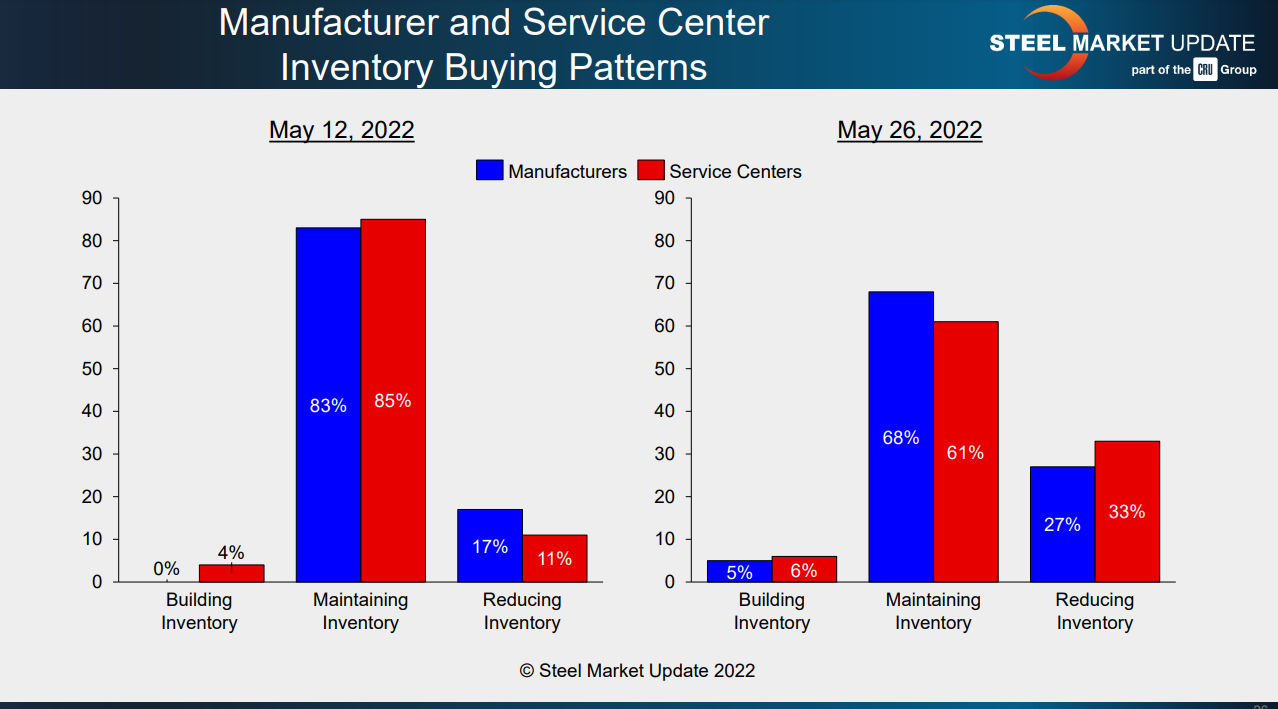

More steel consumers are purging inventories compared to just a few weeks ago:

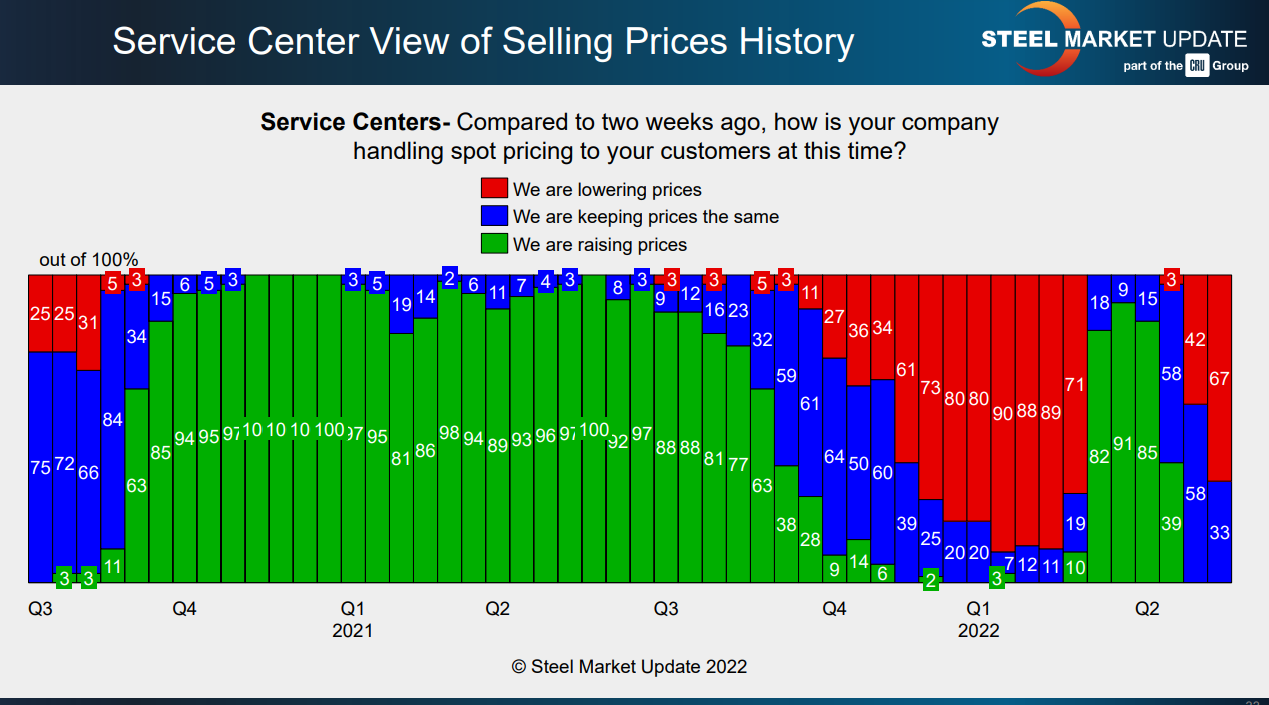

That is in turn is driving resale prices lower:

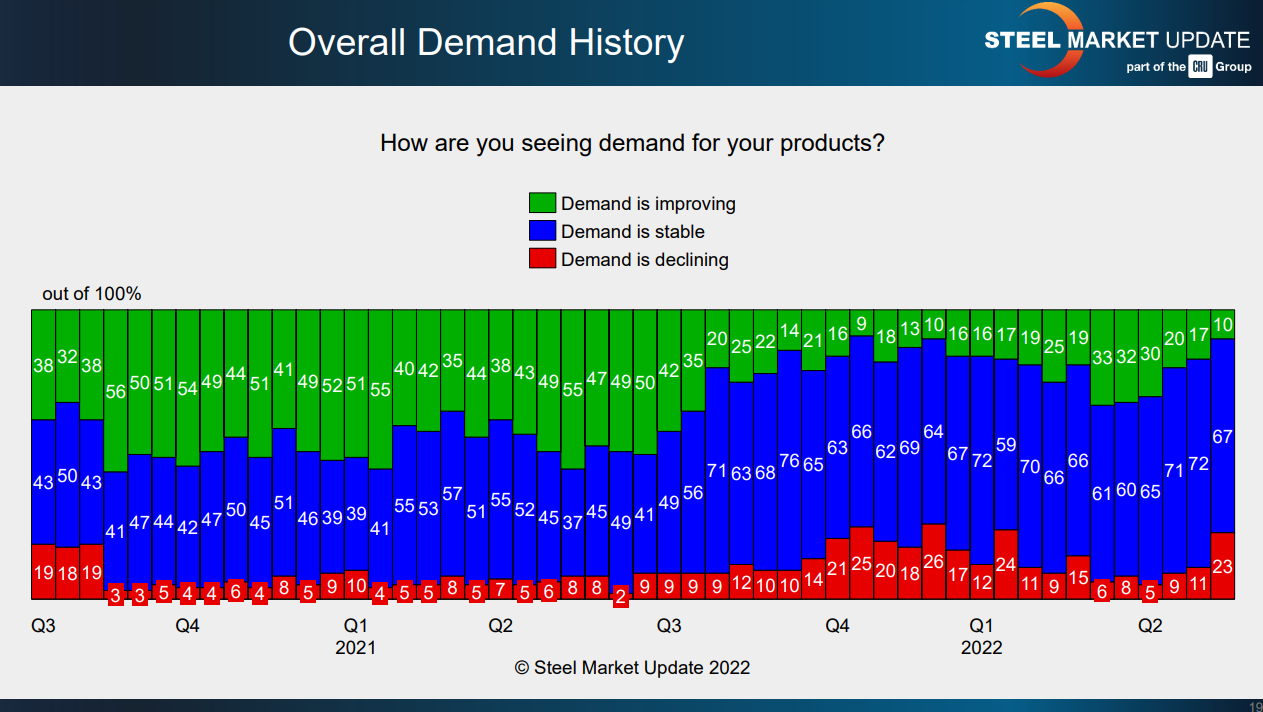

And all that is happening as more sources are reporting that demand is decreasing:

That’s not the kind of feedback loop typially associated with higher prices.

I should note that some market participants have suggested that a United Steelworkers (USW) strike or lockout could sharply reduce supplies and send prices higher. But the current contract labor contracts between the USW and US Steel as well as between the USW and Cleveland-Cliffs Inc. don’t expire until Sept. 1. That means any labor action — assuming any happens, which is a big if — is likely months off.

By Michael Cowden, Michael@SteelMarketUpdate.com