Prices

June 28, 2022

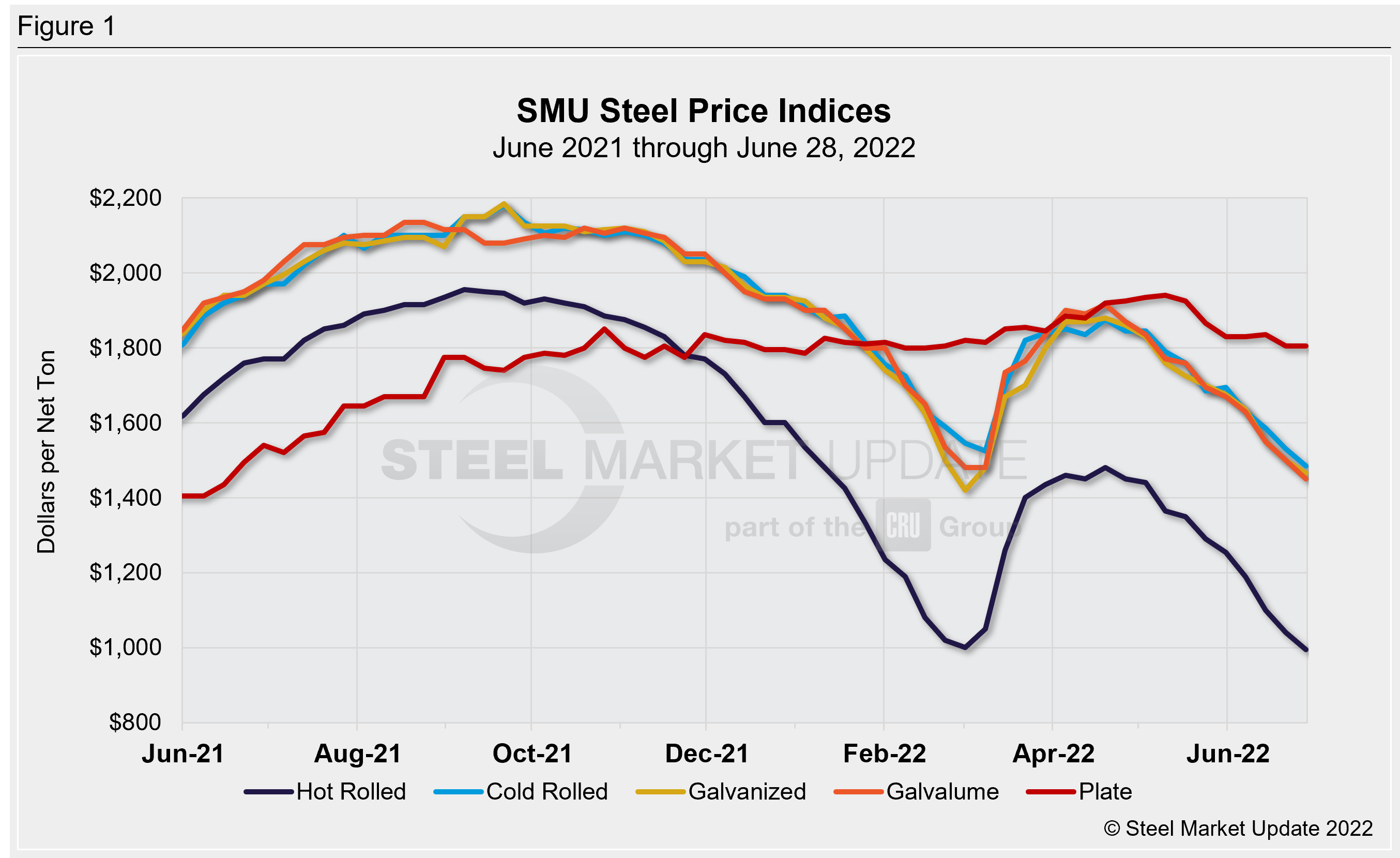

SMU Price Ranges: HRC Falls Below $1,000/ton for First Time Since ‘20

Written by Brett Linton

Steel Market Update’s average hot-rolled coil price has fallen below $1,000 per ton ($50 per cwt) for the first time since December 2020 – or 18 months ago.

The move comes as some market participants said that a floor might be near while others said such talk was mostly wishful thinking.

Our benchmark hot-rolled coil price now stands at $995 per ton, down $45 per ton from $1,040 per ton last week and down $310 per ton from just a month ago.

The prior low for this year for HRC was $1,000 per ton in early March, before raw material supply concerns stemming from the war in Ukraine sent prices briefly and sharply higher.

HRC prices in late December 2020 were at $980 per ton, according to SMU’s interactive pricing tool. A supply squeeze and pent-up demand from the pandemic resulted in them nearly doubling by September 2021 to $1,955 per ton.

Other sheet prices saw similar declines with cold rolled down $45 per ton, galvanized base prices down $35 per ton, and Galvalume base prices down $50 per ton. Plate prices continued to resist broader trends in the sheet market and were flat week over week.

Our price momentum indicators remain at Lower, meaning we expect lower prices over the next 30 days.

Hot Rolled Coil: SMU price range is $940-$1,050 per net ton ($47.00-$52.50/cwt) with an average of $995 per ton ($49.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $40 per ton compared to one week ago, while the upper end decreased $50 per ton. Our overall average is down $45 per ton from last week. Our price momentum indicator on hot rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $1,410-$1,560 per net ton ($70.50-$78.00/cwt) with an average of $1,485 per ton ($74.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $70 per ton compared to last week, while the upper end decreased $20 per ton. Our overall average is down $45 per ton from one week ago. Our price momentum indicator on cold rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 4-9 weeks

Galvanized Coil: SMU price range is $1,420-$1,510 per net ton ($71.00-$75.50/cwt) with an average of $1,465 per ton ($73.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end decreased $50 per ton. Our overall average is down $35 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,526-$1,616 per ton with an average of $1,571 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks

Galvalume Coil: SMU price range is $1,360-$1,540 per net ton ($68.00-$77.00/cwt) with an average of $1,450 per ton ($72.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $80 per ton compared to last week, while the upper end decreased $20 per ton. Our overall average is down $50 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,679-$1,859 per ton with an average of $1,769 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks

Plate: SMU price range is $1,750-$1,860 per net ton ($87.50-$93.00/cwt) with an average of $1,805 per ton ($90.25/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4-7 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com